Advertisement

Advertisement

Xie Yu

Chief China Finance Reporter, Business

Xie Yu worked at the Post from 2015 until 2019. She was the chief China finance reporter, covering the economy and development of financial markets.

The credit ratings agency downgraded Ruyi to B3 from B2, and put it under review for further downgrade as it faces a slew of maturing debt amid tight liquidity

Zhang Zhenxin, head of sprawling UCF Group, died last month in hospital in London of multiple organ failure and alcohol dependence, his company said

Markets recover slightly after Hong Kong leader says city not in state of emergency

The Hang Seng Index hit a one-month low at the close on Friday, ending the day at 25,821. Utilities, local property developers and financial services providers proved to be the biggest drag on the benchmark.

Advertisement

The Hang Seng Index closes 0.3 per cent higher at 26,220.3 on Thursday, boosted by a Hong Kong government plan to ban face masks at public gatherings.

Rebounding MTR shares, mainland Chinese health care and consumer stocks, as well as the Macau casinos lifted the Hang Seng Index into positive territory at the close on Thursday. The benchmark closed 0.3 per cent higher at 26,220.3.

The Hong Kong protests as well as disappointing US manufacturing data weighed on the city’s stock market, which was closed on Tuesday for the National Day holiday.

Retailers, financial services providers and utilities were among the biggest losers, while Macau casinos and mainland Chinese telecom services providers were among the biggest gainers. Hong Kong property developers, meanwhile, managed to close above water

The Hong Kong market closed higher on Monday, boosted by heavyweights in telecom and energy, while fears about the US delisting Chinese companies weighed on sentiment in mainland China, where the Shanghai Composite fell to a monthly low, wiping out all its September gains.

Budweiser Brewing Company APAC rises more than 4 per cent on its trading debut. The company’s CEO, Jan Craps, said Budweiser was very optimistic about the bright future of Hong Kong “as one of the most important financial centres in Asia”.

Risk-off sentiment prevailed in the Hong Kong and mainland China stock markets on Wednesday, following news overnight of an impeachment inquiry against US President Donald Trump, leading to the Hang Seng’s biggest daily decline in a month.

The Hang Seng Index closed 1.28 per cent lower at 25,945.35, while telecoms, electronics and equipment makers led declines on mainland Chinese indices.

The move was the result of a January dialogue in Beijing between Premier Li Keqiang and representatives of the country’s private enterprises, who gave their feedback on what ailed China’s economy.

Struggling brokers are finding they can no longer rely on their traditional rescuers – mainland Chinese buyers willing to pay a healthy premium to get a foothold in the local market.

