Advertisement

Advertisement

Aidan Yao

Aidan Yao is a senior investment strategist for Asia at Amundi, based in Hong Kong. Prior to joining Amundi in October 2024, he was chief economist, global macro, investment strategy and asset allocation research at Long Shine Asset Management in Hong Kong. Before that, he spent 10 years at AXA Investment Managers serving as senior emerging Asia economist. From 2011 to 2013, he held a managerial role in the research department at Hong Kong Monetary Authority. Aidan holds a master’s degree in finance from the University of Otago.

The most effective and sustainable solution for China is to put its own house in order by focusing on reinvigorating domestic demand.

What ails China’s economy is a deficiency of demand, making fiscal transfers to boost domestic spending the right cure. A consumption-led recovery is not only consistent with Beijing’s goal of rebalancing the economy, but will also help address China’s trade imbalance with the US and strengthen economic relations with its regional partners.

A new round of troubles of high-profile developers has added to the urgency policymakers feel to stabilise China’s ailing property market. While the near-term priority is to stop the bleeding, longer-term reforms such as increasing social housing are needed to put the market on sustainable footing.

The raft of second-quarter economic data should lay to rest doubts about China’s post-pandemic recovery having run its course. Beijing’s macroeconomic policies are out of sync with reality, and policymakers must take action to boost growth.

Advertisement

Together with a forceful stimulus to revive growth, a smart approach to defuse China’s local government debt bomb could go a long way towards reducing systemic risks of the financial system, lessening the burden of the economy and restoring the confidence of investors.

The Chinese economy is operating significantly below its full potential despite the rosy year-on-year growth numbers. With rising unemployment, worsening deflation and growing systemic risks, policymakers need to do what’s right for both economy and society.

Instead of being unduly cautious about stimulus, Beijing should learn to avoid allocating it to unproductive sectors. China’s policymakers could also consider relying on the equity market, instead of property, to unleash household wealth.

A pause for profit-taking after weeks of gains is not surprising, and the underpinnings of China’s equity market are solid enough to support further recovery. Markets might need confirmation of a genuine earnings recovery to continue the ascent, so investors should continue to monitor markets closely.

What was assumed to be a gradual reopening has turned into a sprint to the exit. This means deeper near-term disruptions but the rebound is also likely to be more vigorous.

As Beijing begins easing pandemic restrictions, the rising Covid-19 caseload and pressure on hospitals could force local authorities to back-pedal. Moreover, even with a fully reopened economy by next year, recovery will take time.

Markets may start bottoming out on the news but investors should pay more attention to what the government does, than what it says. True challenge is in implementation, given China faces its most severe outbreak in months.

