Advertisement

Advertisement

Stephen Vines

Stephen Vines is a Hong Kong based writer and journalist. He has worked in Asia for The Guardian‚ The Daily Telegraph‚ and The Independent‚ and was a consultant editor for The Asia Times.

The recent land supply consultation, which was pre-empted by the chief executive’s reclamation proposal, only deepens people’s cynicism over the government’s intention to engage the public.

The new ban is based on flawed arguments. Young people are also at risk from carbohydrates, trans fats and fast food, so is the Carrie Lam administration going to intervene in all these markets, too?

While shareholders’ quest for short-term profit is understandable, the long-term well-being of the company as well as the greater public good could at stake.

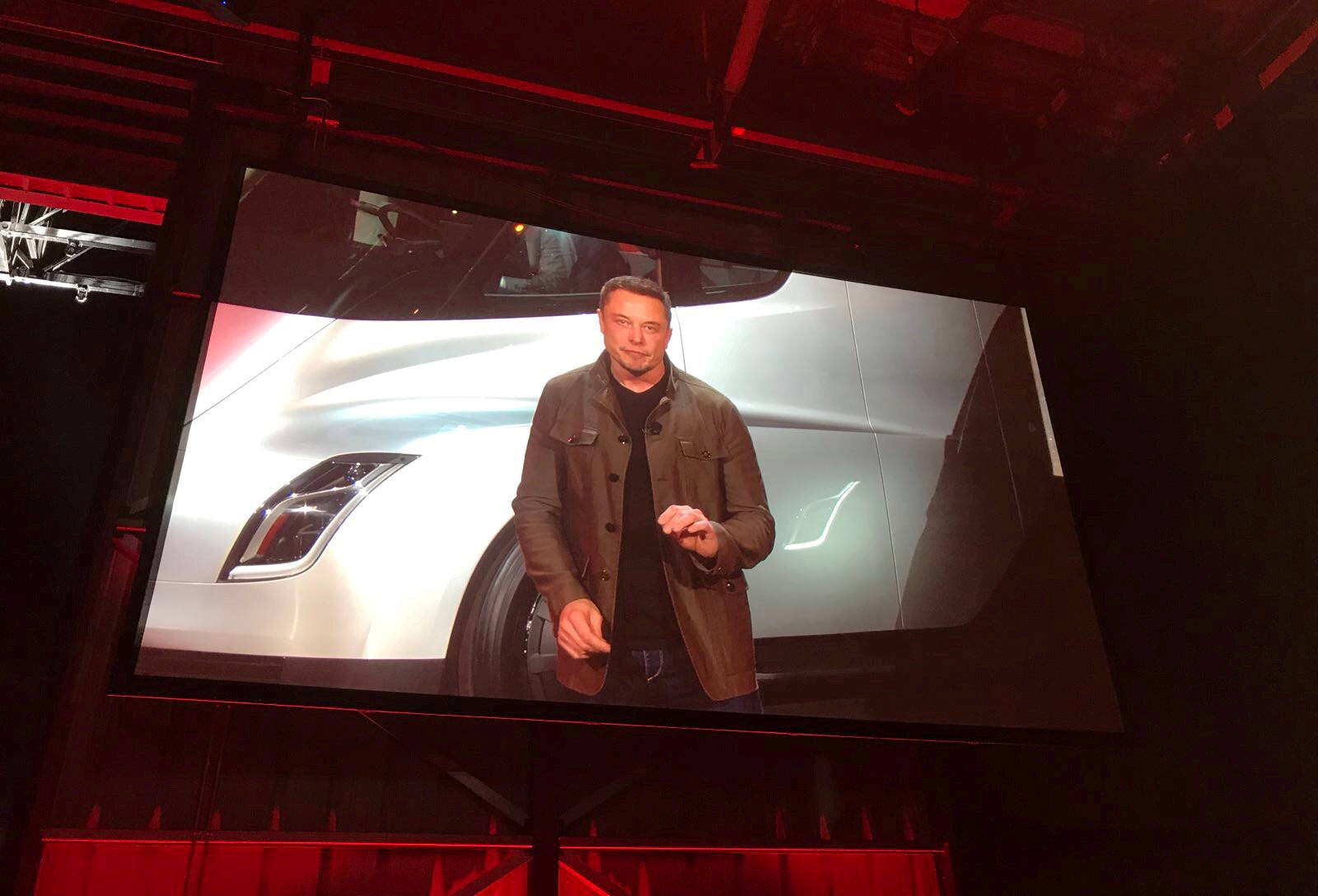

Tesla has been spared a plunge in its share price after an SEC lawsuit was settled out of court, but it continues to face a challenge familiar to all companies dominated by a larger-than-life founder: protecting its legacy.

