Advertisement

Advertisement

Robert Halili

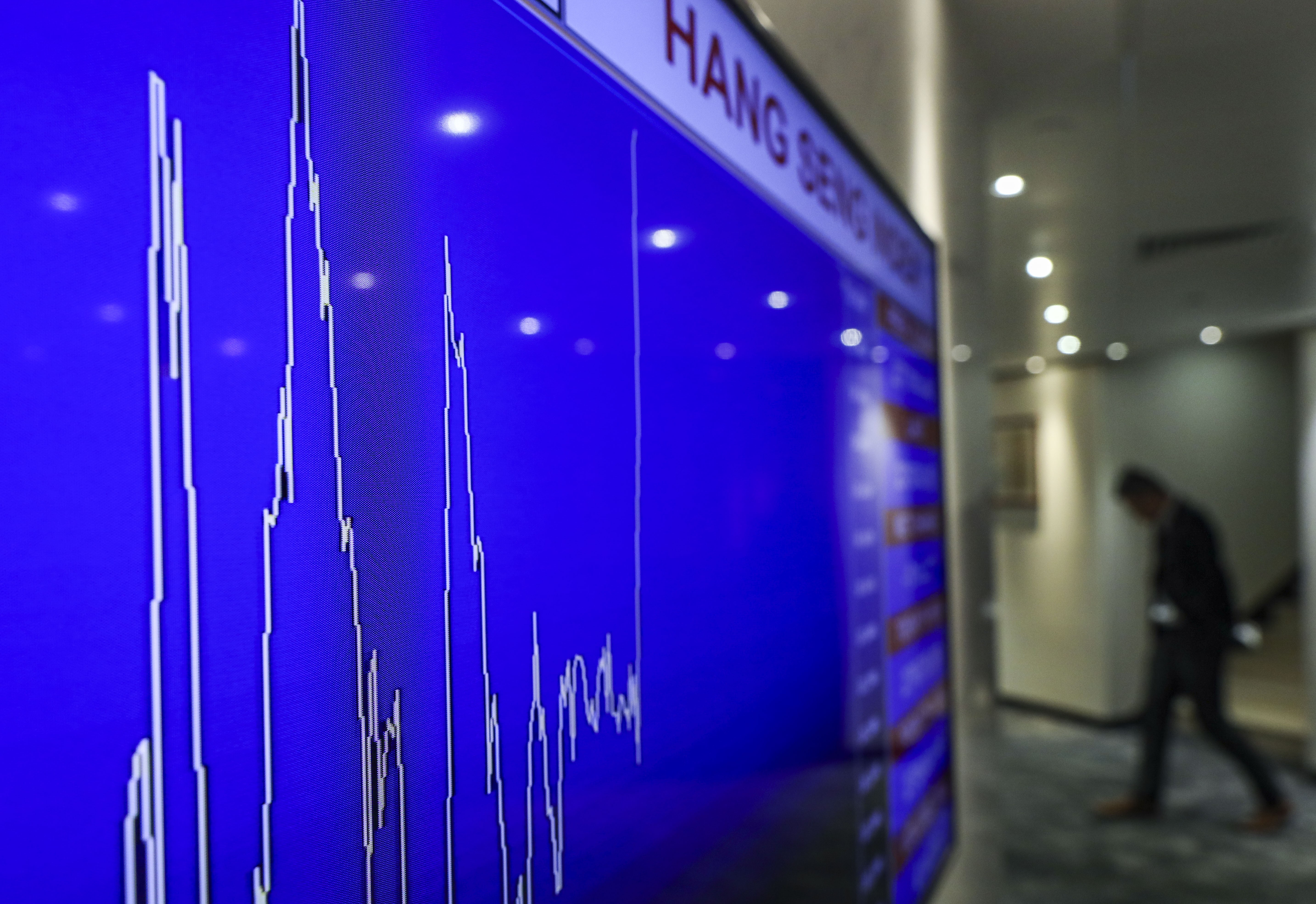

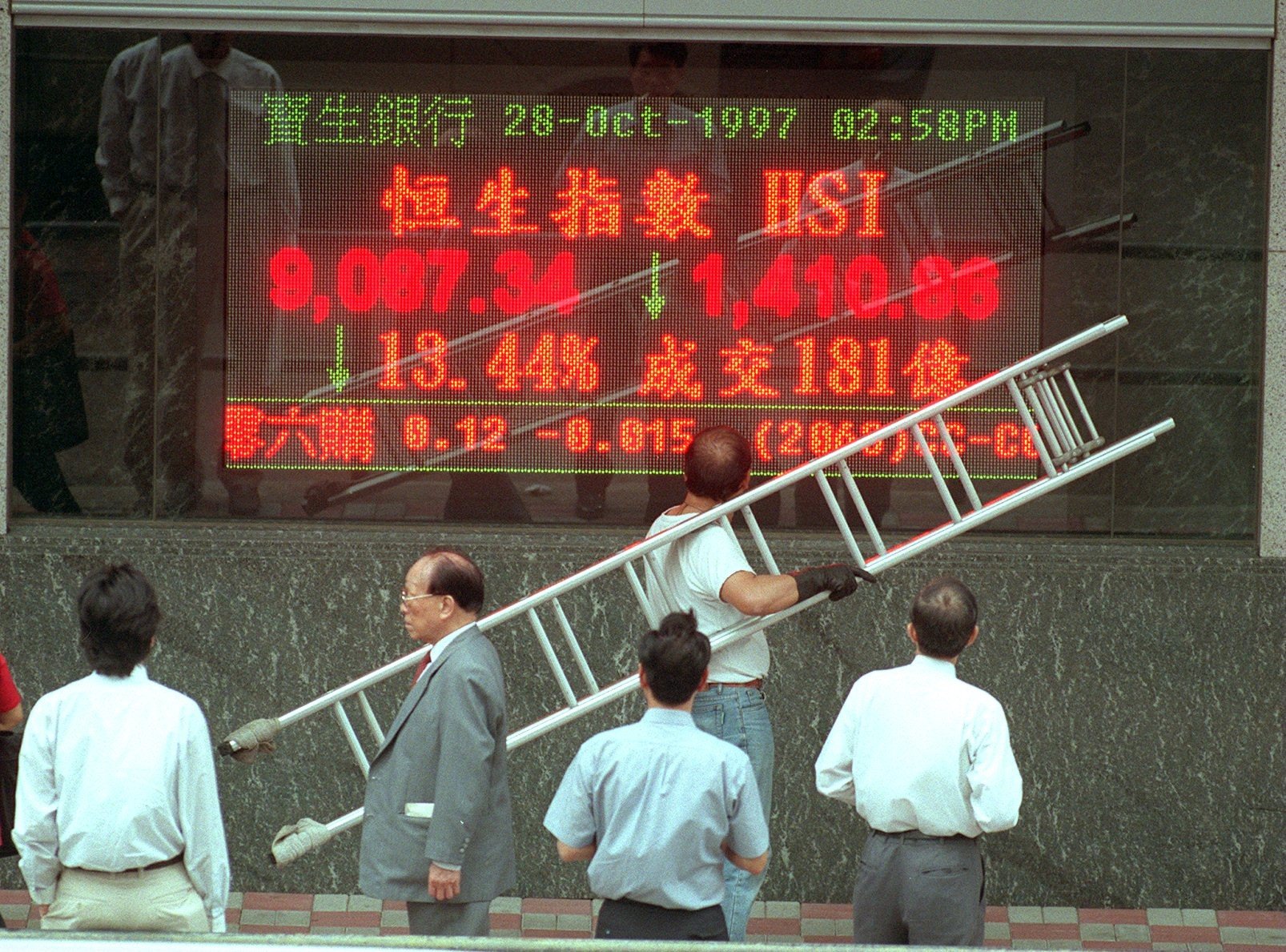

Insider buying rose for the third straight week while the selling was up for the second straight week based on filings on the Hong Kong stock exchange from August 27 to 31

Buying rose for a second straight week, with some directors who had been quiet for more than two years moving to support their companies’ shares

Chief executives of Taste.Gourmet Group and Wisdom Education International record first buys as directors since their companies were listed

Overall insider activity was mixed last week as buying fell while selling rose

Advertisement

Insider share trading activity fell for a third straight week, as is consistent with rules that prohibit director trading ahead of earnings results

