Hozon files Hong Kong IPO to raise funds for its global growth, skirt China’s discount war

- Hozon said it plans to use the money from its IPO to support its ‘internationalisation strategy’, where it plans to ‘localise’ its production facilities in different markets

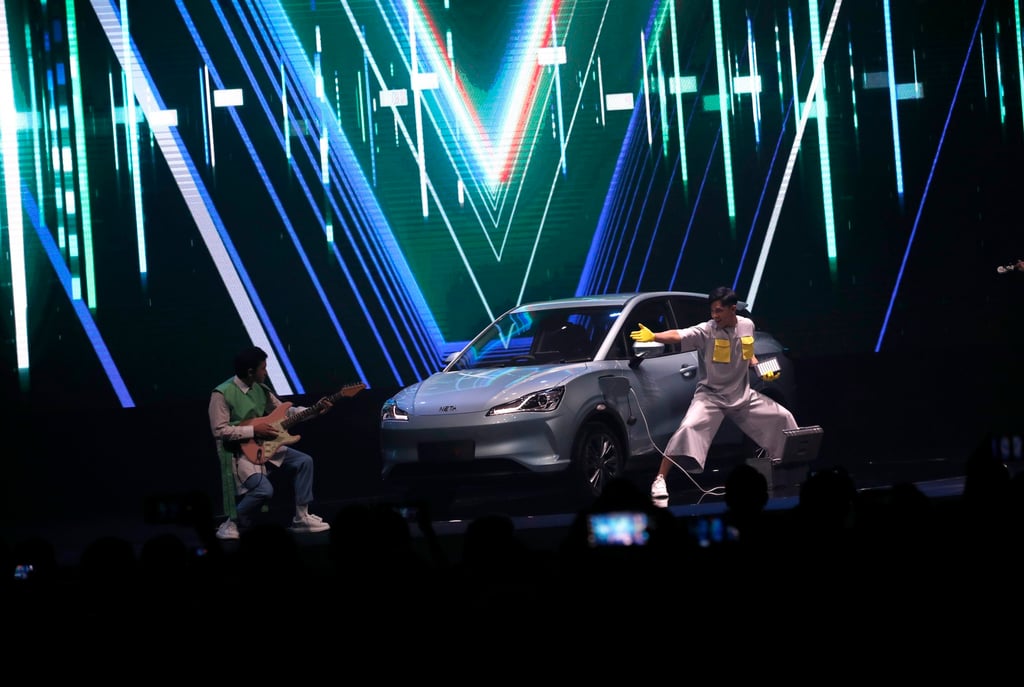

Hozon New Energy Automobile, the start-up behind the Neta brand of electric vehicles (EVs), has applied to raise capital in Hong Kong, joining BYD, Xpeng and Li Auto in using the world’s fourth-largest stock market as the launching pad to fund its overseas expansion and escape China’s brutal discount war.

Hozon plans to use the money from its initial public offering (IPO) to support its “internationalisation strategy”, where it plans to “localise” its production facilities in different markets, the Shanghai-based carmaker said, without disclosing the size of its fundraising.

“We will accurately address global user needs and fine-tune our product mix,” Hozon said in the filing to the Hong Kong stock exchange. “The company will continue to expand sales, service and charging networks worldwide.”

Hozon, founded in 2014, has raised 26.4 billion yuan (US$3.63 billion) in venture capital funding over 11 rounds from 19 investors, according to Crunchbase’s data. Its backers include the Chinese cybersecurity firm Qihoo 360 Technology, Citic Securities and the Beijing municipal government’s EV maker BAIC-BJEV.