Advertisement

Advertisement

Saudi minister urges China ‘not to miss opportunities’ to invest in the Gulf state – and exploit its access to different markets.

Former World Bank vice-president Zhu Xian says China needs to engage with all possible international stakeholders.

China’s top legislative body is reviewing local debt swaps on the first day of its session, suggesting more fiscal stimulus could arrive.

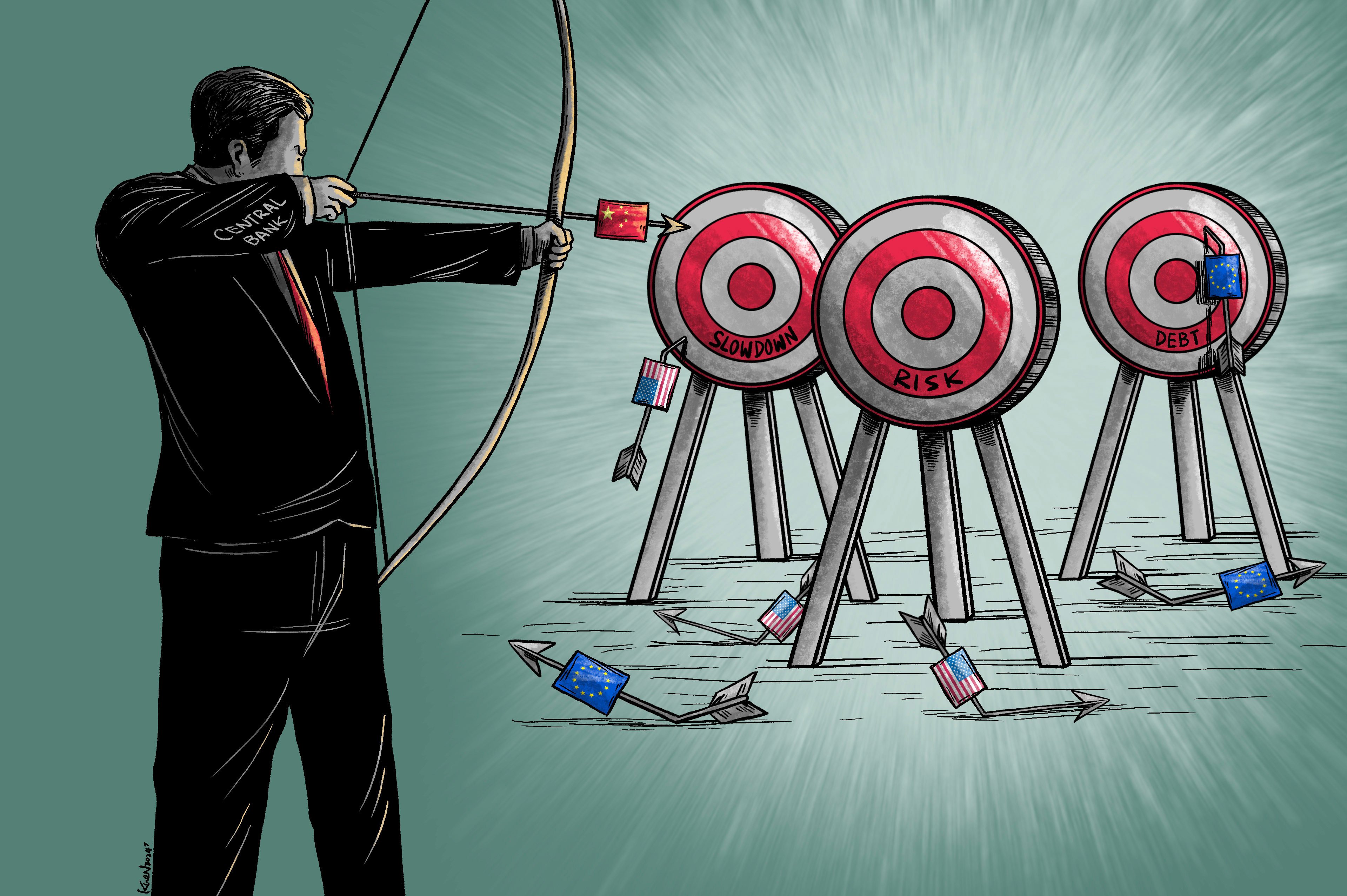

The world’s second-largest economy is looking to balance the scales of international financial governance under a system dominated by the World Bank and IMF.

