Advertisement

Advertisement

Patrik Schowitz

Patrik Schowitz is a global multi-asset strategist at JP Morgan Asset Management.

While more modest corporate earnings and the quick pace of policy tightening have hurt the tech sector and US equity market, the two leaders of the global stock rally, emerging market equities have been much more resilient by contrast.

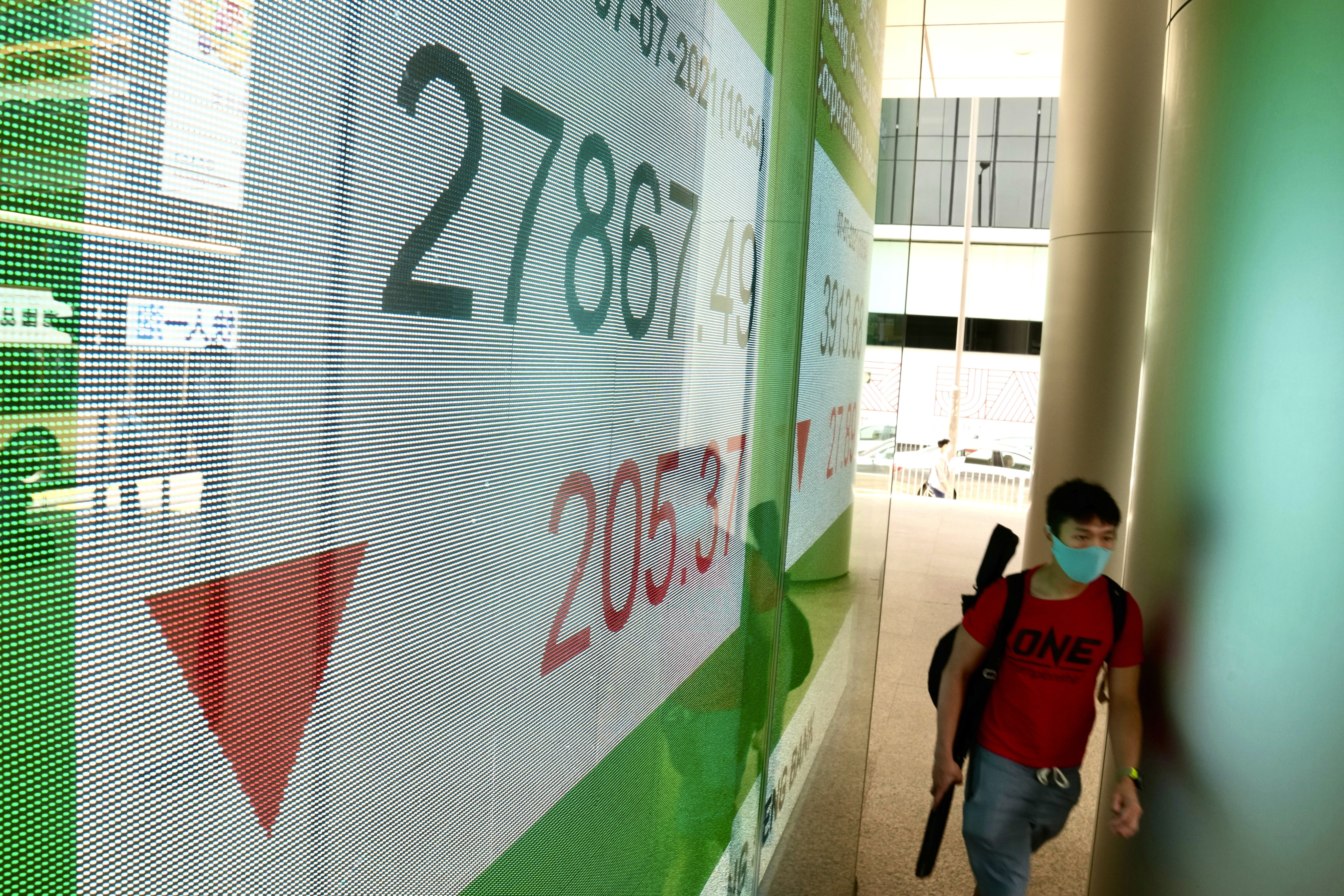

Strong corporate profits in a rebounding global economy lifted stock markets in the developed world but not those in emerging markets. China’s slowing growth, property sector jitters and the government’s regulatory crackdown all played a part in weighing down Chinese assets.

Inflation might be higher in this economic cycle than the last, but the current elevated rate is likely to represent the high point. Further burdening the economy with tighter policy could threaten the recovery central banks have worked so hard to nurture.

If the slowdown in the Chinese economy continues, policymakers could loosen monetary policy again. That might end up helping the parts of the economy policymakers want to de-emphasise, but Chinese and emerging equity markets would cheer such a turnaround.

