Hong Kong director share buying falls, but property firms still top list of buy-backs

Insider buying and buy-backs are building up in the retail and consumer goods sectors

Hong Kong company directors may be experiencing buying fatigue after recording heavy purchases of their own companies’ shares in recent weeks, with activity falling for a second straight week, although property firms continued to stand out as major buyers of their own shares.

A total of 52 companies recorded 210 director purchases worth HK$720 million (US$91.8 million) based on filings to the stock exchange from July 23 to July 27. The figures were sharply down from the previous week’s 68 firms, 391 purchases and HK$1.278 billion.

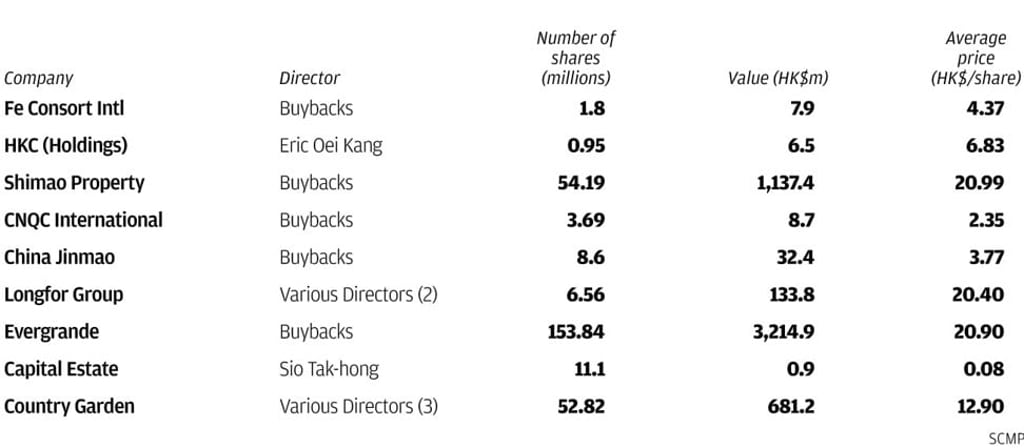

The property sector led all buyers for the sixth straight week, with huge insider purchases in Country Garden Holdings, Agile Group and Future Land Development and buy-backs in China Evergrande Holdings and Shimao Property.

Other lesser known property stocks that have provided the most consistent support this month are HKC Holdings, CNQC International, Longfor Properties and China Jinmao Holdings, with buys recorded in almost every trading day. The CEO of HKC Holdings, Eric Oei, for instance, recorded buys for 14 straight trading days from July 3 to July 20, with purchases that accounted for 43 per cent of the stock’s trading volume.

Although some of these property stocks have not risen, the high frequency of purchases by directors and companies have prevented their shares from falling further following the heavy correction the market in the past month.