Advertisement

Advertisement

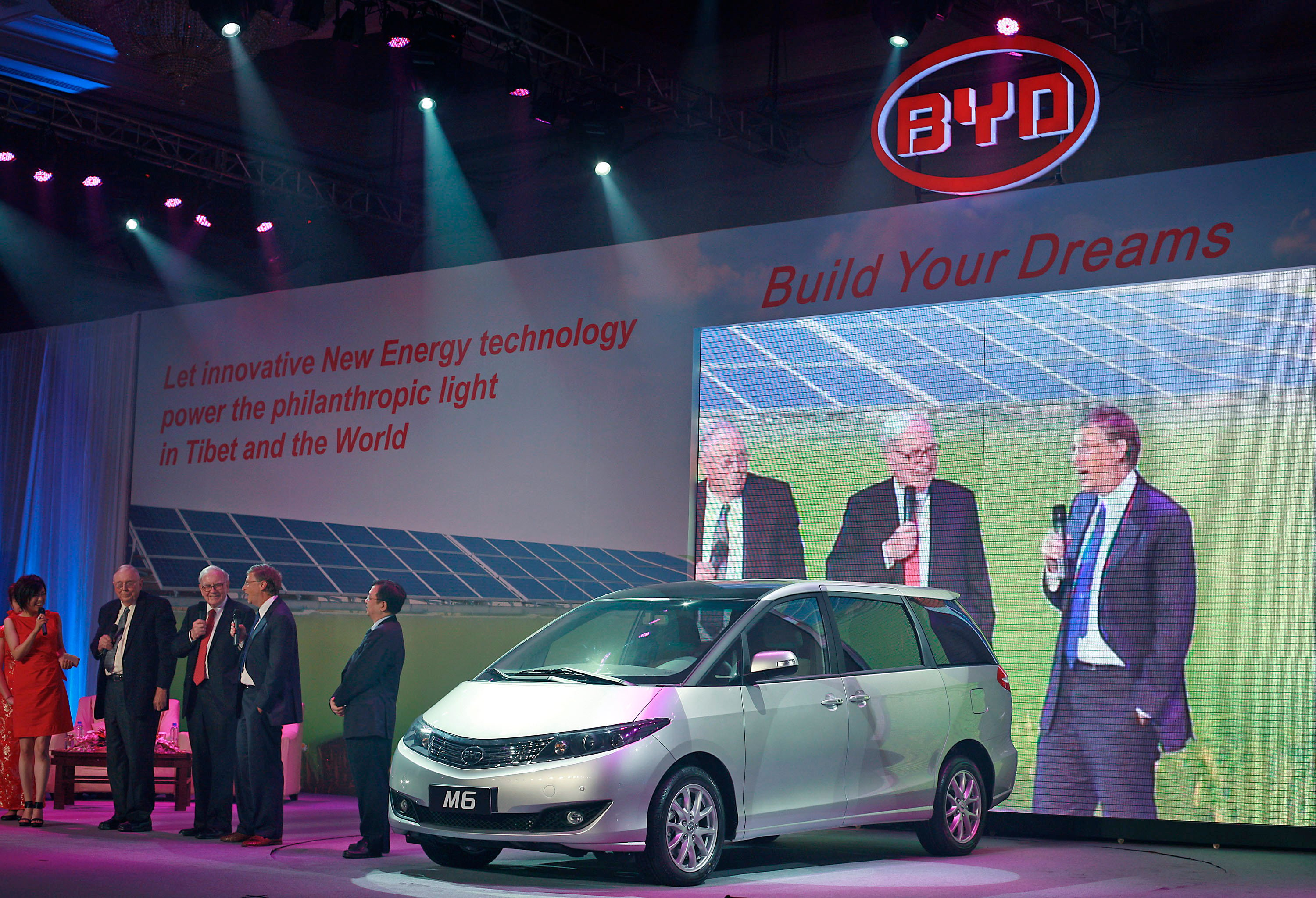

BYD plunges in Hong Kong trading after a filing shows Berkshire Hathaway trimmed its stake in the EV maker by about US$47 million.