Advertisement

Falling bond yields are probably an exaggerated reflection of economic headwinds, given the distortions by central bank policy. Equities should stay positive as earnings outperform expectations.

Setbacks in the recovery are possible, and news on the Delta variant and Chinese economic momentum must be closely watched. But looking at economic fundamentals, this time it seems likely that it is bond markets that have got carried away with a gloomy world view.

While Asia has come to be regarded as a global vaccine laggard, clear differences are emerging between markets in the region. Among economies where vaccine take-up has been sluggish, those that rely on tourism will be harder hit.

Consider China, which has been leading economic trends during the pandemic. GDP growth reached a high point in the first quarter, but is now likely to slow and Chinese equity markets are reflecting this.

While emerging markets are much more stable than they were during the ‘taper tantrum’ of 2013, they are dominated by internet, technology and consumer giants. Because manufacturing and financial companies will benefit more from global growth, emerging equity markets may struggle to keep up.

Markets have been fairly relaxed about vaccination roll-out delays but could still be spooked if a new virus strain proves resistant. A sharp rise in interest rates, particularly as a result of inflation, could also prompt a damaging sell-off.

Asset markets will have to transition from an environment fuelled largely by emergency policy support, to one driven increasingly by real global economic recovery. The likely recovery in corporate profits in 2021 is unlikely to lead to another period of outsize equity gains, as much of it is already priced in.

While short-term optimism surges, questions remain over how much the pandemic has scarred the global economy and constrained future growth potential. It is hard not to be concerned about the impact of high debt levels on inflation and economic growth, even as some economists challenge orthodox views on debt.

Uncertainties remain, but the positive trajectory of global growth continues to march ahead. This should provide a good environment for emerging market stocks dominated by Asian export powerhouses that are dependent on the health of the world economy.

The domination of a few tech giants means the US stock market is more vulnerable to both narrow bull runs and sharp reversals in investor sentiment.

The US’ mishandling of the coronavirus means its economic outperformance relative to the euro area and Japan no longer seems guaranteed. The dollar’s drop, however, is not a tectonic shift.

Most market watchers predict a drop and bounce-back in profits sharp enough to be called V-shaped. If they are right, the reporting of second-quarter company earnings now under way should reflect a turning point in global profits downturn.

Amid a dramatic US-led stock market rebound, overlooked emerging market equities stand to reap the benefits of a cyclical upturn, subject to US dollar strength, while European equities are increasingly attractive after recent policy boosts.

Investors seem to be weighing the market’s long-term prospects, based on stimulus measures, rather than voting on short-term risk.

Most Asian economies are net oil importers so a fall in oil prices will lead to stronger economic growth, allowing governments to initiate fiscal stimulus measures to counteract the effect of the coronavirus outbreak.

After a spectacular 2019, markets could rise modestly in 2020 on the back of stabilising profit margins amid recovering economic growth. The reporting season now under way will set the tone for markets.

The divergence of rising stock markets from economic realities and political tensions can be expected to narrow in the coming year, on signs of a modest rebound in global manufacturing and a reduction of geopolitical risks.

While economic growth is important, investor returns depend on more than that. In China’s case, the deepening and opening up of its financial markets are factors that will boost returns – and help it escape the middle-income trap.

Recent positive developments in some of the major issues weighing on markets, from the US-China trade war to Hong Kong’s protests, offer a welcome respite. But economic fundamentals remain weak and policymakers’ toolboxes are limited.

Normally falling bond yields are a sign of conditions that bring down equity markets. That’s not the case at the moment, but failure to resolve the trade dispute could end equities’ winning streak.

While China’s boost to the property sector in 2016 translated into an increase in commodity imports from emerging Asia, this year’s infrastructure-focused stimulus is unlikely to have the same effect. Meanwhile, trade war headwinds are likely to hit exports from the region.

A close look at the Shanghai benchmark index reveals investors were already less bullish before the latest trade war flare-up. Chinese investor sentiment is also closely linked to whether the central bank will take further stimulus measures.

Despite a recent surge, stock markets are roughly where they were before last year’s drop-off. Investors should watch what companies are saying about global conditions to anticipate what’s next.

While markets’ optimistic response to progress on a US-China trade deal and Chinese economic stimulus seems sensible, expectations that the Fed will continue its leniency in this cycle may be overblown.

Despite the gloom of a slowdown as the impact of a trade war with the US hits, the raft of policy measures Beijing is taking is boosting market optimism. The strong rally in the stock market may well signal the economic cycle is ready to turn.

If investors are looking for something to bank on amid market chaos, take the projected profit growth coming out of US companies, then add 3 to 4 percentage points