Hong Kong directors’ share buying remains high in latest week, while selling increases

Company share buy-back activity also remains high in early April

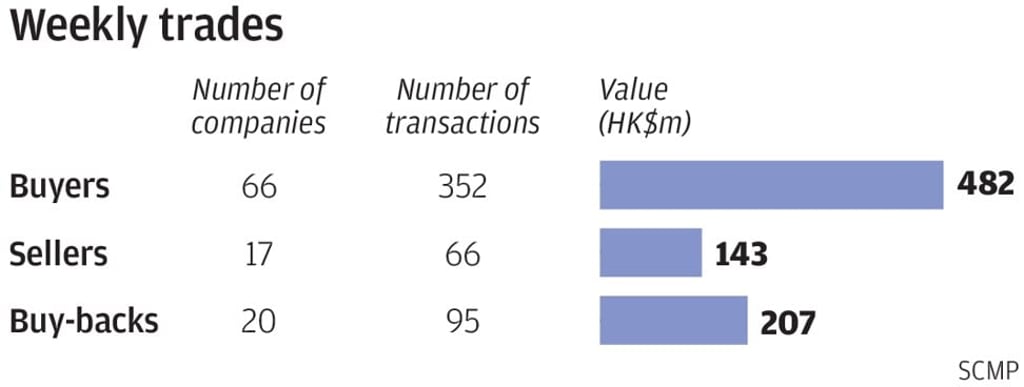

Buying of their own companies’ shares by Hong Kong company directors remained high while selling rose, based on filings to the city’s stock exchange from April 9 to 13.

A total of 66 companies recorded 352 purchases by directors worth HK$482 million (US$61.4 million) versus 17 firms with 66 disposals worth HK$143 million. The buy figures were consistent with the previous week’s three-day totals of 56 companies, 240 purchases and HK$203 million. The sales, on the other hand, were sharply up from the previous week’s 12 firms, 32 disposals and HK$50 million.

Meanwhile, company share buy-back activity was high for the third straight week, with 20 companies posting 95 repurchases worth HK$207 million, based on filings from April 6 to 12. The number of trades was sharply up from the previous two-day total of 42 repurchases, while the number of firms and value were consistent with the previous week’s 15 companies and HK$180 million.

There were several rare transactions last week, with buy-backs in Sinosoft Technology Group, buy-backs and insider buying in Far East Consortium International and director purchases in Gemilang International and Skyworth Digital Holdings.

Application software products provider Sinosoft Technology Group bought back for the first time since listing in July 2013, with 6.845 million shares purchased from April 4 to 6 at HK$2.52 to HK$2.72 each or an average of HK$2.64 each. The trades were made on the back of a 37 per cent rebound in the share price since February 12, when it stood at HK$1.99. Despite the rebound in the share price, the stock is still down since August 2016’s HK$4.62. The stock closed at HK$3.44 on Friday.

There were buy-backs and a purchase by managing director Hoong Cheong-thard in property developer Far East Consortium International, with a combined 2.74 million shares purchased from March 29 to April 12 at HK$4.15 to HK$4.56 each, or an average of HK$4.41 each. The trades, which accounted for 33 per cent of the stock’s trading volume, were made after the stock fell by as much as 16 per cent from HK$4.95 in November 2017.