China ‘debt trap diplomacy’: ex-central bank governor slams accusations as a ‘smear’ amid warnings of global credit risks

- Former central bank governor Zhou Xiaochuan says Chinese lending has long-term economic benefits and is asked for by debtor countries

- The International Monetary Fund (IMF) and World Bank warned this week about record global debt levels, especially among poor nations

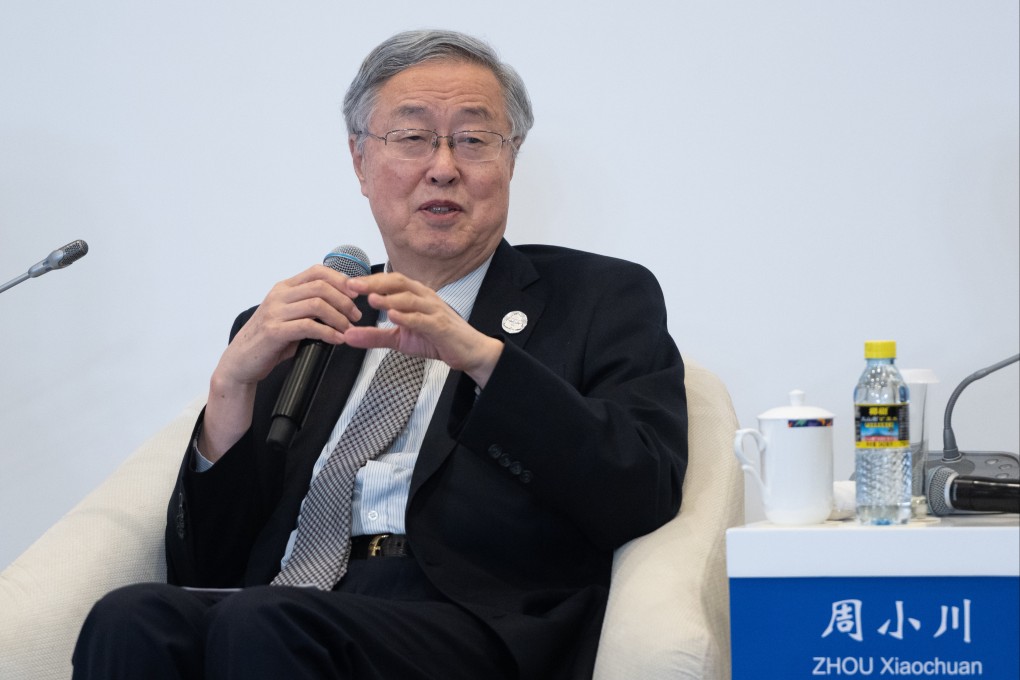

China’s overseas lending is not a “debt trap”, former central bank governor Zhou Xiaochuan has said, after two of the world’s biggest international financial institutions warned of growing credit risks in poorer countries as they struggle with the coronavirus and soaring food prices.

Speaking at the Boao Forum for Asia, Zhou acknowledged that some Chinese lending might not have always been “carefully designed” and poor communication has created problems.

But in general, it was not like the image portrayed by some media and countries, which amounted to a “smear” on China, he said.

“Most of [the lending] is for projects that companies in debtor countries have demanded, and at the same time they have economic benefits and are beneficial to the country in the long run,” Zhou told a panel discussion on China’s Belt and Road Initiative on Thursday.

“There is a certain degree of difficulty in this process and it must be carefully considered and designed to find a way to alleviate the debt problems of the countries along the belt and road, while avoiding suggestions that there are bad motives.”