Advertisement

BYD, CATL and Kweichow Moutai among biggest losers as offshore investors dumped US$3.1 billion worth of Chinese stocks in July

- Offshore investors sold a net of 21 billion yuan (US$3.1 billion) worth of A shares last month, according to Stock Connect data

- Mortgage boycott partly to blame, caused a loss of confidence among investors, analyst says

Reading Time:2 minutes

Why you can trust SCMP

Offshore investors dumped US$3.1 billion worth of mainland Chinese stocks in July, turning net sellers for the first time since March, according to exchange data.

Advertisement

They sold a net of 21 billion yuan (US$3.1 billion) worth of A shares last month, according to data from the Stock Connect, a key scheme connecting the mainland and Hong Kong exchanges. The last time mainland stocks saw net selling was in March, when 45 billion yuan worth was dumped.

Among the top stocks offloaded by foreign investors were 13.8 billion yuan of liquor distiller Kweichow Moutai, 14.2 billion yuan of auto and battery producer BYD and 17.9 billion yuan of battery maker Contemporary Amperex Technology. Other stocks included Tianqi Lithium and Longi Green Energy Technology.

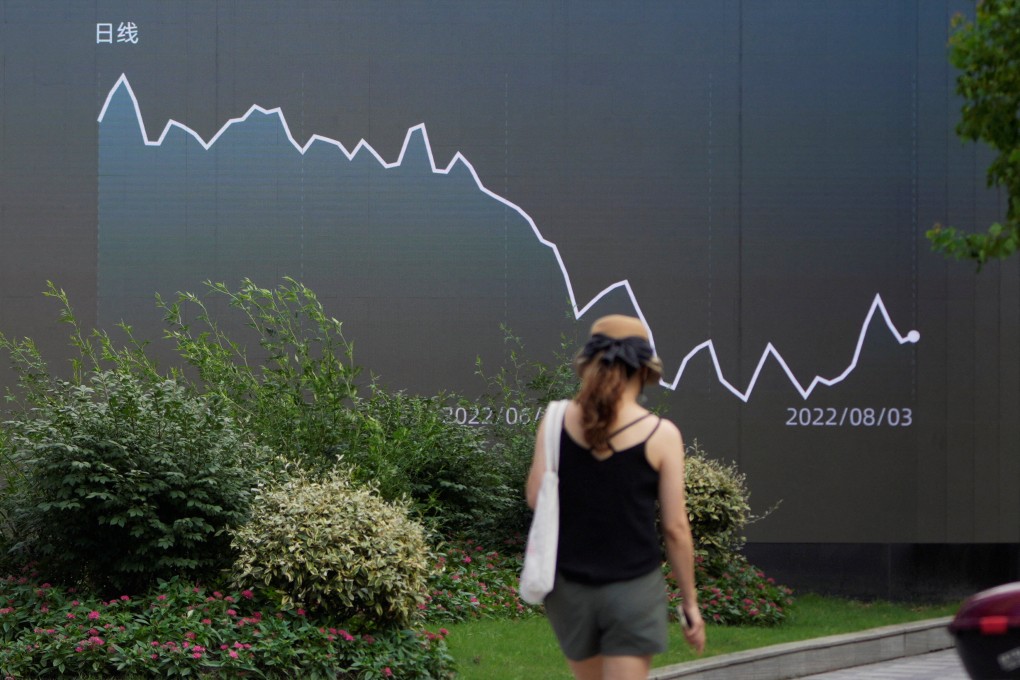

Onshore Chinese stocks stood out as the biggest losers among a sea of gains last month. The Shanghai Composite Index tumbled 4.3 per cent and the Shenzhen Component Index sank 4.9 per cent, even as major world indexes clinched gains led by a US stocks rally.

More than 2.8 trillion yuan was erased off both mainland gauges, as China’s poor second-quarter growth, renewed regulatory concerns and Covid-19 outbreaks kept optimism in check. The sell-off deepened following a growing mortgage-payment boycott on unfinished houses, ending onshore stocks’ two-month rally that had braved a global equities slump previously.

Advertisement

Advertisement