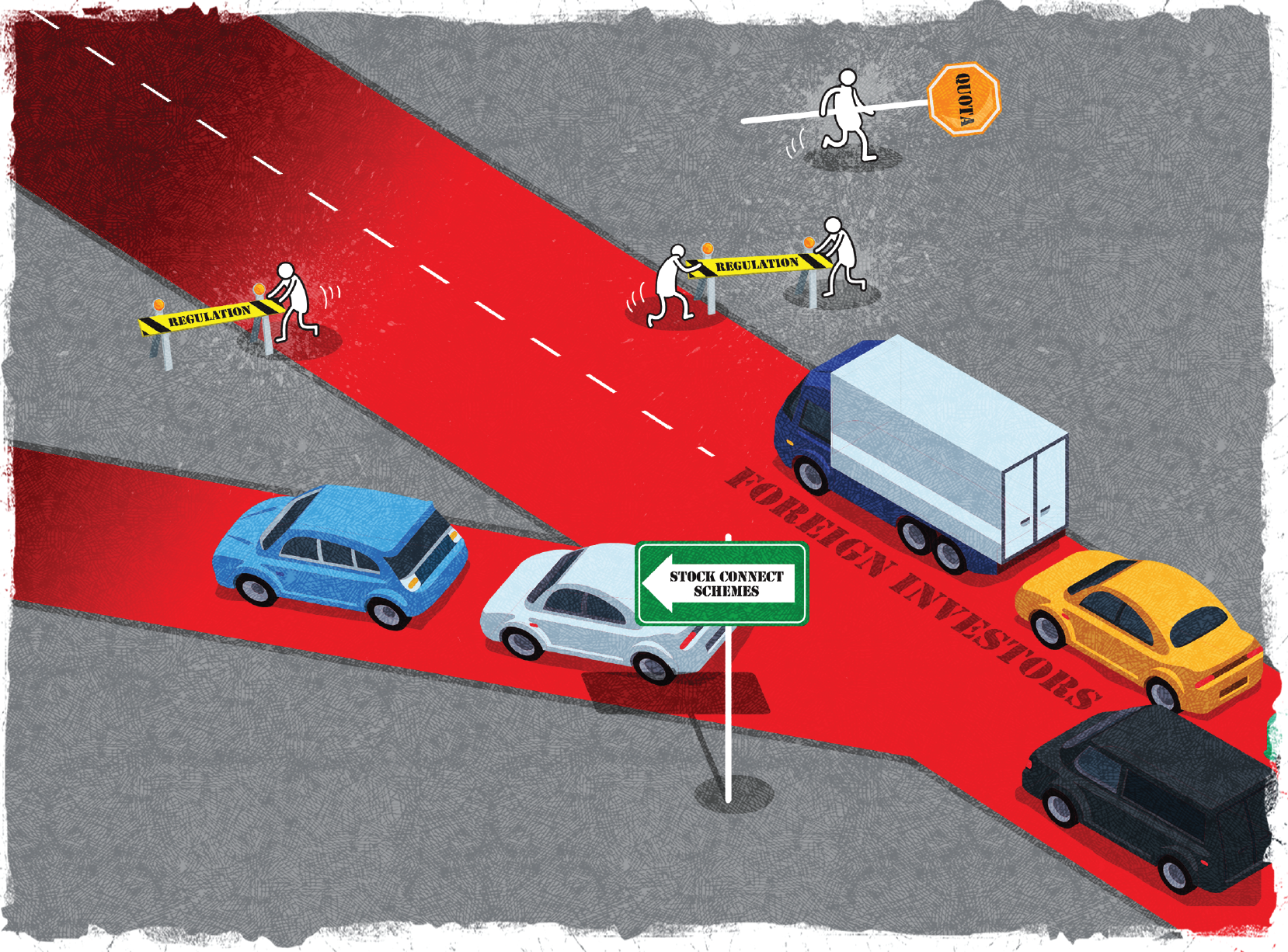

Hong Kong’s unique location, regulatory framework and openness make it irreplaceable for foreign investors looking to tap the Chinese onshore market, analysts say.

Beijing’s recent decision to remove quotas on the QFII and RQFII schemes carries only symbolic significance as the programmes are quickly becoming obsolete, say analysts.

The multimillionaire buyer and his wife visit London and the Corinthia Hotel is their favourite hotel in the city, according to their agent Aston Chase.

Brokerage CLSA has renewed its office lease at Hong Kong conglomerate Swire Properties’ flagship property. The Financial Times reported on Wednesday the firm had been under pressure to quit the premises by its mainland Chinese state-owned parent, Citic Securities.

Risk profile of bond issuers varies as it depends on the strength of the government backing the note.

Massive trading suspension cannot happen again as global investors have a higher exposure to A shares, says Jessie Pak, managing director for Asia at FTSE Russell.

State support for the Chinese banks will vary as the authorities try to share some of the losses with large creditors, say analysts at Moody’s and Fitch.

Trade war escalation and a weak pound are driving a spike in applications to emigrate to the UK from mainland China, say analysts

The olive branch extended by city leader Carrie Lam fell far short of protesters’ demands. Violence broke out again at an MTR subway station, weighing on investor sentiment.

MTR, Cathay Pacific, retailers and property companies that posted big gains on Wednesday fell today

Luxury retailers, property heavyweights and MTR were among big winners, after seeing their shares hammered as the protests that started June 9 steered away shoppers and mainland tourists.

MTR, property companies and luxury retailers among day's huge winners

The Hang Seng Index may break through 25,000 or even 24,000 in coming months, said Kenny Wen, wealth management strategist at Everbright Sun Hung Kai. It would enter a bear market if it drops to 24,125.992.

Protests could be 'catastrophic' for Hong Kong's economy, says chief of China Travel

MTR – the owner and operator of the city’s subway system – fell 3.1 per cent, after vandalism by protesters forced it to shut down the Tung Chung line on Sunday. Shares are down 21 per cent since July 18.

MTR shares have fallen about 21 per cent in six weeks, as violence has grown.

![A mask left behind by protesters in Hong Kong’s Wan Chai district following clashes on September 29. An analyst said the impact of a face mask ban would be ‘neutral’. He said: “how are they going to enforce [the ban]?’ Photo: AFP](https://cdn.i-scmp.com/sites/default/files/d8/images/methode/2019/10/03/70a344cc-e5be-11e9-8a10-b9721f28293e_image_hires_174541.JPG)