Advertisement

Advertisement

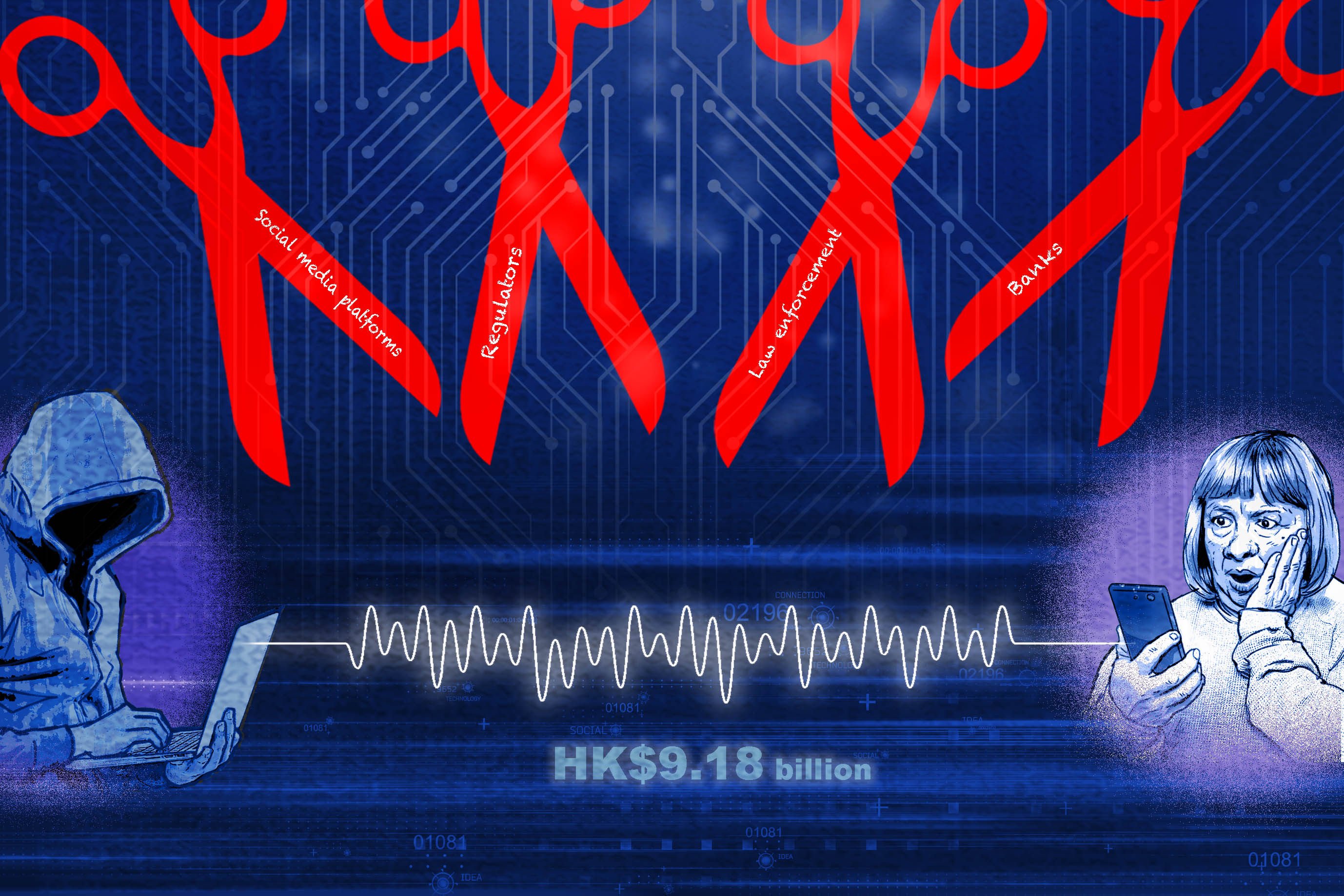

How financial scammers target Hongkongers

After scams in Hong Kong nearly doubled last year to HK$9.18 billion, this series looks at how emerging technologies like deepfakes have made fraud easier, and what financial regulators and banks are doing to stem the losses.

Updated: 22 Aug, 2024

Advertisement

[1]

Can an ‘anti-fraud tsar’ stamp out Hong Kong’s HK$9 billion scams?

Losses nearly doubled last year amid growing victim frustration, while fraudsters reap profits with seeming ease and banks and financial regulators struggle to contain the damage.

03 Aug, 2024

Advertisement

Advertisement

[2]

AI has made Hongkongers more vulnerable to fraud but is also used to fight back

Fraudsters are using AI to convincingly portray themselves as acquaintances and steal digital identities, driving demand for hi-tech cybersecurity solutions.

10 Aug, 2024

[3]

Hi-tech fraud: here are the technologies changing the face of scams in Hong Kong

Emerging technologies like deepfakes, large language models and cryptocurrencies have made fraud easier than ever, with Hong Kong proving particularly vulnerable.

09 Aug, 2024

[4]

Explainer | What are the biggest financial scams in Hong Kong? Here’s how to avoid being a victim

A company lost HK$200 million (US$25.6 million) in a corporate scam, while scores of cryptocurrency investors were duped in a HK$1.6 billion JPEX scandal. Here are some tips to avoid the pitfall and how to respond if you are targeted.

02 Aug, 2024

[5]

Exclusive | Greed, financial illiteracy expose Hongkongers to scams: The Goldfinger maker

Felix Chong, director of the box-office hit The Goldfinger, shares his views about the Carrian fraud case from the 1980s and suggests why Hongkongers continue to fall prey to bigger scams.

08 Aug, 2024