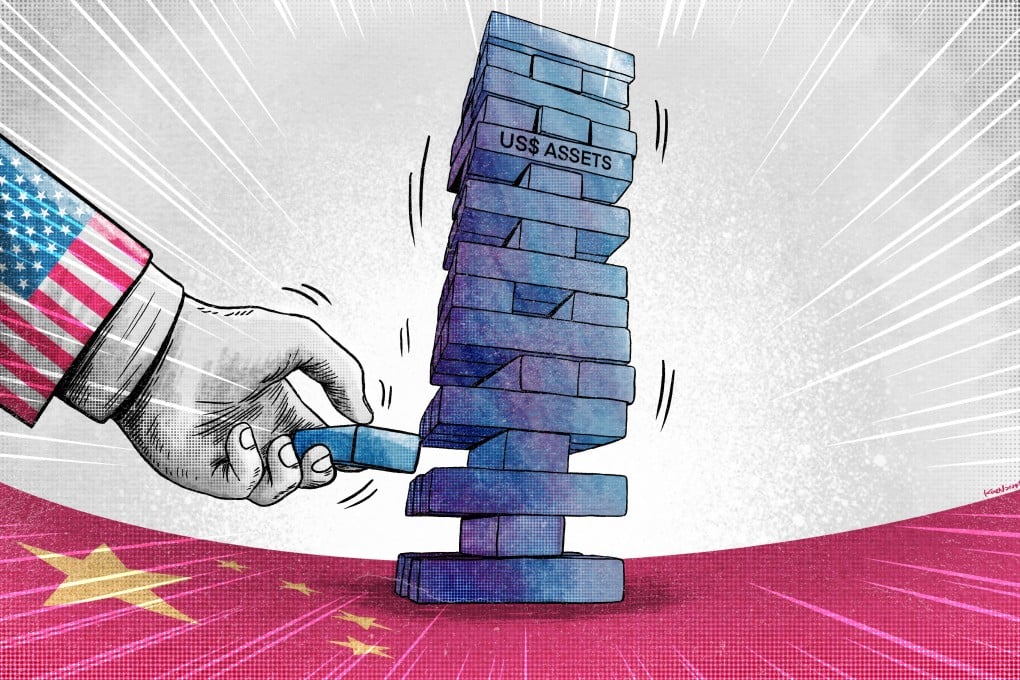

China searches for safe havens amid US debt woes, dollar weaponisation

Risk of financial sanctions prompts Beijing to rethink where it parks its massive foreign exchange reserves

Ever since the US dollar cemented its role as the backbone of the global financial system following the second world war, it has been a weapon of choice for American presidents waging economic warfare.

But as the United States’ use of sanctions has proliferated in recent years, concerns have grown in China and elsewhere over whether the US dollar can remain a safe haven currency.

“We’re still a safe haven – [offering] flight to safety in a messy dangerous world – and that’s a huge benefit,” former US treasury secretary Timothy Geithner told Bloomberg News in July.

He then cautioned that “people in policy have to understand: that position the dollar enjoys, there’s no entitlement to that. It’s not like a guarantee”.

When the governments of the world’s most-advanced economies, led by the US, froze nearly half of the Bank of Russia’s foreign reserves following Russia’s invasion of Ukraine in February 2022, it was a stark reminder to China that its foreign exchange reserves, the world’s largest, could also be affected by US sanctions.

The risk of a forced sale or freezing of related [US] assets also needs to be considered