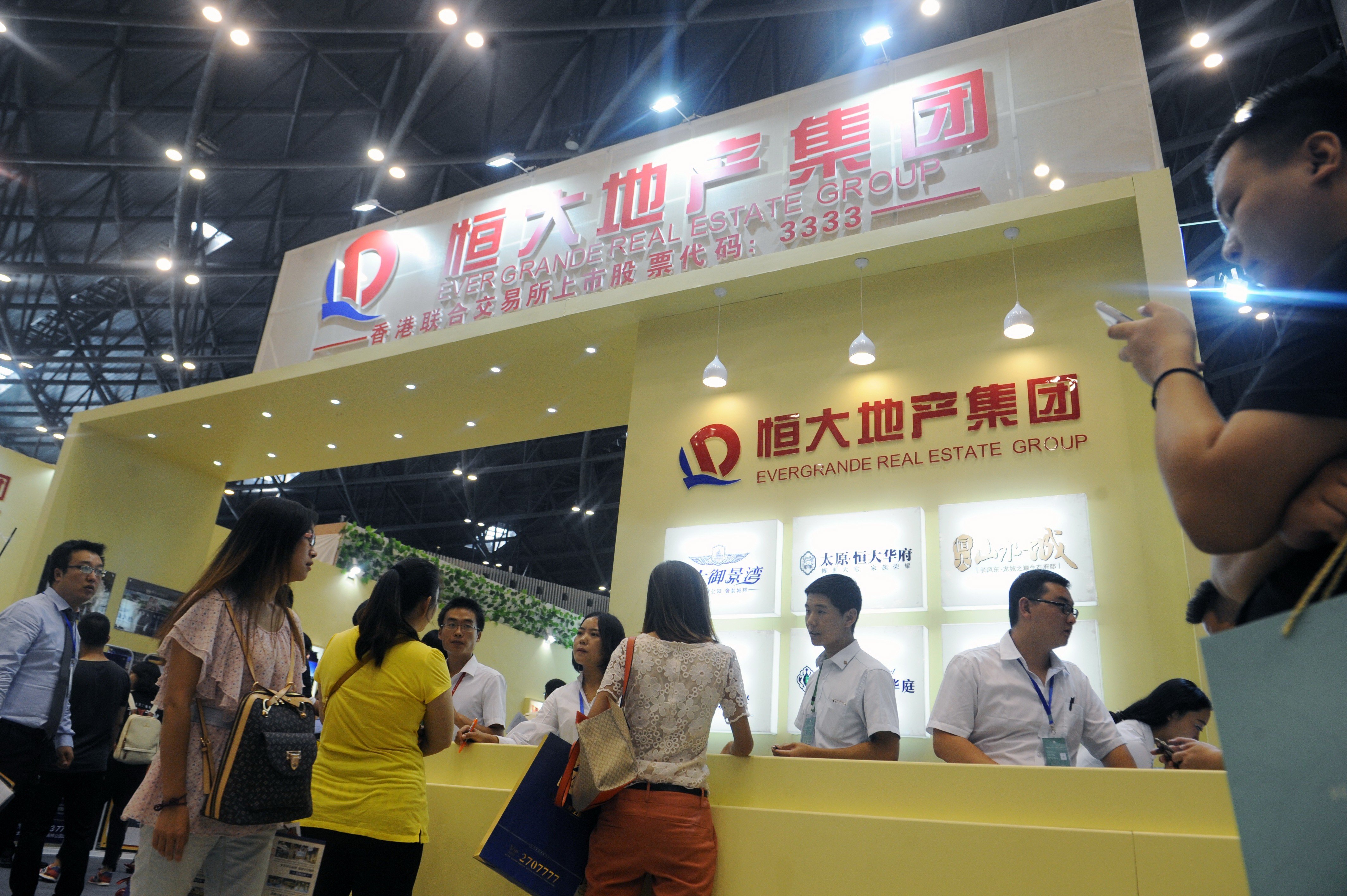

Mainland property firms top repurchases this month

Insider buying particularly high among three mainland property developers – Sunac China Holdings, China SCE Property Holdings and Country Garden Holdings

Several significant trades with buy-backs in SMI Holdings and NewOcean Energy Holdings following sharp falls in their share prices while two high-level board members of C&N Holdings and Clifford Modern Living Holdings have been unloading shares at progressively higher prices

Kohei Sato, CEO of pachinko operator Dynam Japan Holdings, also sells his shares for the time since listing in August 2012

Thirty-nine recorded 179 purchases worth US$28.29 million versus 11 firms with 34 disposals worth US$22.21. The number of companies on the buying side was not far off the previous week’s 5-day total of 42 firms

Rare repurchases seen in China All Access Holdings, China New City Commercial Development, Nature Home Holding and Fortunet e-Commerce Group

Buy-backs rise for second straight week with 12 companies posting 50 repurchases worth nearly US$25m

Sixteen firms record 69 purchases worth HK$121 million (US$15.4m) versus eight firms with 29 disposals worth HK$58 million

Eight companies that posted 25 repurchases worth HK$61 million based on filings from February 20 to 23, a holiday-shortened trading week