JD.com, Tencent drag Hong Kong stocks as China slowdown dents earnings, BlackRock cuts view on market outlook

- Alibaba, Tencent, JD.com led losses as Covid-induced lockdowns hit corporate earnings

- Money managers at BlackRock predicted more downside to China economy after downgrading views on local, developed market stocks

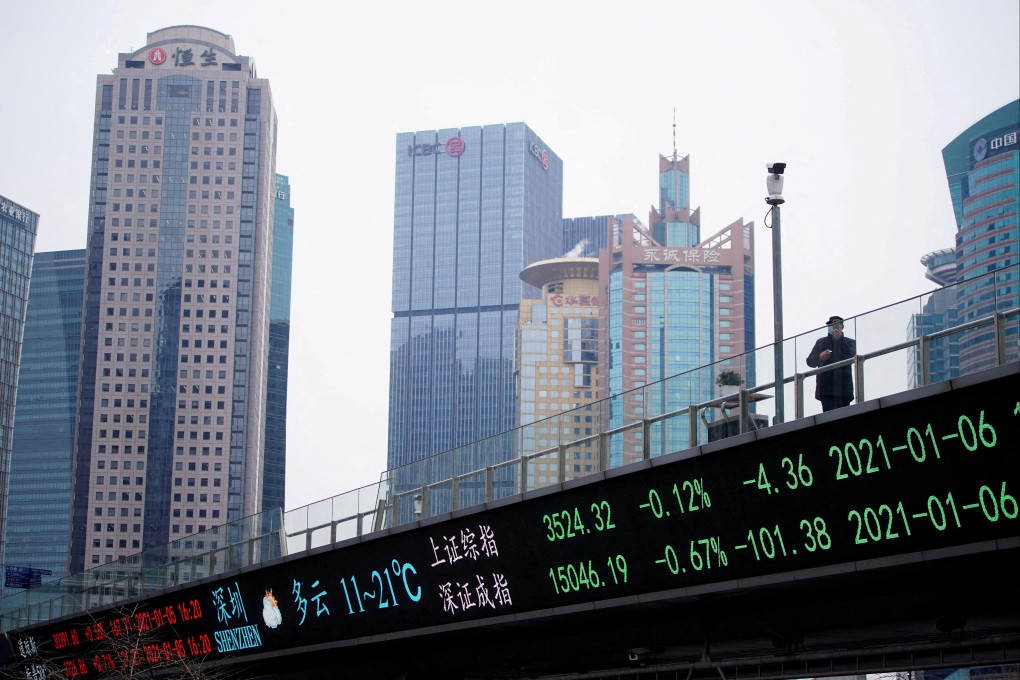

The Hang Seng Index declined 1.8 per cent to 20,112.10 at the close of Tuesday trading, its first back-to-back losses in two weeks. The Tech Index retreated 3.5 per cent, while the Shanghai Composite Index fell 2.4 per cent.

Alibaba Group Holding slipped 1.8 per cent to HK$83.60 and JD.com slumped 5.3 per cent to HK$201.60. Tencent Holdings dropped 2.6 per cent to HK$338 after Barclays downgraded its US-listed shares, citing stalling growth in key businesses.

“We expect China’s deteriorating economic outlook to be a drag on global growth and we think consensus forecasts for China’s 2022 GDP growth are likely to get revised down,” global strategists including Wei Li at BlackRock wrote on Monday.

Video-sharing platform Kuaishou and online gaming group NetEase are set to announce their quarterly results on Tuesday. Kuaishou fell 3.9 per cent to HK$63.35. NetEase weakened 1.9 per cent to HK$151 after first-quarter profit stalled at 4.4 billion yuan versus a year earlier.