Advertisement

Go big or bear the risk of watching China’s economy fall off a cliff, says prominent head of fiscal academy associated with Ministry of Finance.

Some prominent economists have called for China to roll out a stimulus plan worth 10 trillion yuan, but the real number is anyone’s guess as prudence is at play.

Earlier than expected launch of China’s Securities, Funds and Insurance companies Swap Facility triggers market enthusiasm, speculation of more supportive policies.

China’s top economic planner, the National Development and Reform Commission (NDRC), held a press conference on Tuesday morning.

With 110 member states and years of experience, AIIB vice-president says Beijing-based development bank a model for multilateralism.

Micronesian island of Nauru named as the 110th member of the Beijing-headquartered Asian Infrastructure Investment Bank (AIIB) on Thursday.

Warning about protectionist trade actions comes on sidelines of Asian Infrastructure Investment Bank’s annual conference, in Uzbekistan.

China’s central bank has conducted at least three large monetary adjustments since Pan Gongsheng was named People’s Bank of China governor in July 2023.

Marc Uzan, who has campaigned for changes to the global financial system for 30 years, says he remains optimistic about international cooperation despite the rise of unilateralism.

In a highly anticipated move, the People’s Bank of China has conducted its first open-market trade for treasury bonds in nearly two decades.

Alfred Schipke says the upcoming third plenum needs to show China is open for business despite its challenges, including the struggling property sector.

China's central bank, concerned about a decline in long-term bond yields, will borrow treasury bonds from primary market traders to maintain liquidity in the market.

Chinese Premier Li Qiang delivered a speech during the opening plenary session at the 15th Annual Meeting of the New Champions in Dalian on Tuesday.

A fiscal gulf exists between China’s central and local governments, and it is seen as a hurdle to healthy and sustainable development ahead of the third plenum.

A Chinese scholar has called for a renewed commitment to pro-market reforms to generate sustainable growth and solve several persistent issues that have vexed economic policymakers.

