Property companies prominent as Hong Kong directors, firms trade own shares

Greenland Hong Kong, Shimao Property and China Evergrande among those involved in director buying or buy-backs even as the stock indices fall

Hong Kong directors’ trading of their own companies’ shares remained high in the latest week, while buy-back activity surged, with property firms to the fore amid a decline in the overall stock market.

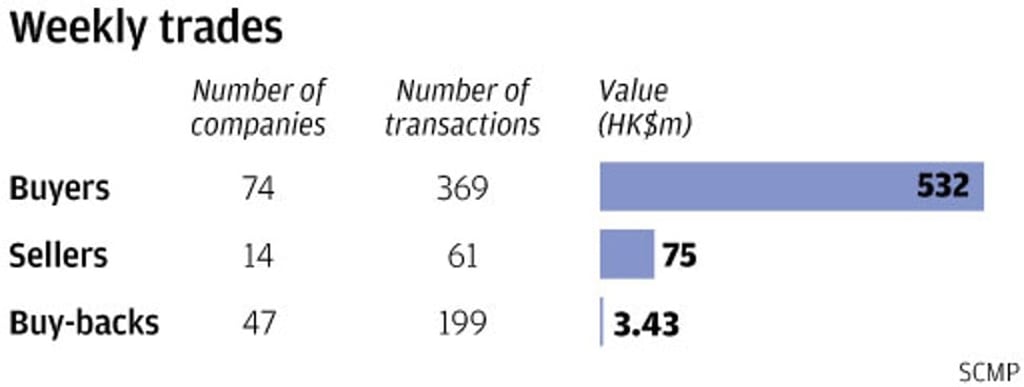

Buyers outweighed sellers with 74 companies recording 369 purchases worth HK$532 million (US$67.8 million) versus 14 firms with 61 disposals worth HK$75 million, based on filings to the stock exchange during the holiday-shortened week of July 3 to 6.

The number of companies and trades on the buying side were consistent with the previous week’s five-day totals of 81 firms and 472 purchases. The buying value, however, was sharply down from the previous week’s HK$1.13 billion. Sales were up from the previous week’s 10 companies, 43 disposals and HK$68 million.

Meanwhile, company buy-back activity surged for the third straight week, with 47 companies posting 199 repurchases worth HK$3.43 billion, based on filings from June 29 to July 5. The four-day figures were up from the previous five-day totals of 36 firms, 186 trades and HK$2.94 billion

Director trading and company buy-back activity has been heavy since the market started falling after the first week of June, with the Hang Seng Index dropping from 31,512 points to a low of 28,182 points last week.