Advertisement

Macroscope | Asian markets’ coronavirus divide: bright prospects for China, Japan as tourism-dependent economies struggle

- Asia has come to be regarded as a global vaccine laggard, but clear differences are emerging between markets in the region based on vaccination rates

- Among economies where vaccine take-up has been sluggish, those that rely on tourism will be harder hit

Reading Time:3 minutes

Why you can trust SCMP

0

Until relatively recently, it seemed that Asia had a better grip on the pandemic than the rest of the world. However, as countries across the globe move from containment and suppression towards vaccination and reopening, Asia risks falling behind Europe and North America.

While they struggled to contain the initial outbreak of Covid-19, the US and the UK were the first major economies to start widely vaccinating their populations and they are reaping the benefits of relaxed social distancing measures as their economic activity rebounds. Having initially got off to slow starts, Europe and Canada are now also on a very similar trajectory.

In contrast, Asia has increasingly come to be regarded as a global vaccination laggard due to combinations of still-strong suppression of Covid-19 cases, related vaccine hesitancy, and lack of vaccine supplies. However, this broad-brush-stroke picture is increasingly unjustified, as clear divergences are emerging between markets in the region.

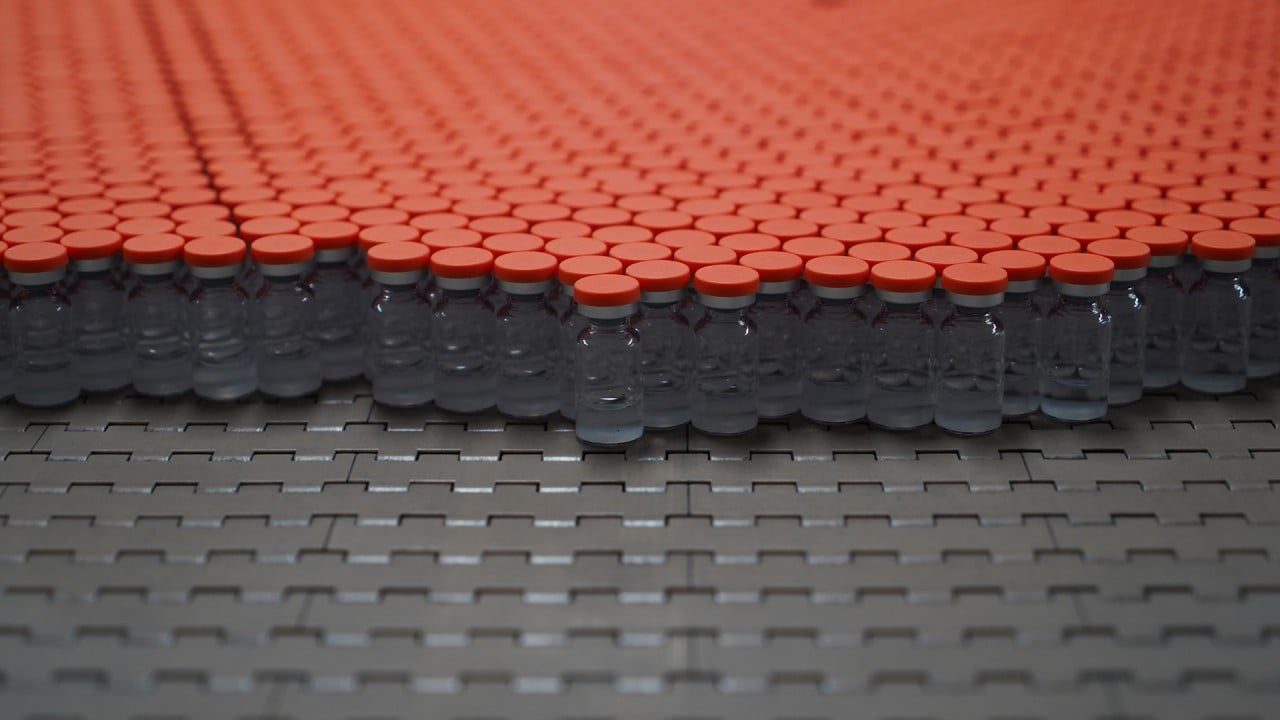

On one side are the two major economies, China and Japan. In both, the vaccination picture is beginning to look more encouraging. China, in particular, has been ramping up its vaccination rate dramatically and, in recent weeks, has been vaccinating well over 1 per cent of its population per day.

If this speed can be sustained, it could conceivably vaccinate its entire population before the end of the year. And high coverage is likely to compensate for the fact that China’s vaccines are generally regarded as having relatively lower efficacy.

Even in China’s fully-recovered economy, this would be likely to benefit the consumer sector, which has lagged behind in the recovery.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2-3x faster

1.1x

220 WPM

Slow

Normal

Fast

1.1x