How are NFTs driving up prices for rare whiskies? Gordon & MacPhail, Glenfiddich and The Macallan are all experimenting with tokens and digital art to add value to their bottles and casks

- Digital art was changed forever when Christie’s sold Beeple’s The First 5000 Days in May 2021 for a staggering US$69 million – now whisky brands are joining the party

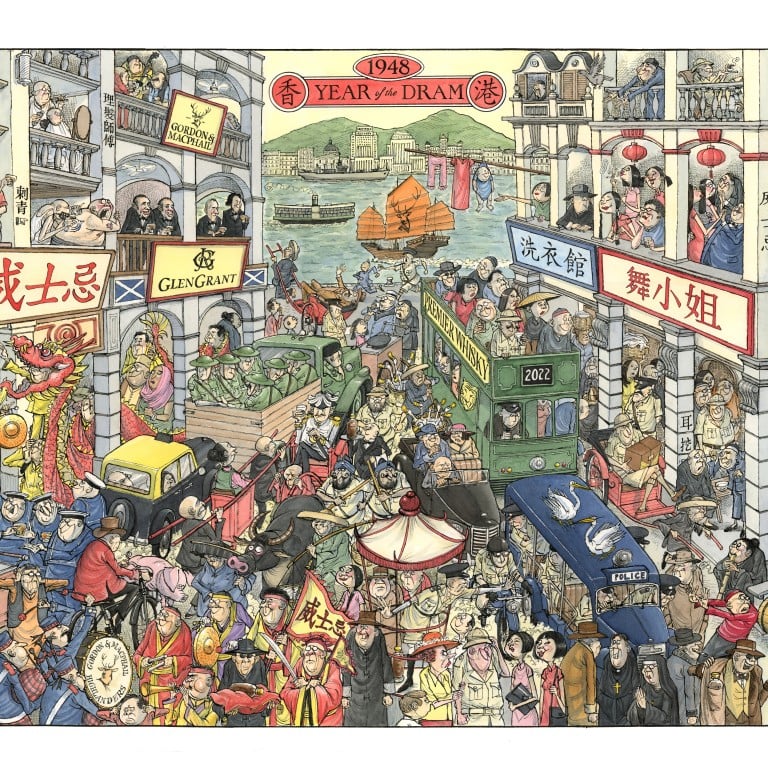

- Gordon & MacPhail’s 72-year-old Glen Grant made US$119,000 at auction at Bonhams Hong Kong together with an NFT artwork by political cartoonist Harry Harrison

That unprecedented sale kick-started a revolution, with artists, houses and digital platforms racing each other for a piece of the blossoming NFT art space – a fast-fattening pie that has grown into a US$10 billion marketplace.

Naturally, other industries were quick to take note – but some manoeuvres make more sense than others. Drinks might seem an odd place to start – after all, many would say they need to be drunk to be enjoyed. But for collectors of rare whisky and other spirits, the NFT sector seems to be one category with huge potential, with the possibility of now owning both a digital and a physical asset, both of which can appreciate value.

Recent sales point in a profitable direction. A bottle of Gordon & MacPhail’s 72-year-old Glen Grant broke records earlier this year, fetching US$119,000 (HK$937,500) at auction at Bonhams Hong Kong. The twist? The purchase included an NFT artwork by political cartoonist Harry Harrison celebrating the year 1948 – the whisky’s cask date, or “The Year of the Dram”, as Harrison captioned it.

“Since its inception, The Gordon & MacPhail’s Glen Grant 72-year-old has consistently surpassed our expectations,” said Nicholas Breton, founder of Meta Malts and CEO of Premier Whisky. “The addition of a one-off NFT artwork commemorating 1948, the year the whisky was ‘born’, undoubtedly contributed to the high price reached at auction, as it made an already highly rare and collectible whisky even more collectible.”

BlockBar is another recent entrant to the alcohol NFT space. Created by the Falic Group, the company behind a network of duty-free stores in US airports, BlockBar brings the world’s biggest spirits and wine brands to the NFT market. BlockBar’s first partnership was with the world-renowned Glenfiddich Distillery, and their limited release of 15 bottles sold out in just four seconds.

The buyer of the digital NFT also owns the real physical asset, which is stored in BlockBar’s high-end storage facilities. The buyer is free to trade the NFT until the time they choose to redeem it and receive the real physical bottle.

“The success of our first launch with Glenfiddich demonstrates that BlockBar is what consumers are looking for today, bridging the physical and digital worlds of luxury,” said Blockbar CEO Dov Falic.

The company has created a fun and straightforward way to tie spirits to the NFT space, and is rapidly launching new projects.

The aim, said Breton, is “to use the NFT model to fractionalise the asset, thus allowing for multiple investors to benefit from the purchase”.