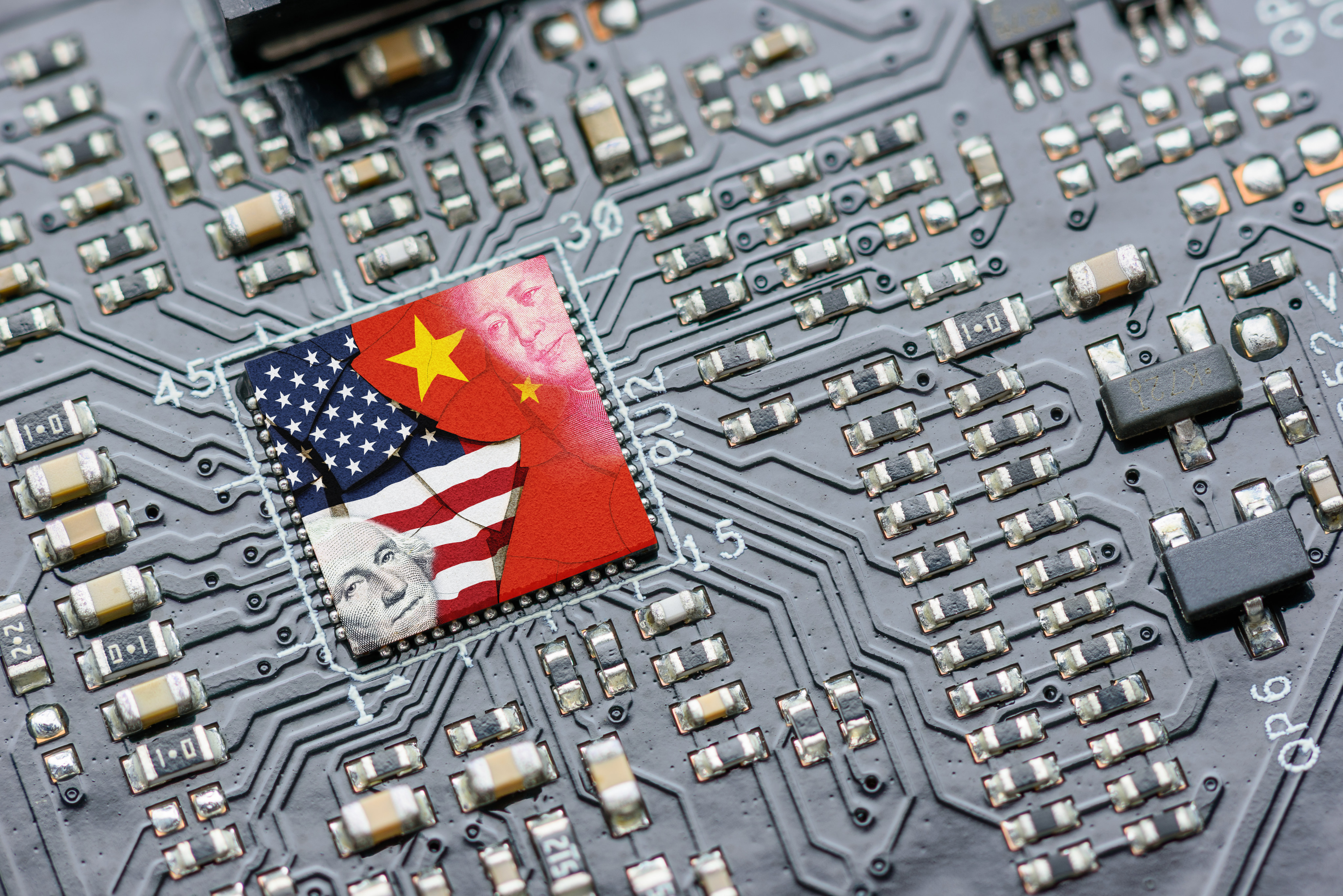

A blanket ban on products that use US technology being sold to China would not just affect China’s tech development and hurt US companies with Chinese business. It would also rip up global tech supply chains, leaving the world economy with higher inflation and slower growth.

Given China’s close trade ties with the US and Europe, weakening demand in those markets will have an obvious impact on the Chinese economy. Also, China’s financial markets will not be immune to the external volatility induced by US recession fears.

Beijing’s insistence on housing being for living in rather than speculation suggests a bailout for the sector is not forthcoming. Instead, there needs to be a focus on managing risks in the short term, finding new growth engines in the medium term and eventually reshaping the housing market.

