Advertisement

Advertisement

Yuke Xie

Beijing

Yuke obtained her BA and MA in Film and Media Studies from Columbia University in 2019 and 2021. She joined the Post as a business reporter in 2023, following stints at various media outlets including Mergermarket and Süddeutsche Zeitung.

New chairman’s state-linked background sends positive signals, but company’s fate still depends on a sales recovery, an analyst says.

China Pacific, Taikang Life and Sunshine Life among the firms putting ‘patient capital’ into A shares to help stabilise the market.

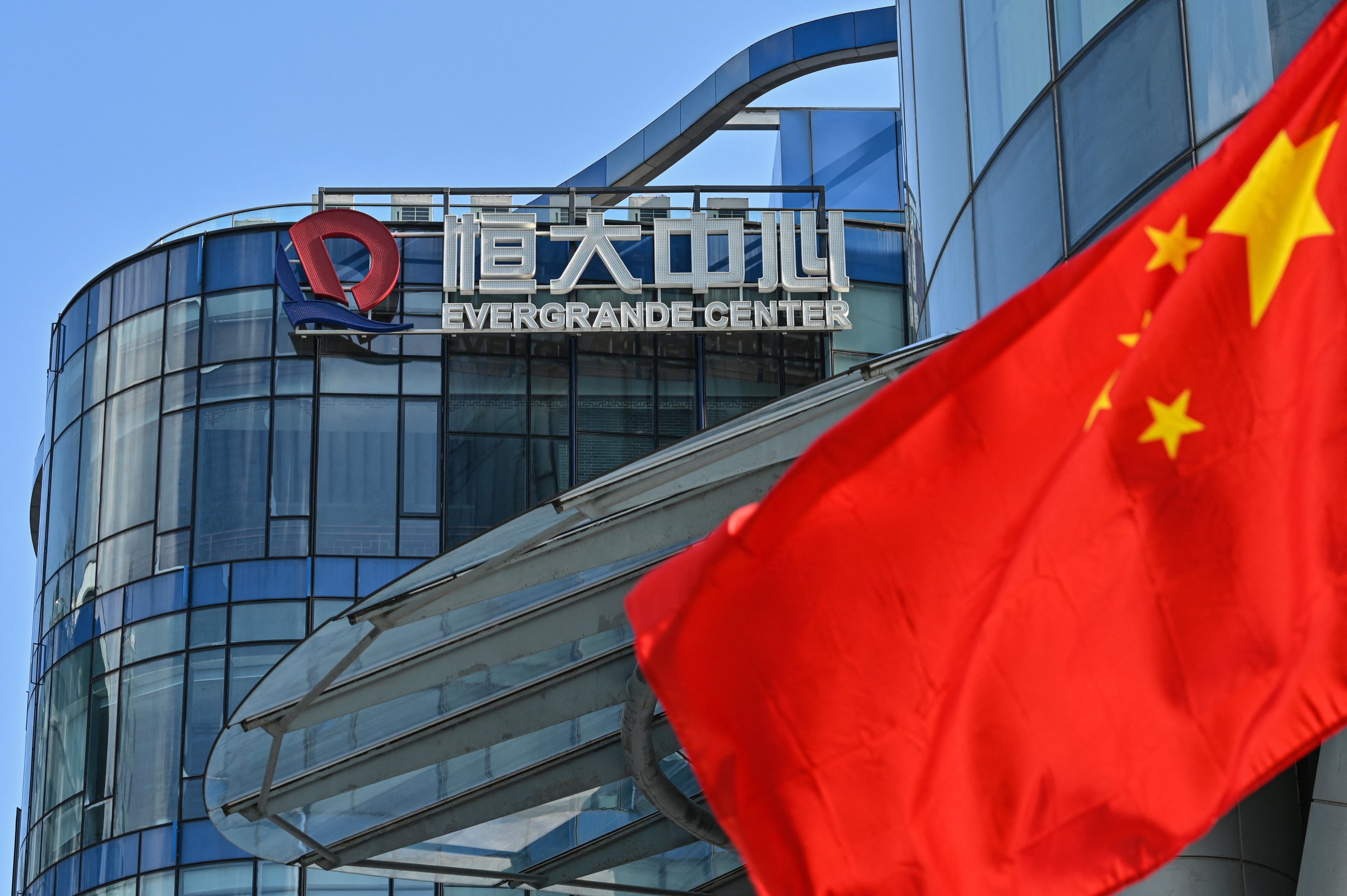

Restructuring terms allow the Chinese developer to effectively cut its annual borrowing costs to 4.12 per cent from 9.6 per cent.

Beijing’s call for insurers, mutual funds and social-security funds to boost their A-share investments should reduce volatility, analysts say.

Advertisement

As domestic spending falters, Chinese consumer brands are eyeing global markets, but tariffs and cultural barriers could get in their way.

Low prices are destroying the quality of Chinese products and undermining the economy, tycoon says.

Residential sales in Hong Kong continue to improve, and mainland China sales are on track, embattled company says.

Investments from the National Social Security Fund, mutual funds and other sources will be increased to boost the stock market, regulators say.

Specialist in recycling batteries, electronic waste, scrapped cars and waste plastics seeks funds to speed global expansion.

S&P Global also downgrades indebted builder’s bonds two notches on concerns about the company’s liquidity.

Domestic brands and private labels stand to benefit as households save less and spend more, Swiss bank says.

Ou Zongrong placed under legal compulsory measures after restructuring support agreement expired, according to holding company.

‘Major milestone’ enhances Hong Kong’s role as a conduit to China, the world’s biggest consumer of metals.

A government takeover could be seen as a positive development in the market, according to an analyst.

The infrastructure unit under Chow Tai Fook Enterprises said it will apply to list the new shares on the Hong Kong exchange.

Foshan-based developer also says revenue for first half of 2024 fell 55 per cent to 102 billion yuan (US$13.9 billion).

Elfin character loses value on speculative market, but gives investors faith in Pop Mart’s formula for monetising intellectual property.

China’s developers collectively have over 700 billion yuan worth of property bonds due this year.

Analysts believe more firms will follow suit in an effort to ease their liquidity crises.

The stock has dropped 7 per cent this year after losing more than 50 per cent of its value last year.

The Chinese retailer has been ramping up its overseas expansion efforts in a bid to create a global network of 40,000 stores.

Parent FMG is also reportedly planning a more than US$100 million initial public offering in Hong Kong.

The industries in question include integrated circuits, biopharmaceuticals and new materials.

Around 15 per cent of the office space in the business district is currently vacant because of weak demand.

Most executives expect revenue growth next year, and hiring intentions are at a four-year high, CPA Australia report says.

At about 2.03 per cent, rental yield is still way below the benchmark home mortgage financing rate to spark investment in new homes.

Shimao faced liquidation petition from Hong Kong branch of state lender CCB over unpaid borrowings.

Sino Ocean and Shimao debt plans inch ahead in ‘positive signal’, but true recovery is still far off given structural issues, analysts say.

The divestment comes amid Sunac’s efforts to restructure about US$2 billion in onshore debt.

Stake in New World Sports Development, the developer of Kai Tak Sports Park, sold to Chow Tai Fook Enterprises for US$53.5 million.