TOPIC

Libor

Libor

Libor (London interbank offered rate), is meant to represent how much banks pay to borrow from one another. It is also a benchmark for at least US$550 trillion worth of contracts spanning interest rate derivatives to residential mortgages. A scandal erupted after banks were found to be rigging the system. Barclays was fined US$453 million by global regulators in June 2012 for manipulating Libor, and UBS was hit with a US$1.5 billion bill in December 2012. In February 2013, RBS was fined US$612 million to settle US and UK regulatory charges of misconduct, manipulation, attempted manipulation and false reporting of yen, Swiss franc and dollar-denominated Libor.

last updated:

9 September, 2024

Advertisement

Advertisement

Advertisement

Jake's View | In Hibor debate, remember you have to pay for good data

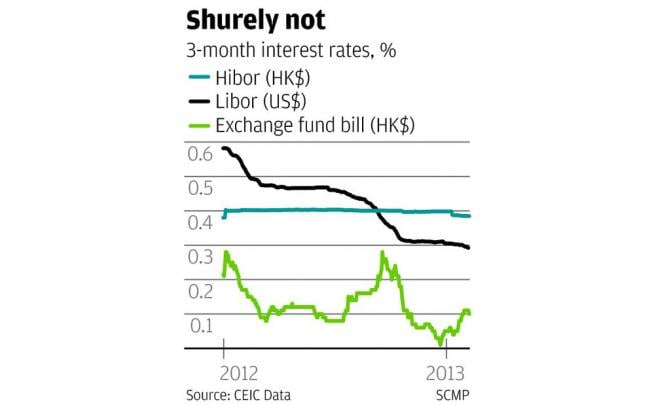

We are already very much in line. In characteristic copycat fashion the HKMA started an investigation of the Swiss bank UBS a day after it paid up for alleged Libor (London interbank offered rate) infringements. Hibor rhymes with Libor. How much more guilt do you need?

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement