Hong Kong company directors’ buying of own shares falls for second week; HSBC buys back

HSBC repurchases 3.945 million of its own shares, the first buy-back since November 2017

Buying by Hong Kong company directors of shares in their own companies fell for a second straight week while selling rose for the first time in three weeks, based on filings to the city’s stock exchange between May 7 and 11.

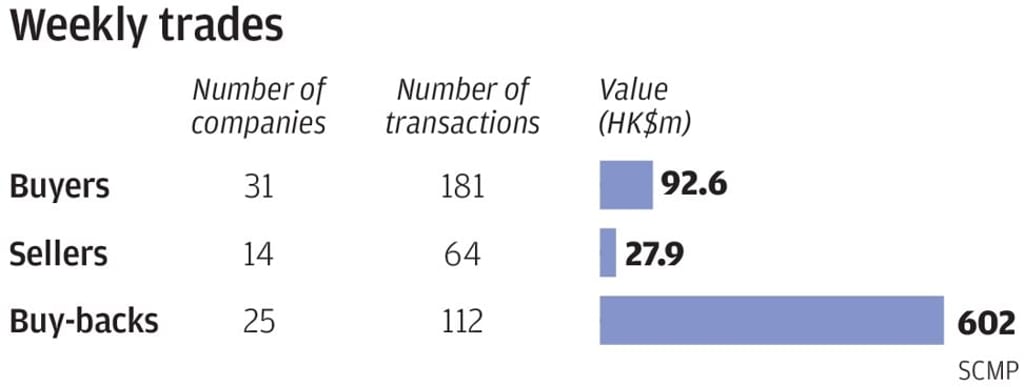

A total of 31 companies recorded 181 purchases by directors worth HK$93 million (US$11.9 million) versus 14 firms with 64 disposals worth HK$28 million. The number of trades on the buying side was consistent with the previous week’s four-day total of 152 purchases, but the number of companies and buying value were sharply down from the previous week’s 38 firms and HK$613 million.

Buy-back activity picked up, with 25 companies – including global banking giant HSBC Holdings – recording a total of 112 repurchases of their own shares worth HK$602 million, based on filings from May 4 to 10. The number of firms buying back shares was unchanged from the previous four-day total, but the number of trades and value were sharply up from 63 repurchases worth HK$107 million.

Among directors selling shares, the CEO of men’s casual clothing maker China Outfitters Holdings, Zhang Yongli, recorded his first on-market trades since November 2017, with 6.15 million shares sold from May 8 to 10 at HK$0.29 to HK$0.24 each or an average of HK$0.253 each.

The trades, which accounted for 73 per cent of the stock’s trading volume, reduced Zhang’s holdings to 1.651 billion shares, or 47.93 per cent of the issued capital. The disposals were made after the stock fell by as much as 30 per cent from HK$0.345 in November 2017.