Advertisement

Advertisement

Neil Newman

Neil Newman is a thematic portfolio strategist focused on pan-Asian equity markets. Experienced in the major global financial centres of Tokyo, London and New York, he is a regular commentator on commercial investment strategies that suit constantly changing investor trends. He is a long-term resident of Hong Kong.

Hong Kong may be doing what it thinks the mainland wants, but it still has something to learn – that people have their limits, writes Neil Newman.

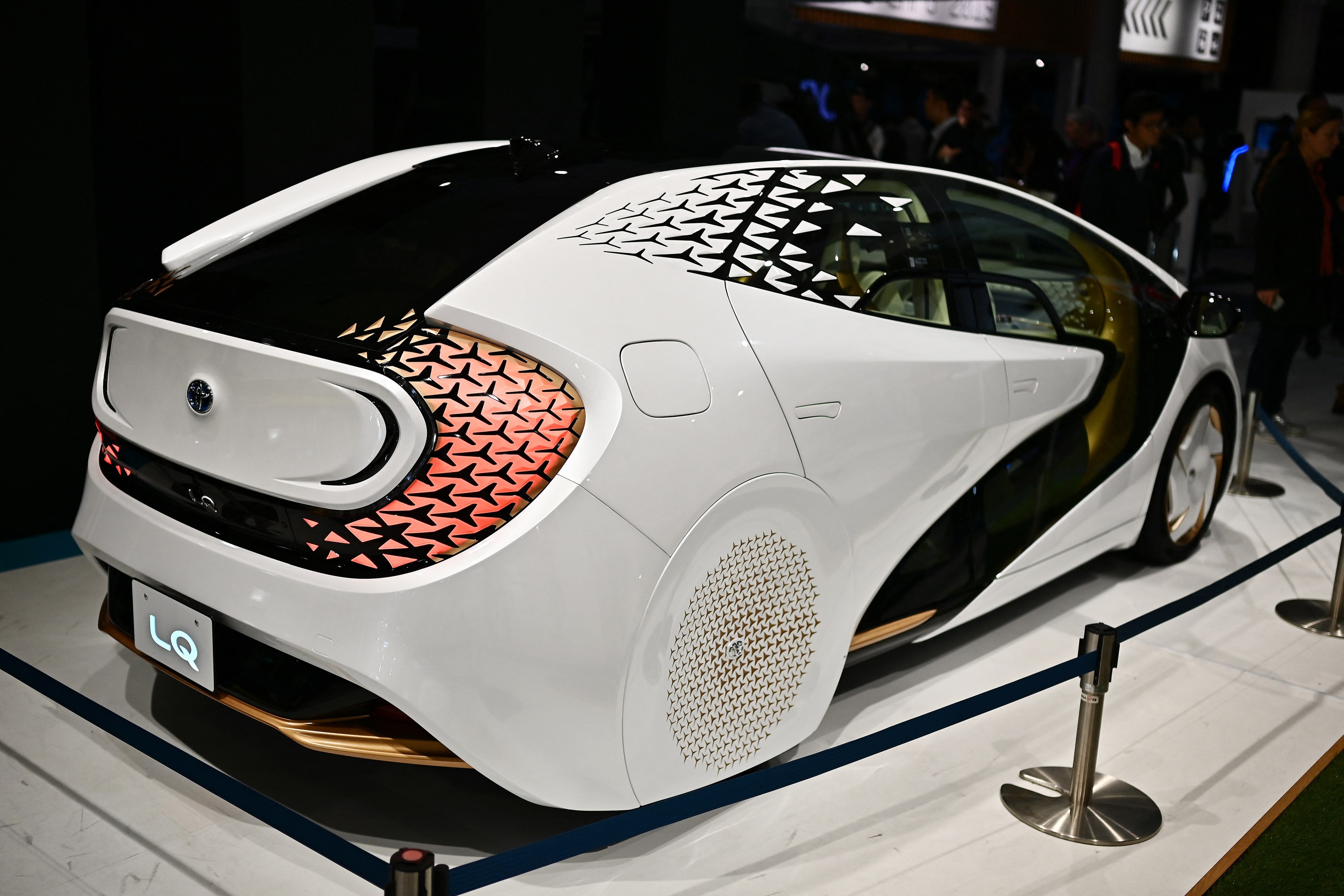

Neil Newman discovers a little-known automotive design team in Hong Kong building the prototype of an original electric vehicle conceived in the city.