Hong Kong’s bourse operator may have to wait longer to extract the benefits of more IPOs and trading volume as the US-China audit deal could allow Chinese companies to keep their New York listing status.

Markets are now pricing in around a 50 per cent chance of them being delisted based on a new delisting risk model created by the US bank. That compares with a high of 95 per cent in mid-March.

Covid-19 lockdowns, heatwave and power shortages are causing sales and production pain for Chinese Tesla challengers. Analysts have recently turned less bullish as big funds scooped up more shares.

Advertisement

Local stocks halted a two-week slide as Alibaba and Chinese tech peers powered this week’s 2 per cent rally. A solution to the US-China audit tiff may support further gains.

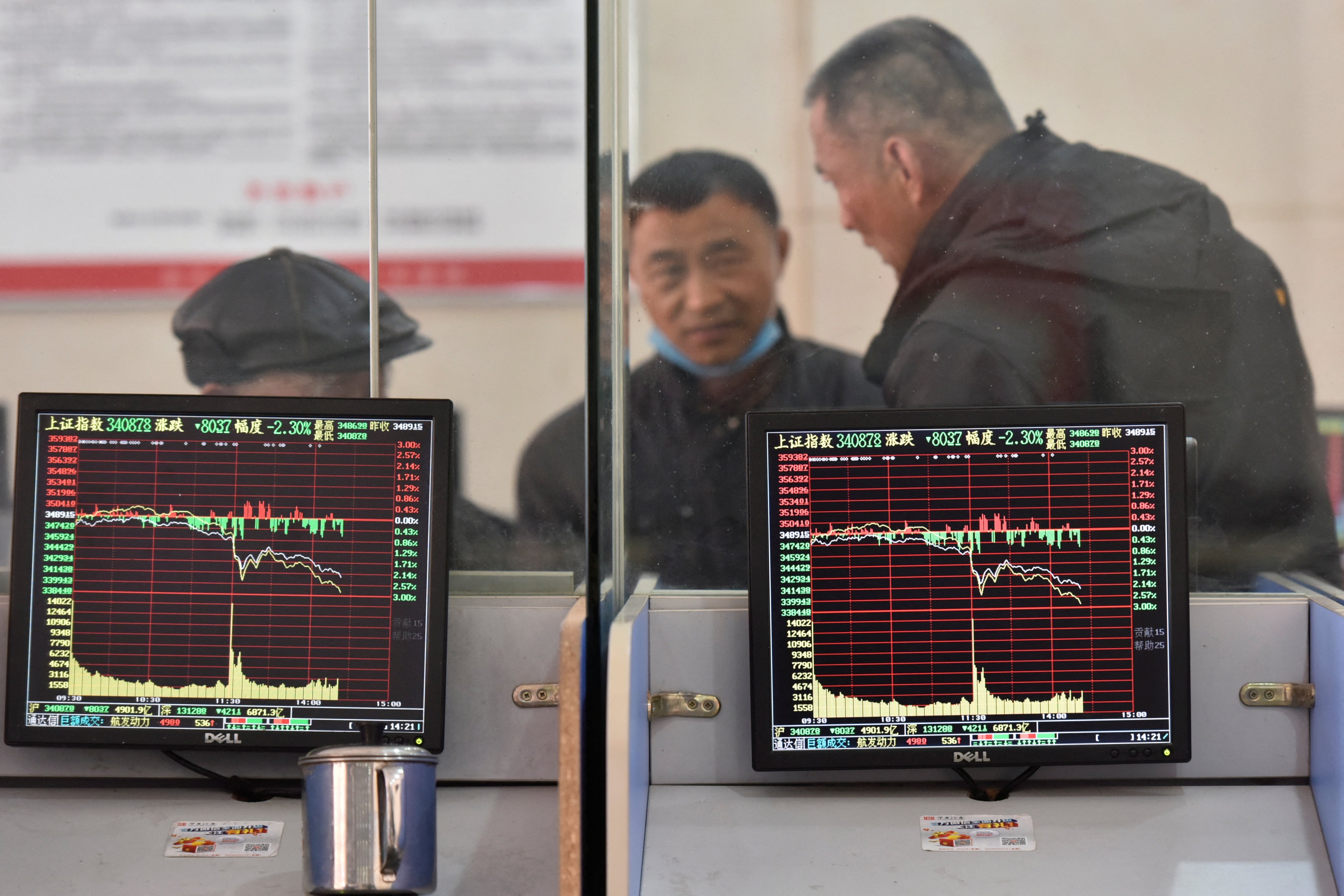

Onshore stocks decline in early trading with traders worried about economic slowdown and a looming power crisis. The morning session in Hong Kong was cancelled for all markets because of typhoon warning.

