Advertisement

Advertisement

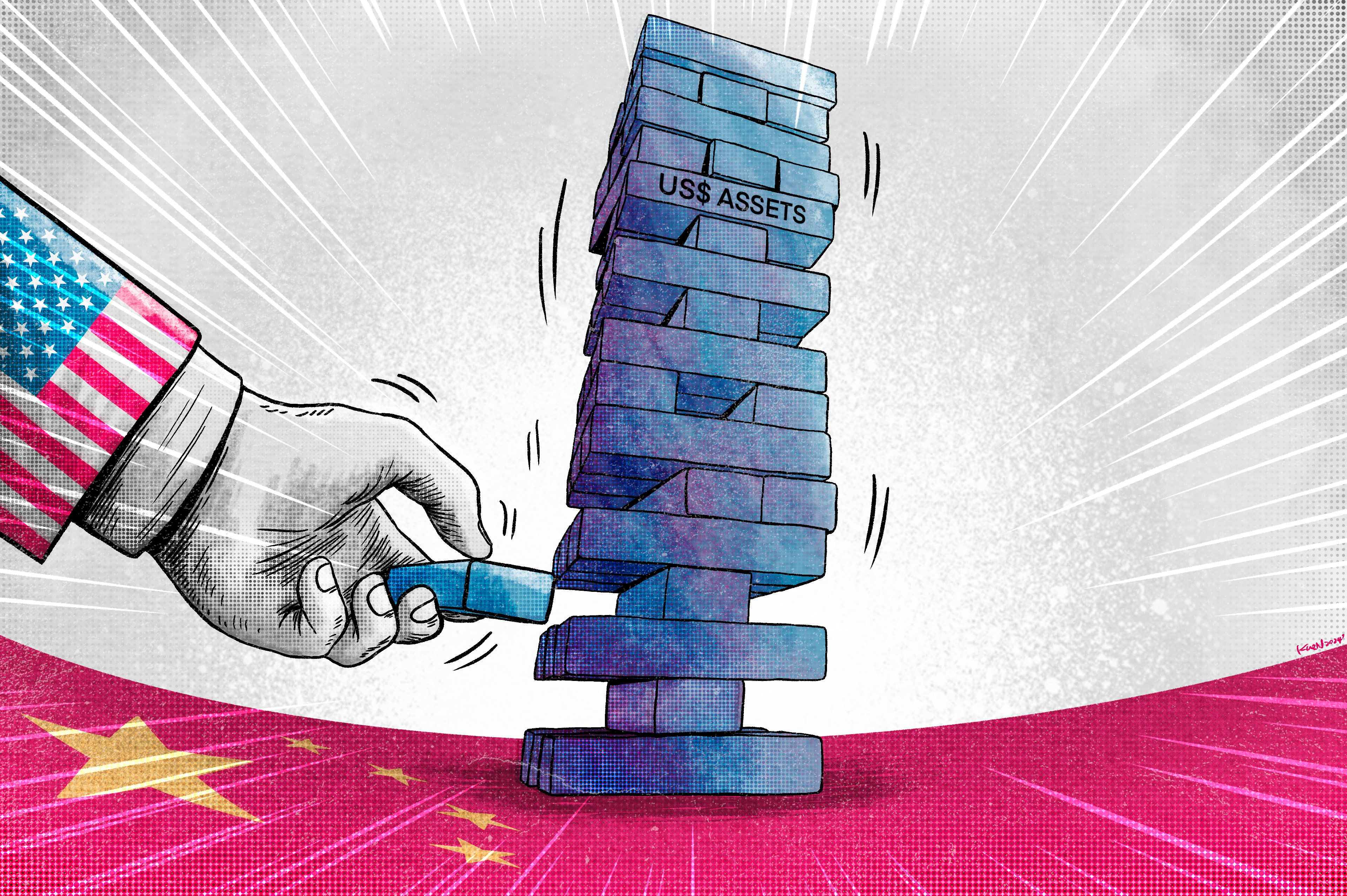

Risk of financial sanctions prompts Beijing to rethink where it parks its massive foreign exchange reserves.

Chinese buyers with nowhere else to look snap up gold bars in search for ‘reliable value-preserving asset’.

Though Vladimir Putin has called for the group of emerging economies to develop an alternative payment system, enthusiasm appears limited.

China’s top legislature meeting provides a window for potential fiscal stimulus announcement; current agenda includes discussion of financial work and review of law revisions.

Advertisement

Hudong-Zhonghua Shipbuilding is due to deliver six vessels to a Hong Kong containership lessor by 2028.

A big-spending county in one of China’s poorest provinces has become a topic of discussion again as local debts still encumber economy.

China just saw its slowest economic growth in more than a year, but analysts say Beijing’s stimulus plans could still right the ship.

China said it appreciated Laos’ interest in and intention to cooperate on Chinese commercial aircraft without naming the C919 or ARJ21.

He Lifeng calls for efforts to help China beat property sector slump, which has been a stumbling block to economic recovery.

China’s consumer price index grows by 0.4 per cent year on year in September, while the producer price index slips by 2.8 per cent.

Low-altitude economy is seen a new growth engine for China, highlighted by demonstrations during the recent week-long National Day holiday.

For maximum effect, observers say, a fiscal expansion to boost China’s economy will need to come soon if it is to come at all.

Leading Chinese economist Mao Zhenhua says China should consider issuing additional long-term treasury bonds following last week’s raft of measures.

Analysts suggest China could sell at least 1 trillion yuan (US$142 billion) of special treasury bonds and lift its budget deficit ratio.