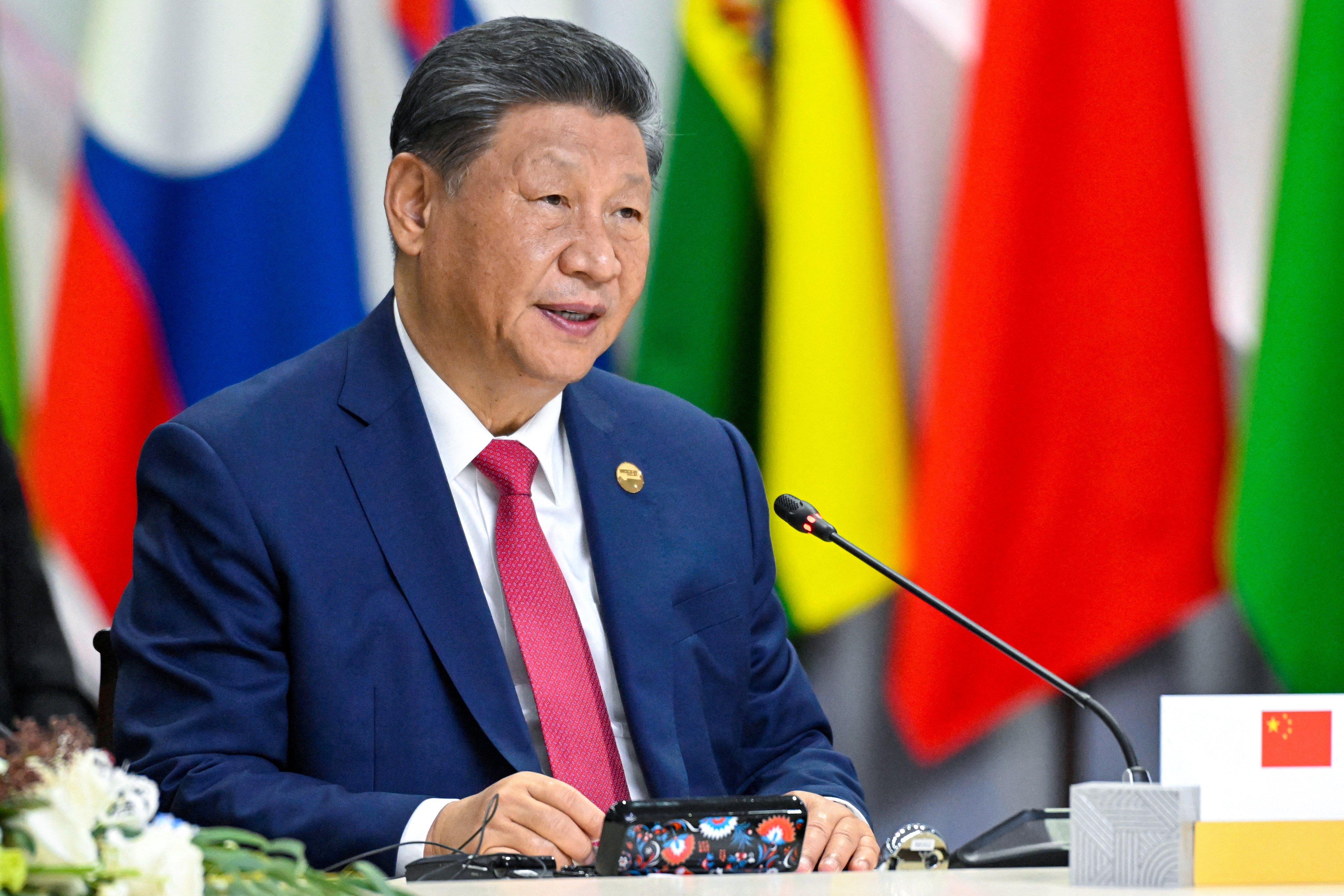

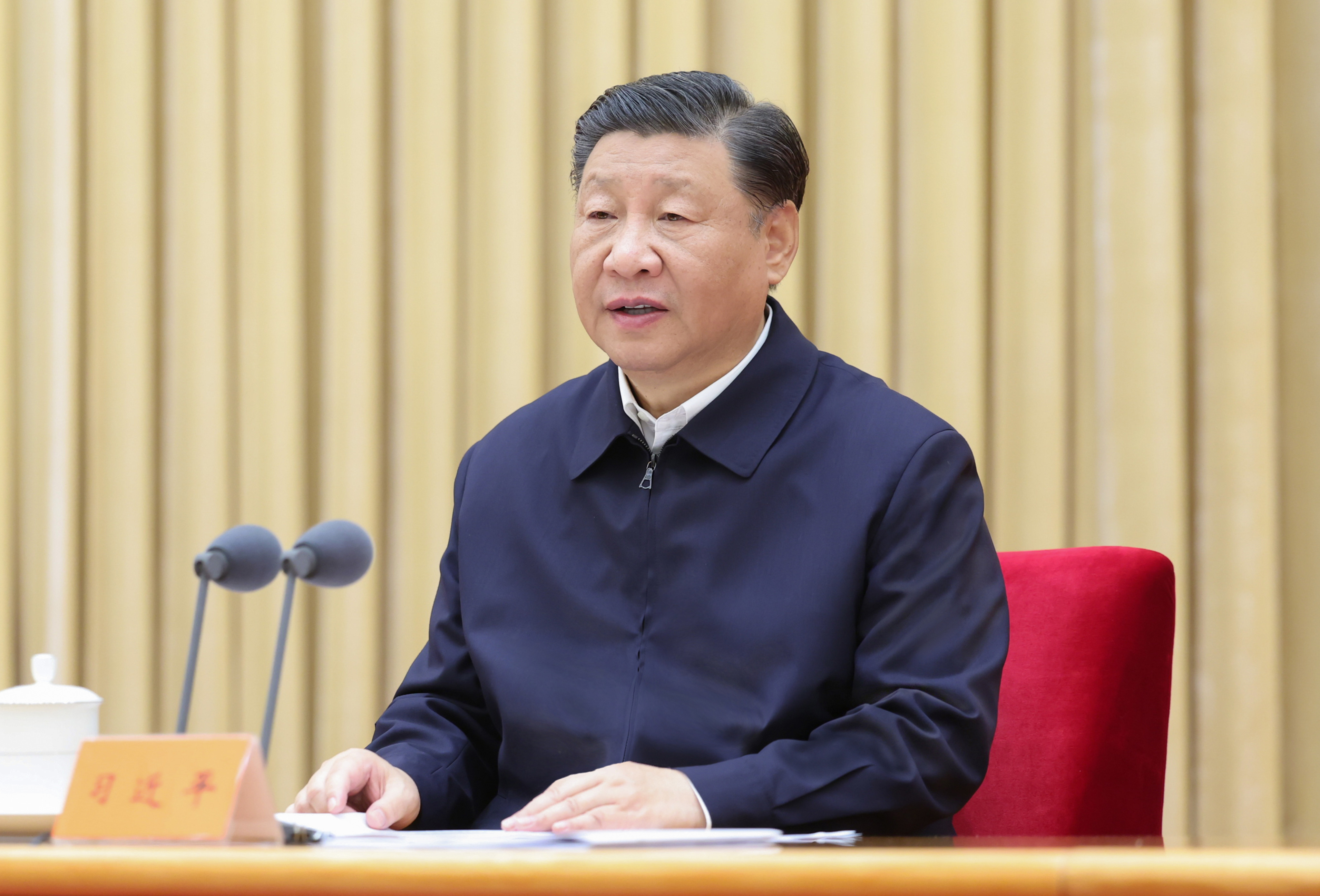

Chinese president calls for deepened reforms to address economic woes and says country should pursue ‘goal- and problem-oriented’ approach.

