Asia’s financial system will be bigger than US and Europe combined by 2030, says ANZ chief

Asia’s financial system will be bigger than the US and Europe combined by 2030 amid continuing economic reform, in which China will account for half of the financial assets, ANZ said on Monday.

Asia’s financial system will be bigger than the United States and Europe combined by 2030 amid continuing economic reform and deregulation, in which China will account for half of the financial assets, ANZ said on Monday.

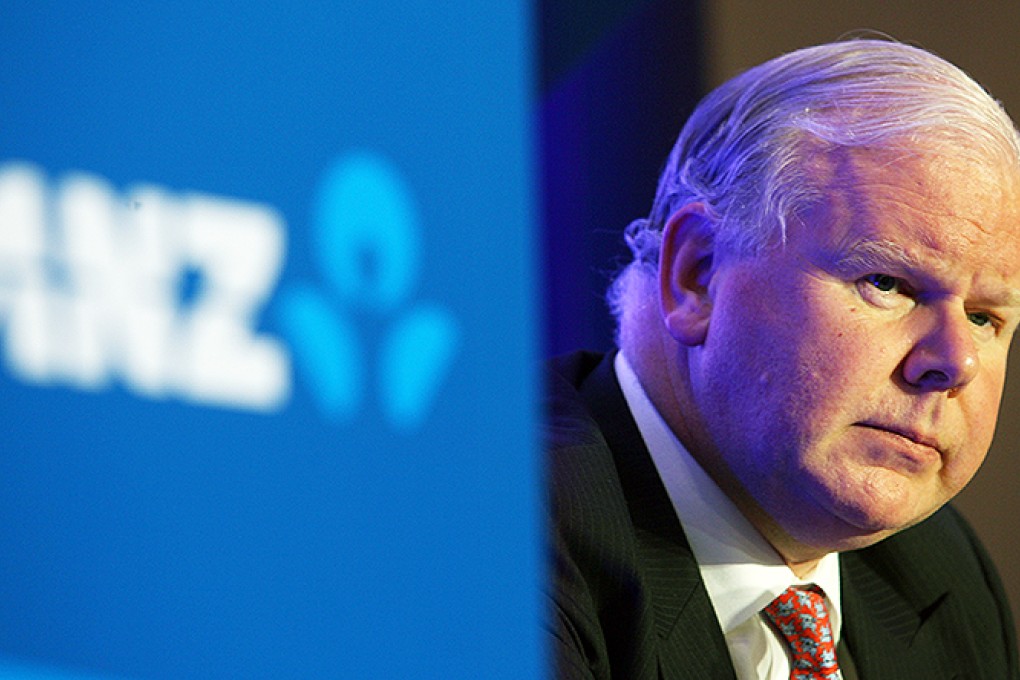

The financial system has to grow bigger to reflect the depth of economy in Asia, ANZ chief executive Michael Smith told reporters in Hong Kong on Monday.

“Given the high levels of economic growth, rapid progress is needed in financial reform,” Smith said. “It means more deregulation, and it means opening up global markets in Asia.”

Given the high levels of economic growth, rapid progress is needed in financial reform. It means more deregulation, and it means opening up global markets in Asia

“A profound transformation in the Asian financial system has to occur for Asia to fulfil its full potential,” Smith said.

Systematic reform on the structure and liberalisation of currency and foreign exchange could help the Asian financial system to grow significantly, the Australian bank said.

The ANZ bank chief said that Asian bond markets (excluding Japan) are expected to grow by six times their current size over the next 15 years to match the size of US debt markets, and the equity market cap across the region would rise to almost US$55 trillion by 2030 from US$9 trillion now, with the opening up of Asian markets to speed up cash flow.

On the back of the Federal Reserve scaling down its quantitative easing policy, Smith said he was less worried about Asian emerging markets.