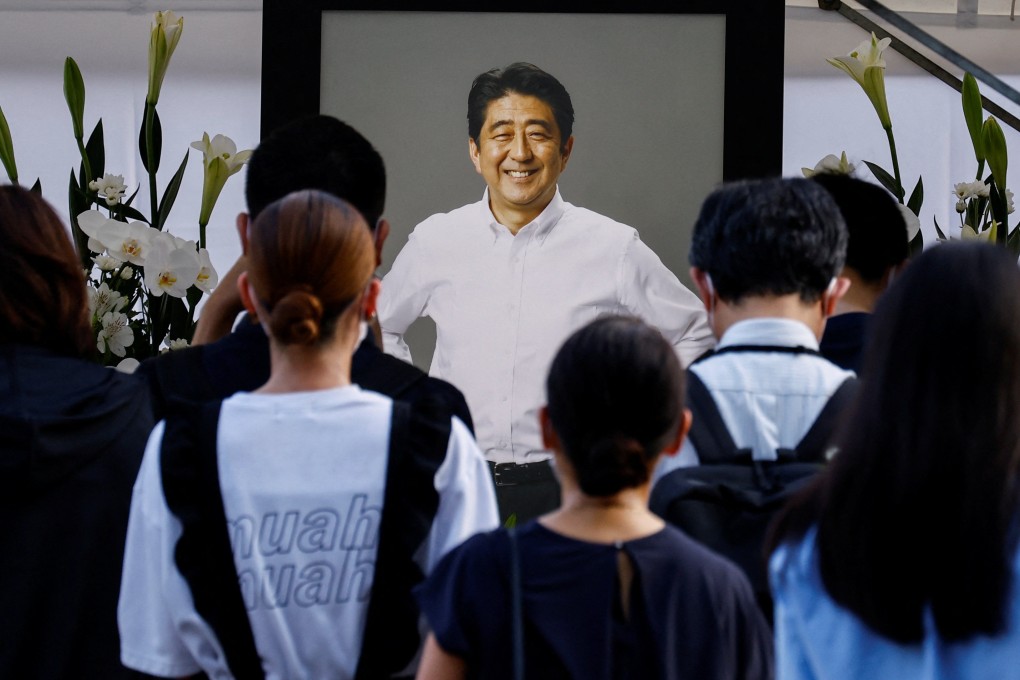

Shinzo Abe: Abenomics not seen as the answer for China’s economic woes with reform favoured over stimulus

- Shinzo Abe’s three-pronged Abenomics approach has long been cited by Chinese policy advisers as a warning against unconventional policy loosening

- Beijing has avoided all-out stimulus after efforts to avert the financial crisis in 2008 led to high local government debt, a rising household leverage ratio and a property bubble

China should concentrate on structural reform to unleash long-term growth potential, rather than resorting to the monetary stimulus favoured by the Abenomics approach adopted by the late former Japanese prime minister, analysts said.

Ultra-loose monetary policy, a flexible fiscal policy and structural reforms made up the core of the policy which was adopted in 2012 to “break down any and all walls looming ahead of the Japanese economy and map out a new trajectory for growth”, after two decades of deflation and stagnation.

It’s overall positive because it indeed pulled Japan out of the deflation mud, and injected some vigour. But it didn’t generate the desired results in structural adjustment

“It’s overall positive because it indeed pulled Japan out of the deflation mud, and injected some vigour. But it didn’t generate the desired results in structural adjustment,” said Zhou Xuezhi, a researcher with the Chinese Academy of Social Sciences’ Institute of World Economics and Politics.

“The expansionary monetary and fiscal policies generated limited effects in the long run. They just created conditions for structural reform, which is supposed to be the most important content,” added Zhou, who received his doctoral degree in Japan.

Beijing has warned against all-out stimulus after its policy package to avert the financial crisis in 2008 led to high local government debt, a rising household leverage ratio and a property bubble.