Hong Kong companies and directors step up buying of own shares as market weakens

Buying rose for a second straight week, with some directors who had been quiet for more than two years moving to support their companies’ shares

Hong Kong company directors were active in trading their own companies’ shares in the latest week, while buy-back activity by firms also rose, driven in part by a falling stock market that prompted moves to boost share prices.

Activity was notable in a long list of stocks from the exchange filings for the week of August 20 to 24, including We Solutions, Sino Biopharmaceutical, Giordano International, Huabao International, China Gas Holdings, Want Want China, Sun Hung Kai & Co and Hopewell Holdings.

In some cases directors who had been quiet for more than two years moved in to support their companies’ shares, with the timing suggesting that the shares were undervalued. Investors should particularly watch out for China Gas Holdings, with two directors posting rare acquisitions last week.

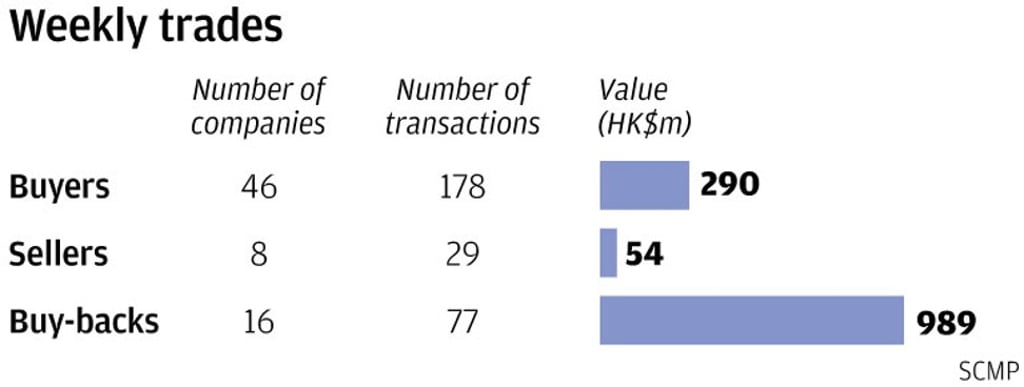

A total of 46 companies recorded 178 purchases worth HK$290 million (US$36.9 million) versus eight firms with 29 disposals worth HK$54 million. The buy figures were up from the previous week’s 30 companies, 144 purchases and HK$271 million and rose for a second straight week, while on the selling side, the number of firms and trades were up from the previous week’s four companies and 19 disposals. The selling value, however, was sharply down from the previous week’s HK$131 million.

Buy-back activity rose for the second straight week, with 16 companies making 77 repurchases worth HK$989 million, based on filings from August 17 to 23. The number of firms and trades was up from the previous five-day totals of 14 companies and 68 transactions. The value, however, was sharply down from the previous week’s HK$1.853 billion.