The Insider | Insider activity down for third straight week as market volatility spikes

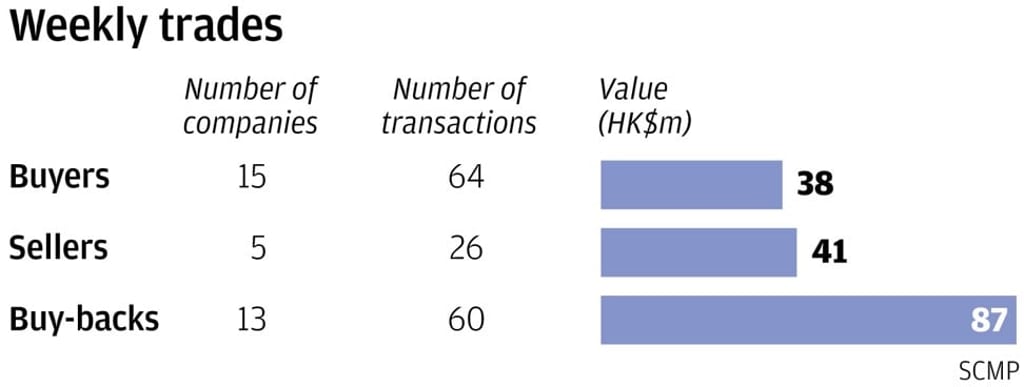

The insider activity fell for the third week straight as buyers turned cautious in this recent market meltdown with 15 companies that recorded 64 purchases worth HK$38 million (US$4.86 million) versus five firms with 26 disposals worth HK$41 million.

The number of companies and value on the buying side were sharply down from the previous week’s 22 firms and HK$290 million. The number of purchases, however, was consistent with the previous week’s 65 acquisitions. The sales, on the other hand, were sharply down from the previous week’s nine companies, 49 disposals and HK$184 million.

While the buying by directors fell last week, the buy-back activity rebounded after falling for two straight weeks with 13 companies that posted 60 repurchases worth HK$87 million based on filings from February 2 to 8.

Investors should note that the insider trading and buy-backs are expected to fall even more in the next few weeks due to the upcoming busy reporting period from March to April. Directors and listed firms are prohibited from trading in the company’s shares one to two months before the announcement of earnings results.

There were only a few significant trades last week with rare insider buys in Cafe de Coral Holdings and Telecom Digital Holdings and buy-backs in Nanyang Holdings.