We need to hear fewer inspirational quotes from cartoon characters such as Daddy Pig or Kermit the Frog, and more from the UK leader’s wartime idol, writes Neil Newman.

Older second-hand cars are largely shunned in Hong Kong but sought after overseas by owner-driver-investors. Could these be an astute purchase, asks Neil Newman.

Advertisement

Until we reach the pandemic’s final act and can see a happy ending, let’s be more like beloved animated character Doraemon and focus on the positives, write Neil Newman.

Fit for Fido, but passed over by people, Neil Newman wonders what it is like to be chipped like a dog to store your Covid data.

Ultravox fan Neil Newman Dances with Tears in His Eyes and Laments over dumping his record collection during a Sleepwalk, as he ponders if transferring art exclusively into the digital world is the right move.

Grande idea: by harnessing the power of real intelligence, not the artificial kind, a café in Tokyo is using robots to serve customers their daily cup of Joe.

Low interest rates are dying off and the Hong Kong economy, reliant on shopping vouchers, looks moribund. Neil Newman spots the last known survivor.

In Japan, where the state foots the bill, you get three square meals a day and are trusted not to do a runner. All you need to do is iron your own toast, writes Neil Newman.

Consumer drones once looked like a fad that would come and go, but now, if you have the means, you can buy one and sit on it, Neil Newman writes.

The city’s leisure and F&B industry is once again in crisis and it’s up to the Hong Kong Musicians Union to ensure entertainers aren’t cut off from government relief.

The rising price of lithium – and the environmental cost of throwing batteries away – threatens demand unless manufacturers are willing to think outside the box, writes Neil Newman.

It may not be ‘war’ by its standard definition, or even a cold war, but geopolitical conflict in this century is being waged through the weaponisation of relationships and people, writes Neil Newman.

On the first anniversary of the US Capitol insurrection and ahead of the November midterms, Trump is hoping the stars will align for him.

KFCs in the country sell much more than just fried chicken and have become a yuletide favourite.

It’s hard to imagine Australians are short of urea, the humble chemical that goes daily down the dunny, but a dwindling supply threatens to cripple the country, writes Neil Newman.

Japan might seem boring, but it could be time to reconsider the safe-haven, low inflation, low interest rate market, writes Neil Newman.

Having binge-watched Squid Game and Hellbound, Neil Newman has another item to add to his New Year detox list.

As the Omicron coronavirus variant delays reopening plans, a pressing question emerges: would the Japanese even really want foreign tourists back?

Hong Kong is caught between a rock and a hard place in opening up the border: by opting for free movement with China, it can’t open up to foreign travel from elsewhere.

‘Japan now has more aircraft carriers than China – it just disguises them as helicopter carriers’.

The city is rich and can ride things out by giving away free money to puff up GDP. But it is becoming poor in other ways and risks missing out as the rest of the world speeds past, writes Neil Newman.

Neil Newman mulls filling sandbags and buying a dinghy next year.

Neil Newman asks: is anyone on Mother Earth’s side at COP26?

Stock markets are going to crash, it’s just a matter of when. So there is some housekeeping to be done now. With gold surprisingly in a downtrend, perhaps it is time to have a look before everyone else notices.

The quarter-century experiment had the best of intentions, but it has ultimately failed. Rather than playing the blame game, isn’t it time for a new approach, writes Neil Newman.

The era in which China could be trusted to buy an abundance of Australian dirt, and pay good money for it too, has come to an end, writes Neil Newman.

In the Aukus subplot, Neil Newman wonders who the Bond villain is.

The increasing nationalism of Chinese consumers, as much as supply chain issues and Covid-related disruptions, is the reason international firms are moving overseas, writes Neil Newman.