Hong Kong stocks surged by the most in four months after China unveiled new stimulus to shore up the economy. Fresh speculation on US delisting matters emerged, lifting tech firms.

Wishful thinking to expect China will fix the housing crisis before the Party Congress, while problems at home and rising geopolitical tensions make assets ‘only selectively investable’.

Local stocks hit another new low, this time with Alibaba, BYD and Geely Auto pacing the drop. HSBC slips as Ping An Insurance calls for improvement in returns.

Benchmark index hit the lowest since mid-May amid concerns about weak earnings and US rate trajectory. Investors betting on Chinese onshore stocks have taken a 15 per cent beating this year.

Hansoh Pharmaceutical, founded by China’s sixth richest woman, rose with two other new members, before officially joining the benchmark index on September 5. Chow Tai Fook Jewellery surrendered gain.

New Covid-19 cases and a looming energy crisis in mainland China are unsettling the market.

The Hang Seng Index compiler will add four stocks to the benchmark gauge from September 5, boosting its capitalisation by US$88.7 billion.

Stock surged by the maximum limit of 44 per cent on the first day of trading in Shenzhen, ending a six-year wait to relist at home since leaving Nasdaq in 2016.

‘Positive vibes’ from Beijing indicate more support on the infrastructure and lending fronts, which could have a ‘multiplier effect on boosting consumption’ and Chinese equities in the second half, says Abel Lim of UOB.

The owner of Shopee online shopping platform is facing multiple headwinds after losses widened. As Tencent retreated, other investors including Temasek bought more shares.

The Chinese government’s planned support for some mainland developers to issue yuan-denominated bonds boosts sentiment in the crisis-hit sector.

The value of Temasek’s holdings in US-listed stocks dwindled by US$5.6 billion amid sales and value erosion, the most since the final quarter of 2004, US filings show.

Meituan sank by 9.1 per cent on report Tencent was considering selling part or all of its 17 per cent stake to appease Chinese regulators. Some developers surged on optimism of state financial support.

Ray Dalio’s giant hedge fund completely exited the five US-listed Chinese tech companies last quarter amid delisting risk and heightened geopolitical tensions.

The Hang Seng Index rose, adding to its best gain in three weeks a day earlier. Government reports next week may show better signs on China’s economic health, according to consensus estimates.

The Hang Seng Index rose 2.4 per cent, shaking off three days of losses as lower-than-forecasted US inflation lessened pressure on the US Federal Reserve to further tighten monetary policy.

