Protests force Hong Kong’s small stock brokers out of business, with little chance of rescue by Chinese buyers

- Struggling brokers are finding they can no longer rely on their traditional rescuers – mainland Chinese buyers willing to pay a healthy premium to get a foothold in the local market

- Ten small brokers have had to shut their doors since the start of the civil unrest that has slashed their revenues by almost a third

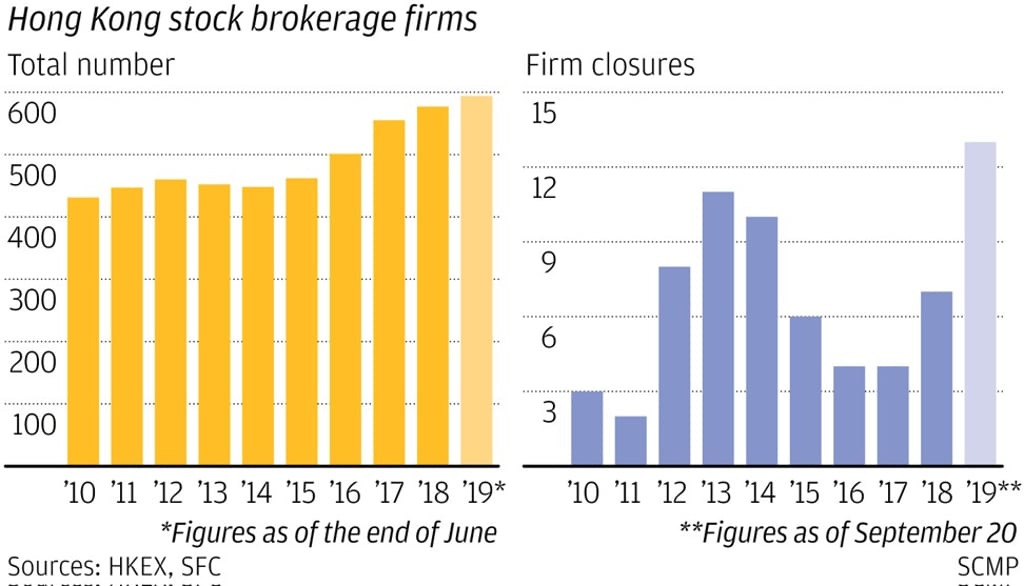

The civil unrest that has shaken Hong Kong to its foundations is taking a toll on small stock brokerage firms, forcing them out of business in unprecedented numbers, data from the stock exchange suggests.

With market turnover slashed by almost a third, struggling brokers are finding they can no longer rely on their traditional rescuers – mainland Chinese buyers willing to pay a healthy premium to get a foothold in the local market.

Of 13 brokerages that have shut up shop this year, 10 have done so since June 9, when massive pro-democracy protests began, according to figures from the Hong Kong stock exchange. That compares to seven closures in the whole of last year, and 11 in 2013, a record at the time.

“The unprecedented anti-government protests led market turnover down over 30 per cent year on year and hence commission has dropped by the same level,” said Tom Chan Pak-lam, chairman of the Institute of Securities Dealers. “The minimum cost to run a local brokage firm is at least HK$300,000 per month. If the protests continue and market turnover continues to go down, more small players may leave the market.”

It was already a battle for survival among small brokerages. Of the 594 brokers operating in Hong Kong, the 65 largest enjoy market share of over 90 per cent, leaving only a small pie for the remaining players to fight over.