China’s ‘two sessions’ 2024: new mandate, party control push central bank beyond ordinary role

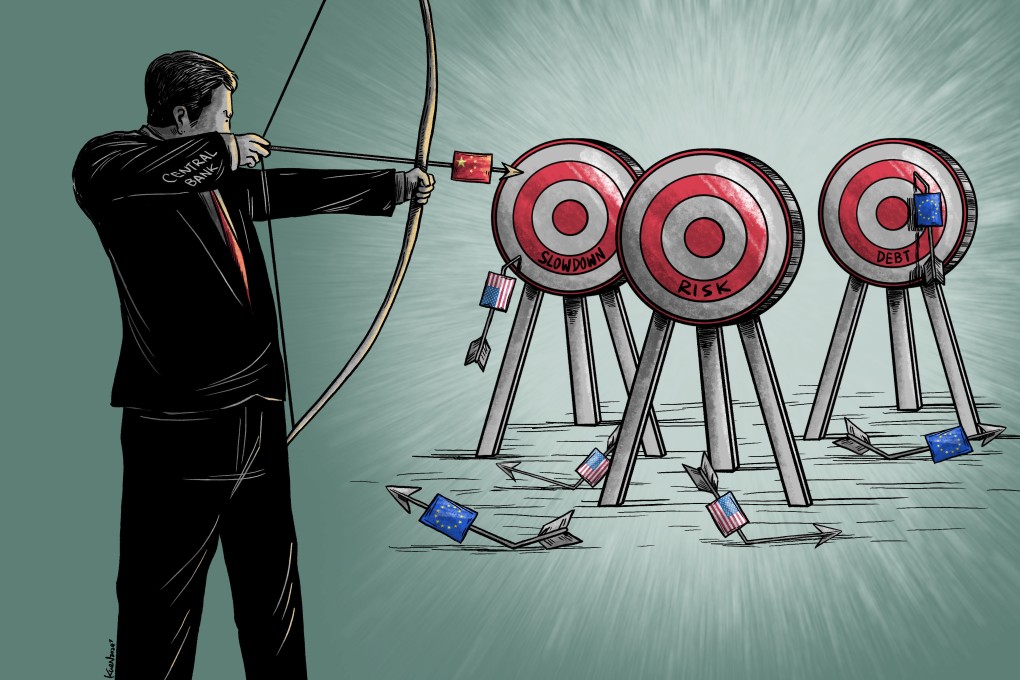

- Proposed revision to law governing China’s central bank, as well as leadership and structural changes which have already occurred, suggest new mandate

- Focus on promoting growth, development, avoidance of sanctions would redefine role outside standards which characterise central banks in the West

Wang Qishan’s phone was ringing, and the news was grim.

When Wang, then vice-premier of China, answered an emergency call from US Treasury Secretary Henry Paulson in 2008 – the year the global economy was upended by the subprime mortgage crisis – he was preparing for an investment fair in the southern city of Xiamen.

Wang, known even then for his hands-on experience defusing fiscal troubles, had planned to use the fair to assure overseas investors of the speed with which China was embracing global norms – but the financial tsunami coming from across the Pacific seemed a more pressing matter.

Rather than take drastic action to silo China from the US and insulate its economy from what already looked like a ticking time bomb, Wang promised his old friend the country would not dump its massive holdings of US treasury bills.

Though that news was a massive relief for the imperiled US economy, it did not come lightly. According to Paulson’s memoir, published in 2010, Wang ended the call with a warning: “I know you think this may end all of your problems, but it may not be over yet.”

If anything, that was an understatement. The earth-shattering event that followed – brought on by deregulation, speculation, over-leveraging and a reckless intrusion of Wall Street into housing markets – triggered a widespread reconsideration of the Western model by economists and cadres in China’s financial sector.