Advertisement

Macroscope | Three ways 2022’s perfect storm could give way to fair winds for Asian economies

- Rising interest rates, a strong US dollar, an energy crisis and the pandemic combined to create stiff headwinds for Asian economies this year

- However, if the US dollar stops rising, the Federal Reserve pauses interest rate increases and China reopens, Asia could be poised for a better 2023

Reading Time:3 minutes

Why you can trust SCMP

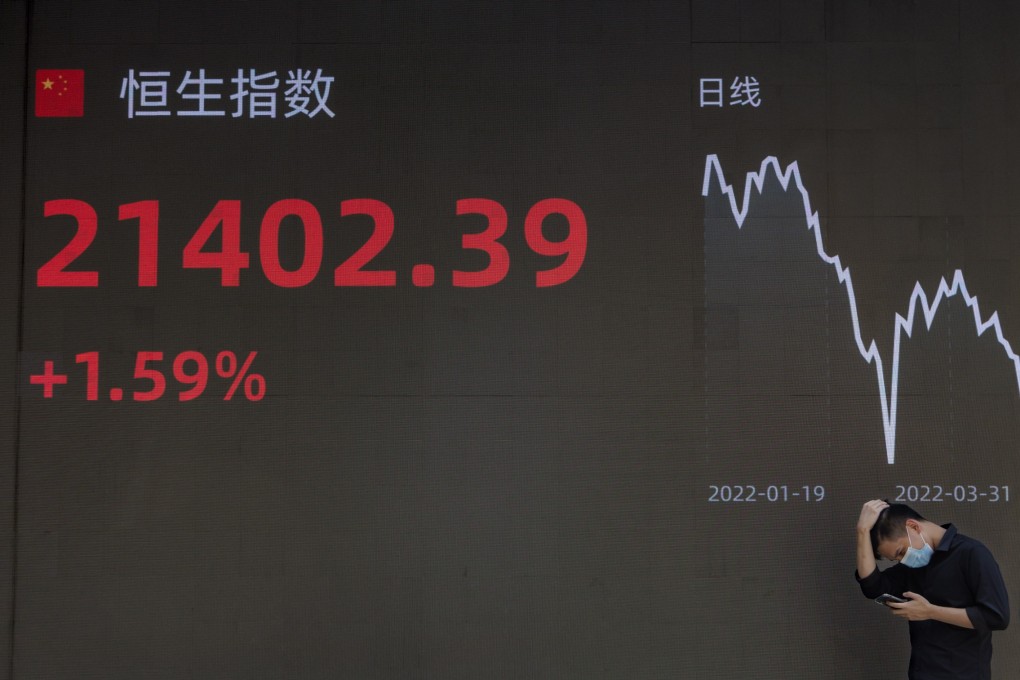

Asian economies and markets faced an almost perfect storm in 2022. Aggressive interest rate increases by the US Federal Reserve and a rising US dollar created well-known headwinds to economic and market performance. Meanwhile, the energy crisis in Europe pushed up living costs and the sharp decline in Chinese economic activity because of Covid-19 restrictions added to the economic woes.

Advertisement

The next year will bring its own challenges as the lagged impact of tighter monetary policy drags on global growth and elevated rates of inflation mean central banks continue to raise interest rates and depress global demand. However, there are reasons Asia might be able to endure these challenges a little better than the rest of the world.

The first reason is if the US dollar stops rising. Asian markets are sensitive to the direction of the US dollar. As the dollar strengthens, Asian markets tend to underperform compared to broader developed-market equities.

A stronger US dollar means Asian central banks might feel pressure to raise interest rates to stem the fall in the value of their own currencies, curbing domestic activity in the process. The cost of offshore funding also rises with the US dollar as repaying debt becomes more expensive.

These factors sparked concerns earlier this year that the region might be set to repeat the 1997 Asian financial crisis. Foreign exchange holdings declined as central banks intervened to stem excessive currency volatility from the rising US dollar.

Advertisement

However, many economies in Asia still have healthy levels of reserves. The abating pace of US inflation has taken some of the heat out of the US dollar as interest rate expectations have adjusted.

Advertisement