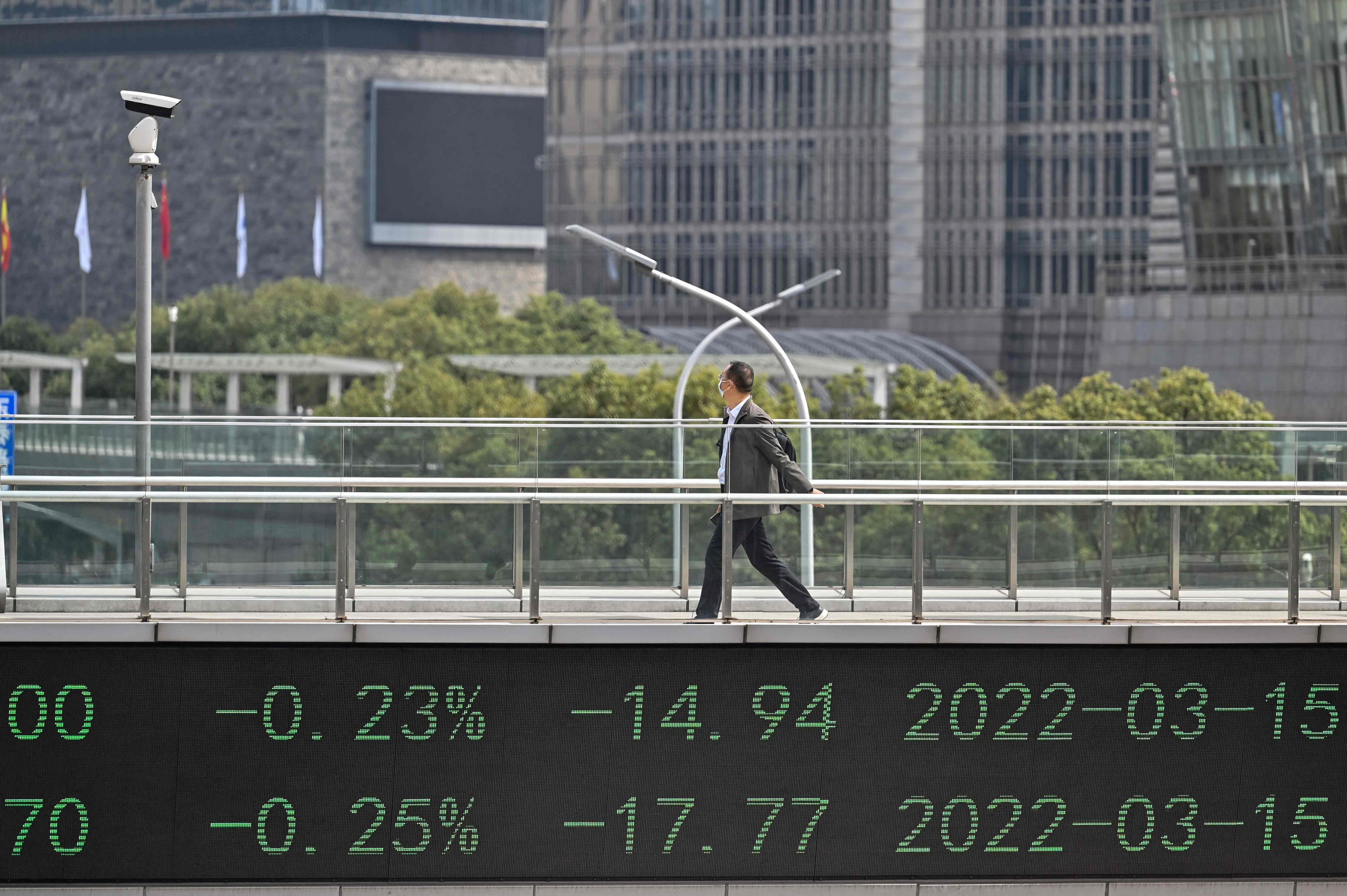

Chinese stocks are holding their own even as aggressive liquidity tightening and recession worries trigger sell-offs in the US and Europe. With much of the bad news priced in and efforts to stabilise the economy bearing fruit, investors who cut their China exposure would be wise to revisit their position.

While pandemic woes and rising commodity prices have shaken investor confidence in China, it remains an open, globally accessible and growing market. The real unease stems from Beijing’s regulatory uncertainty, but policymakers have caught onto this and promised relief.

China is not as medically prepared as many Western countries were before they opened up, with large numbers of elderly yet to have a third vaccine dose. A middle-of-the-road approach, with fewer draconian lockdowns while keeping many social restrictions, could help boost the faltering economy.

As China faces its biggest Covid-19 outbreak yet, the economic impact of the government’s strict approach will make it difficult to meet annual growth targets. There are signs the policy is being recalibrated to prepare for living with the virus, but the moderation will do little to ease growth pains in the near term.

Given its central role in the country’s economy, China’s real estate sector is ‘too big to fail’ and poses wider risks in the event of a meltdown. The push to see housing as shelter rather than an investment is more in line with China’s long-term goals but will not be painless.

Affordable valuations and shifting capital will make China attractive as investors seek value in places where asset prices are less expensive. People moving their money out of real estate and into financial assets could drive an equity and bond market rally this year.

As energy shortages, an overhaul of the housing sector, and uncertainty around Covid-19 threaten economic stability, a more lenient approach to policy is needed to balance short-term pains with long-term recovery.

While fundamental demand for homes peaked in 2018, real estate investment was buoyed by the liquidity created by the central bank. The property investment carnival encompassed the central government, local administrations, wealthy households, banks and developers, but the drive towards common prosperity may spell its end.

Beijing shouldn’t rush to achieve long-term goals – such as reaching net zero carbon emissions and deflating the housing bubble – when the economy is in free fall. It should rethink its zero-Covid, property and coal policies before the risks worsen.

If the shift in Beijing’s long-term development strategy is to succeed, it must adjust tax policies, improve the social safety net, and ensure equal opportunities by reining in corporate excess.

Beijing’s regulatory moves on Big Tech, fintech and for-profit education are aligned with its long-term strategic priority, “common prosperity”. However, this is not a goal that can be achieved with a few policy tweaks, and Beijing should consider the financial market reaction to its moves.

Despite rising costs, a US trade war and the Covid-19 outbreak, China’s resilient supply chain has prevailed and enabled its economy to move up the value chain. China remains an export powerhouse reshaping the landscape of global trade.

The three-child policy is unlikely to reverse the demographic slide, but China can mitigate likely impacts on the economy. Besides raising the retirement age, it could make the most of its educated workers, adopt automation and consider outsourcing.

Markets must adapt to the likelihood of the pandemic lasting years, and adjust growth expectations accordingly. Inflation will depend on whether disinflationary forces are stronger than the impact of unprecedented monetary stimulus.

The green bond market, already the world’s second largest, is expected to grow further in size, depth and liquidity to meet China’s ambitious net-zero carbon target. Strengthening information disclosure and a more rigorous definition of what counts as a green bond will add to the appeal.

The Chinese economy was hit by renewed Covid-19 outbreaks before Lunar New Year, but the effects were uneven and rather short-lived. There are plenty of reasons to be optimistic about China’s economic outlook. Mobility is returning to levels seen in 2019, and China has started a vaccine drive