Some analysts see ‘panicking’ among China’s policymakers, others point to a rising sense of urgency in fighting deflation.

Cuts by the Federal Reserve have prompted exporters to convert their US dollar assets into yuan, strengthening China’s currency.

Continued diversification of reserve portfolio may be in order, but into what, and at what speed, are pressing questions.

‘The risk of intensifying trade wars is very real’.

US Federal Reserve expected to lower its benchmark borrowing rate, which could give China room to ease.

S&P Global Ratings global chief economist Paul Gruenwald says China is under no external or market pressure to deal with the property market.

Firing up the grills boosted Zibo’s national profile and lured millions, but it has done little to economically transform the heavily indebted city.

China has reaffirmed its aid and loan commitments to Africa even as its economy slows, showing its eye remains on the bigger picture.

Former tax official Xu Shanda also urged Beijing to prioritise boosting consumption and the confidence of China’s private sector.

Growth of virtual currencies such as bitcoin and ether used in crimes has been ‘phenomenal’, law professor says.

China’s yuan gained 1.9 per cent against the US dollar in August, which represented the largest monthly change since November.

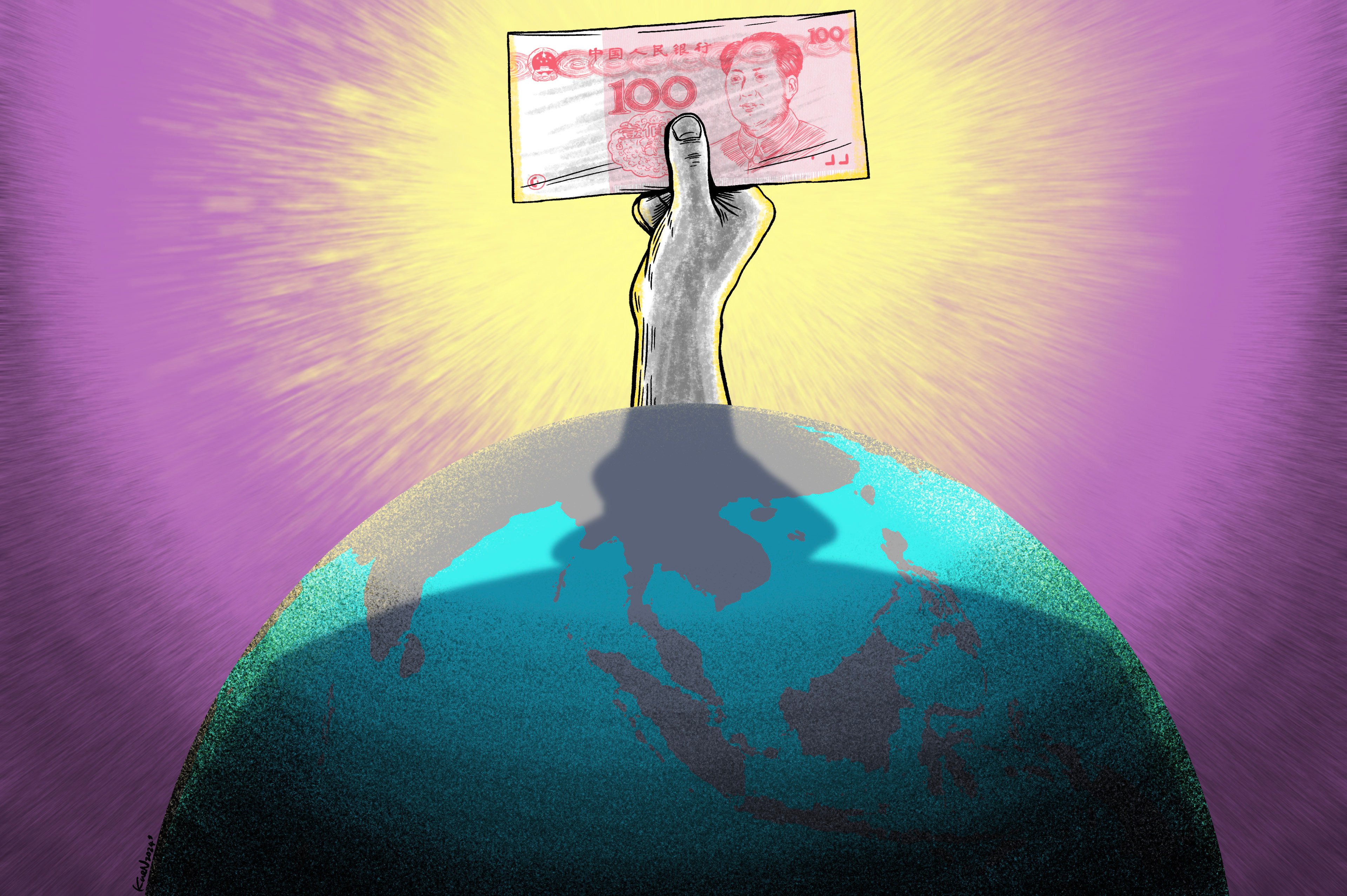

China’s yuan has become more acceptable to foreign countries, but authorities still maintain tight control of fund flows under its capital account.

Barter trades have emerged as an alternative way for China to continue to expand its exports and to circumvent payment issues.

PBOC governor Pan Gongsheng says local debt has fallen and number of high-risk small and medium banks has ‘nearly halved’ from peak.

China’s Ministry of Industry and Information Technology on Friday suspended a steel industry upgrade programme amid slowing demand.

China’s highest judicial bodies on Monday made 13 revisions to its money-laundering law.