Advertisement

The View | Why WeWork’s collapse could be a blessing in disguise for China’s co-working sector

- While the fallout from the turmoil at shared office provider WeWork has been severe in China, it will accelerate consolidation in the sector and prompt co-working providers to move towards corporate clients

Reading Time:3 minutes

Why you can trust SCMP

The ripple effects from the near collapse of WeWork, the loss-making shared office provider which had to shelve its initial public offering in September and was subsequently bailed out and taken over by Japanese technology group SoftBank, continue to spread across global property markets.

Advertisement

Last week, Bloomberg reported that WeWork was reviewing its expansion plans in London as its new management prioritises profit over growth. Even a minor retrenchment in Central London – where the co-working operator is the largest private office tenant, accounting for 7 per cent of leasing activity this year – would send a shudder through the city’s occupier market.

The Post reported that WeWork is mulling giving up space at several of its sites in crisis-ridden Hong Kong, the world’s most expensive office market, where the average price of a hot desk in a flexible space centre is the highest in the Asia-Pacific region, according to data from Colliers, a property adviser.

However, it is in mainland China that the fallout from the turmoil at WeWork is most severe, partly because it coincides with a sharp drop in demand for office space amid a surge in supply in the last several years. Overall vacancy rates in 17 major cities tracked by CBRE, another real estate adviser, rose to a staggering 21.5 per cent last quarter, higher than at the height of the global financial crisis.

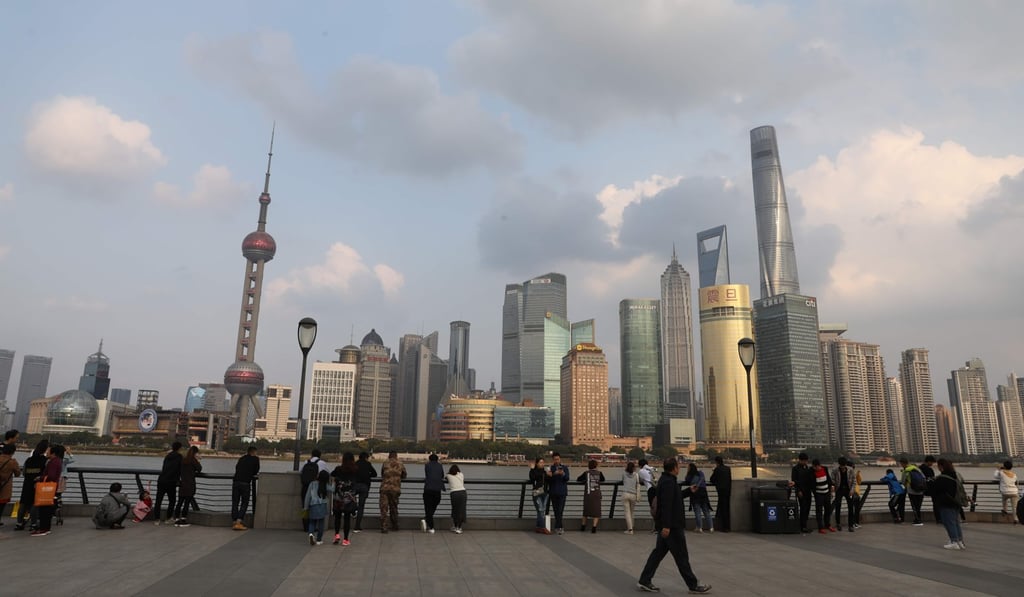

Even in Shanghai, which boasts a well established and actively traded office market, the vacancy level currently stands at nearly 20 per cent, compared with 4 per cent in Central London and just over 7 per cent in New York.

Advertisement

Advertisement