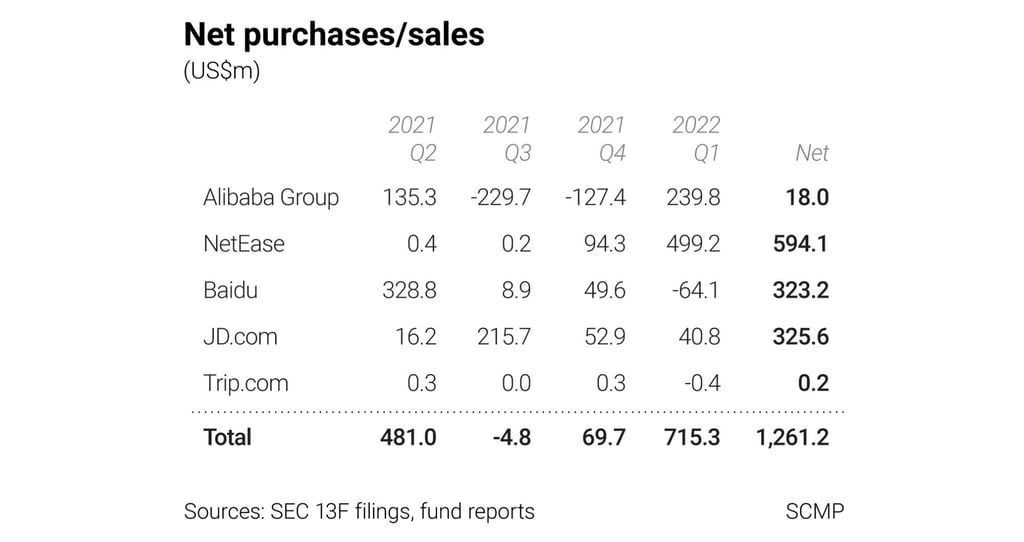

US fund manager piles US$1.2 billion into Alibaba, JD.com, Chinese tech peers in 12 months waiting for policy, valuation payoff

- San Francisco-based fund accumulated US$1.26 billion worth of stocks including Alibaba, JD.com and Baidu over the past four quarters, 13F filings show

- Like Singapore’s Temasek, money manager is banking on policy support, cheap valuations in decision to load up securities

San Francisco-based Dodge & Cox spent US$716 million loading up on the American depositary shares of Alibaba, NetEase, JD.com and Baidu and other Chinese peers in the first three months this year, according to its US regulatory filings. That raised its total net purchases to more than US$1.26 billion over a four-quarter sequence.

Its holdings in selected Chinese tech stocks in the 13F filings amounted to US$3.6 billion on March 31. In all, Dodge & Cox listed ownership in 197 stocks globally, valued at US$164.6 billion.

“We believe depressed prices for equities in China present compelling opportunities for long-term investors,” the managers said in a March report to investors. “Recent concerns about ADR issuance and US listings for Chinese companies [are] a red herring – almost all of the fund’s investments in China already have listings in Hong Kong and/or Shanghai and have the ability to adapt.”