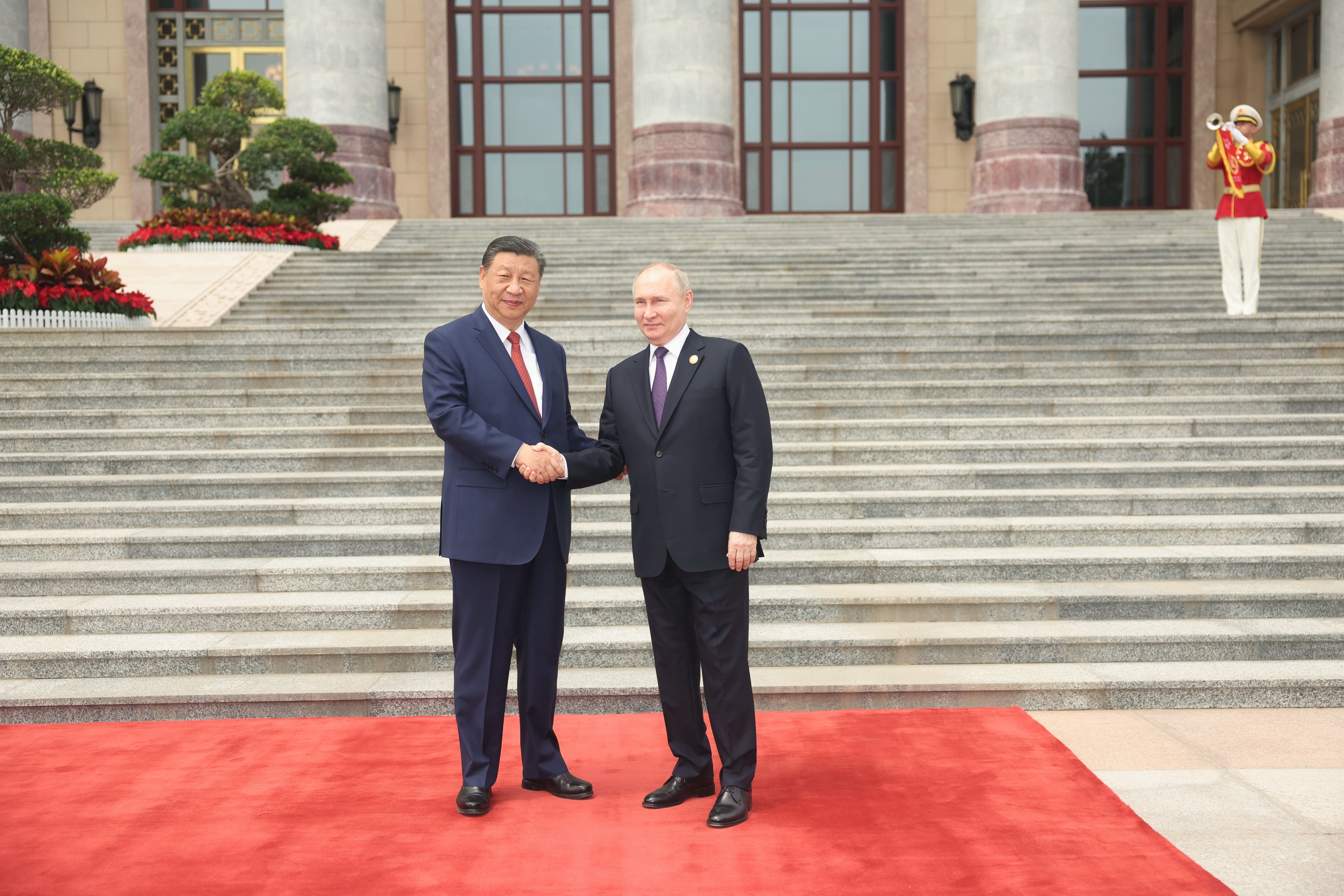

Bilateral trade, an important lifeline to Russia since it invaded Ukraine, is already at a record US$240 billion, with China its largest customer for crude oil.

President Xi has told financial cadres that their monetary policy toolkit must include a controversial means of injecting liquidity into China’s economy – one that has not been used in two decades.

After changes to its leadership and structure, and with draft laws altering its scope, China’s central bank looks to be taking on a different role from years past – one which seems notably distinct from Western norms.

China’s finance, commerce, banking, development and securities heads faced the press in Beijing on Wednesday during the annual ‘two sessions’.

As China makes strides to invigorate economic growth, its aggregate financing reached 6.5 trillion yuan in January – a year-on-year increase of more than half a trillion.

China’s central bank announced on Wednesday that the reserve requirement ratio for commercial banks will be reduced by 50 basis points from February 5, but analysts are expecting more supportive measures.

China’s Ministry of Commerce on Tuesday asked exporters of rare earth metals and oxide products to report transactions, with importers of crude oil, iron ore, copper ore concentrates and potash fertiliser also asked to report orders and shipments.

China’s twice-a-decade financial work conference concluded on Tuesday, with President Xi Jinping saying Beijing must ‘comprehensively strengthen financial supervision’.

Chinese Vice-premier He Lifeng has been confirmed as the office director of the Central Financial and Economic Affairs Commission, taking over from predecessor Liu He.

Official obituary of former leader, who died in Shanghai on Friday, hails his contributions to the economy, belt and road, poverty relief and his support for President Xi Jinping.