Advertisement

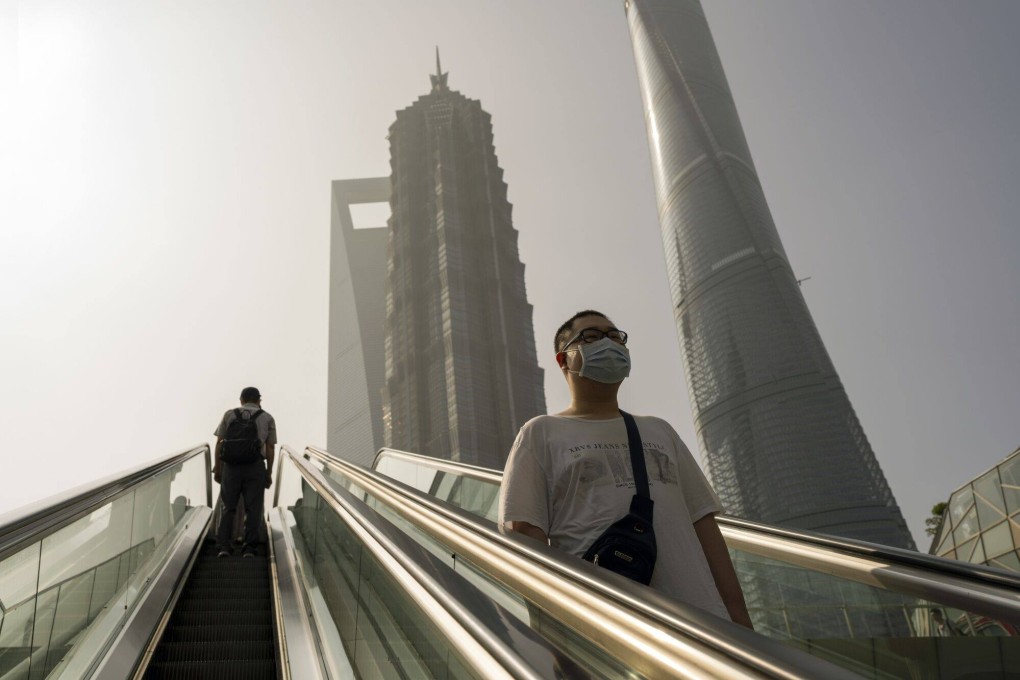

Macroscope | Why China can’t afford to wait and see about economic stimulus

- The Chinese economy is operating significantly below its full potential despite the rosy year-on-year growth numbers

- With rising unemployment, worsening deflation and growing systemic risks, policymakers need to do what’s right for both economy and society

Reading Time:3 minutes

Why you can trust SCMP

1

Investors are growing impatient with the lack of a policy response to China’s faltering economy. Onshore equities have retraced almost all their gains from the first half of the month, while offshore equities have fallen almost 7 per cent from their month-to-date peak. The insufficient follow-through on Beijing’s hints about a comprehensive stimulus package has dimmed hopes for a fast turnaround of the world’s second-largest economy.

Advertisement

So what is holding Beijing back from taking the necessary steps to stop the economic bleeding? Below are a few possible explanations, along with my assessment of their validity.

For a start, Beijing could have been caught off guard by the brevity of the post-Covid recovery. Like everyone else, the authorities might have thought that pent-up demand unleashed by reopening could fuel strong economic growth throughout 2023, during which policy would be best left on autopilot.

In that scenario – which was also the working assumption of the market at the start of the year – policymakers would not have to contemplate any new stimulus until possibly well into 2024. The lack of foresight and planning for the current economic downturn could have contributed to the delayed action.

Second, the authorities may be concerned about the side effects of policy easing. This, unlike in many developed economies, has less to do with inflation in the current environment. In fact, for an economy on the verge of falling into deflation, China would welcome any positive price impulses.

Advertisement

However, the exchange rate is a different matter. A sharp and disorderly depreciation of the renminbi could drive unbridled capital outflows that put financial stability at risk.

Advertisement