The Insider | Directors snap up shares in energy and textile companies; Link Reit continues its share buy-backs

Insider share trading activity fell for a third straight week, as is consistent with rules that prohibit director trading ahead of earnings results

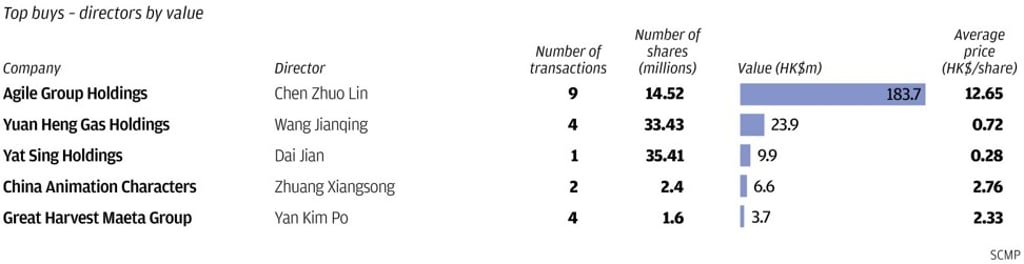

Heavy acquisitions were seen in the energy and textile sectors in a sluggish week for director purchases and buy-backs due to the onset of the reporting season, according to filings with the Hong Kong stock exchange last week.

Directors of energy stocks have good reason to be bullish as the crude oil price has gained nearly 50 per cent from a year earlier.

Crude oil explorer and producer IDG Energy Investment Group acquired 43.5 million shares from July 10 to August 2 at an average of HK$1.18 each in its first buy-back since 2001, when it snapped up 800,000 shares from March to April at an average of 24 HK cents each.

The latest trades, which accounted for 51 per cent of the stock’s trading volume, were made after the stock fell as much as 64 per cent from November 2016.

Shares in IDG Energy closed at HK$1.22 on Friday.