Advertisement

Advertisement

Andrew Collier

Andrew Collier is the Managing Director of Orient Capital Research and the author of "Shadow Banking and the Rise of Capitalism in China". He was previously the President of the Bank of China International USA.

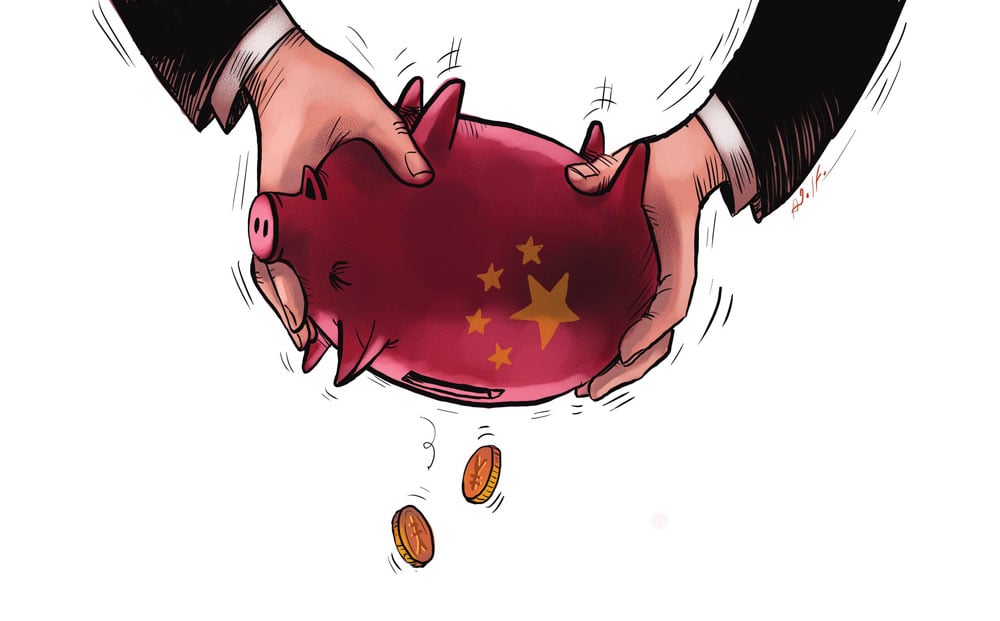

For the past decade, land has functioned as a giant piggy bank for China's cash-starved local governments. Unfortunately, the piggy bank is running on empty.

One of the theories of China's slowing economy is that it will run into a "Lehman moment". This is when a single financial institution collapses, threatening the entire banking system, ultimately creating a financial crisis.

What will happen to small business as China's economy slows? The country's small and medium-sized enterprises are an important part of the economy and even more integral to employment; they account for 60 per cent of gross domestic product but a full 82 per cent of employment. With China's GDP growth dropping from over 10 per cent three years ago to 7.5 per cent or below, SMEs are going to struggle, which could have a disastrous effect on China's future.

Each time China's economy faces difficulties, talk of a collapse tends to surface. Some voices are driven by concerns about their investments; some are looking for speculative opportunities; others might just be following the trend, unable to draw their own conclusions.

Advertisement