Update | China backflips on currency policy with controls to stem yuan’s outflow

Renminbi remittances by China-domiciled companies will be capped at 30 per cent of their equity

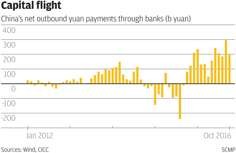

China’s central bank will limit the amount of yuan that Chinese companies can remit outside the country, imposing a cap for the first time in more than two decades to stem the yuan’s outflows amid its 7 per cent decline this year.

Non-financial companies domiciled in China will be limited to lending the equivalent of 30 per cent of the owners’ equity to an overseas company in yuan, according to a November 26 circular by the People’s Bank of China, a copy of which was obtained by the South China Morning Post. Both the lender and the borrower must share an existing shareholding relationship, the document said.

Coming as the yuan had been plumbing daily lows this year, the latest control is a reversal of the government’s strategy of making the yuan a global currency to rival the US dollar, indicating that the monetary authority is willing to put its ambitions on hold for the sake of preserving stability.

“The logic behind the new measure is to drain offshore yuan liquidity because too many people are exporting yuan for currency swaps or for shorting the currency as a way of skirting domestic restrictions,” said Li Yimin, senior analyst at Shenwan Hongyuan Securities. “Previous controls were mainly aimed at controlling the yuan’s inflows to deter hot money. This time, the focus is on its outflows.”

With the new controls, banks will now ask Chinese companies to explain their purpose for remittances and offshore loans in yuan. Any remittance that raises suspicions will be suspended.

Banks can also suspend any remittances for companies whose offshore transfers surpass the 30 per cent limit.