Advertisement

Gold, the traditional safe haven in times of market downturn, seems to be performing poorly despite the US-China trade war, political instability in Europe and currency depreciation in emerging markets.

Hong Kong need only look to its own history to discover the truth in the reams of research that highlight the benefits of immigration to society.

If a patriotism-fuelled boycott of US products in China gets under way, the Chinese companies behind these brands would be the worst affected.

The US should replace three-monthly filings with half-yearly reports and stop driving executives to prioritise short-term goals.

Innovative business leaders struggle with some of the challenges inherent in leading public companies – from shareholder expectations to short sellers.

Chinese exports of marmalade to the US are small and unlikely to be decisive in the trade war, but marmalade is itself a product with a uniquely global production history, showing how much we benefit from international trade.

As the importance of trademark protection to the global trade agenda grows, Hong Kong’s rule of law advantage over mainland China is apparent.

David Solomon’s unusual pastime shows how having a life away from work need not be a detriment to success, whereas Elon Musk’s thoughtless comments in the aftermath of the Thai soccer team’s rescue show that a narrow focus on work can be bad for business.

The focus has been on how producers and markets would be affected, even though consumers, some of whom are getting carried away by the nationalist fervour whipped up, will bear the brunt of the higher prices.

Hong Kong’s public annuity scheme offers a lower return on investment than other financial instruments, does not account for inflation and fails to tackle elderly poverty.

The most successful brands in history share the ability to fill a gap in the market with a pre-existing invention.

The Hong Kong government’s move to raise the retirement age for more civil servants is laudable, but a far bigger change in policy measures and work practices is needed if Hong Kong is to cope with its ageing population.

The lack of accountability displayed by the MTR Corporation’s leadership is rooted in it being a listed company whose major shareholder is also its regulator.

The reason hedge fund managers’ profits continually grow, even as the hedge funds themselves consistently fail to deliver, is that investors tend only to remember the highly publicised cases of ‘money gods’ who netted huge sums in unusual circumstances.

Companies open themselves up to regulatory pressure, advertiser boycotts and damage to their reputations if they appear to support racism.

The closing of the Sai Yeung Choi Street South pedestrian zone shows that Hong Kong’s ‘pro-business’ politicians clearly favour some types of business over others.

Stephen Vines says Fifa head Gianni Infantino has had a less scandal-plagued run than his predecessor, but his grand plans for new global club competitions will mean more corporate dollars and a loss of the local feel fans crave.

Tinkering with the Mandatory Provident Fund won’t do much, the scheme itself needs to go.

It’s hardly unusual that an entrepreneur like the Tesla and SpaceX CEO would clash with investors, who have become conditioned to expect near-term reward in their dividend payments.

Public consultations serve to delay action that needs to be taken, and in the case of land and housing issues, that action should be to take on powerful vested interests, including the Fanling golf club.

Recent events have separately dealt blows to ZTE’s supply chain and Starbucks’ reputation, bringing home the challenges of running a business in these uncertain times.

While most companies go to market to raise money, with its DIY listing on the New York Stock Exchange, Spotify is asking the market to be a loss funder. That’s far from unusual in hi-tech stock listings.

Companies that have been built and thrived on the force of their founders’ personalities struggle when these people become a liability and have to be shunted out

Giving one-off budget ‘sweeteners’ is not an effective way of sharing the wealth. With no public spending reform or universal pension scheme, the next best way may be a publicly funded ‘inheritance’ for, say, all who have turned 25.

Conglomerates built by charismatic tycoons often don’t fare so well under second generation leadership who’ve been groomed for the role but lack street smarts