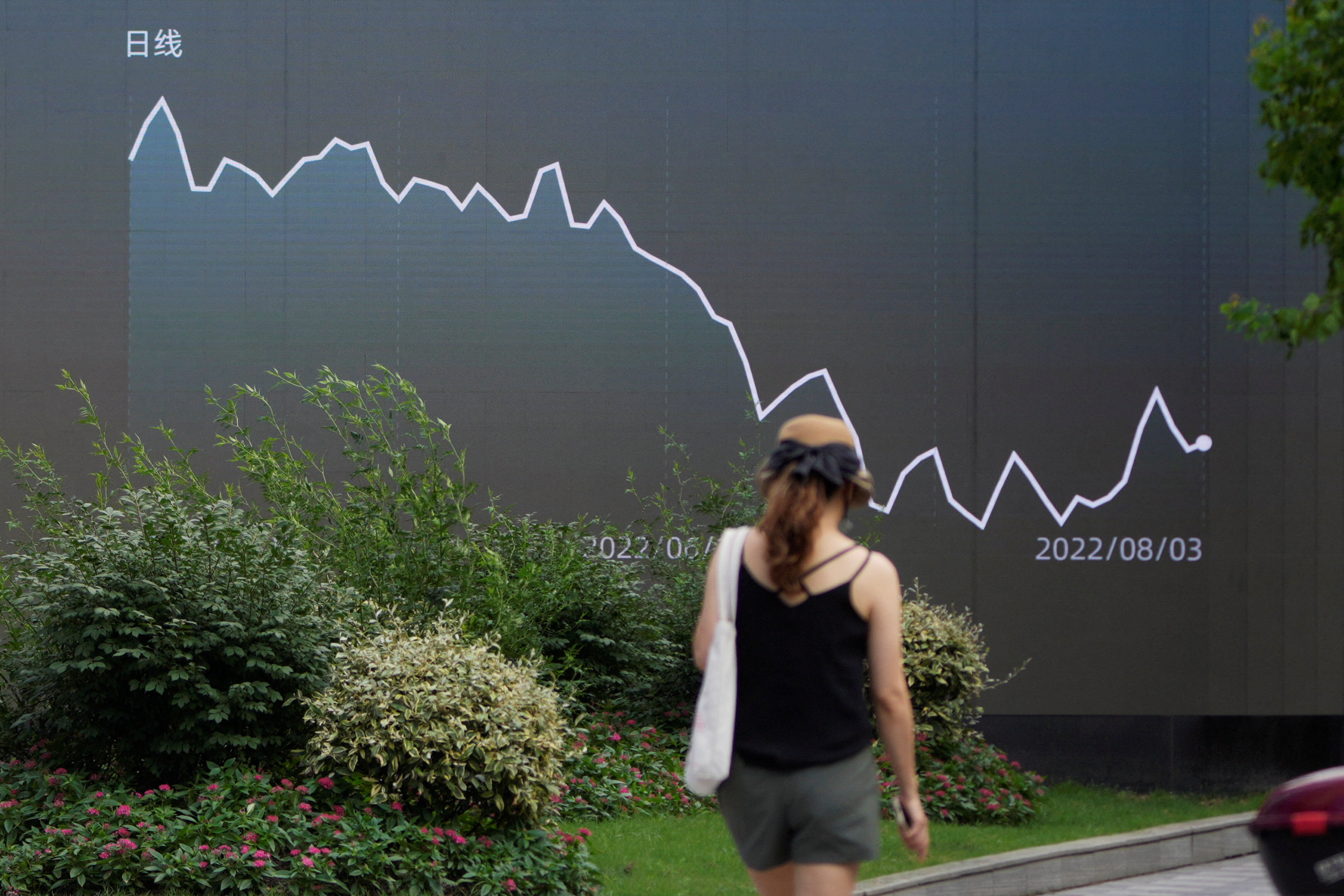

Inflation accelerated by the fastest in two years last month, denting bets for further monetary stimulus in China. Tech stocks slumped amid growing US rivalry before a US inflation report.

Cathay Pacific likely became profitable last month, a boon for the city’s government as it waits to collect bailout dividends. The stock’s advance this year has outpaced every Hang Seng Index member bar one.

Hong Kong’s benchmark index slipped toward a psychological level as tech stocks retreated while confusion plagued property developers over reports on tax waiver for home purchases.

Stocks slipped amid concerns about more lockdowns in mainland China. The latest in southern Hainan province added to existing risks from Taiwan issues and US rate increases.

Offshore investors dumped US$3.1 billion worth of mainland Chinese stocks in July, turning net sellers for the first time since March, according to exchange data.

Investors waiting for additional signs before turning more positive risk being late to the party ‘because markets are pre-emptive’, Robeco says

Local stocks slumped into a technical correction with July’s setback the worst month in a year. Big Tech from Alibaba to Meituan suffered from renewed regulatory concerns while China offered no major stimulus at a key meeting this week.

Daiwa upgraded tech platforms traded on Hong Kong’s markets to overweight from neutral, with Alibaba and Meituan, a food delivery service, being their picks for the sector.