Advertisement

Advertisement

KANIS LI

China's banking sector was warned bad loans are growing due to overdue borrowings at a time when economic growth is slowing on the mainland, according to an analysis by PricewaterhouseCoopers (PwC).

The People's Bank of China said it would lower the reserve requirement ratio at county-level rural banks by 200 basis points from Friday, but some analysts cautioned that adding liquidity too fast could cause a rise in financial risks.

Hong Kong and emerging markets will likely face continued capital outflows given tapering by the US Federal Reserve and the gradual normalisation of interest rates from a very low level, the top official of the Hong Kong Monetary Authority said.

Advertisement

An increasing number of non-local banks are entering the Hong Kong market to grab a slice of the growing yuan-related business.

Hong Kong banks are stepping up efforts in the battle for yuan deposits with high interest rate promotions in the currency, which has fallen the most among Asian units this year.

Mainland banks' credit quality is likely to worsen this year as the government may allow more defaults in a market-driven adjustment to the banking industry and sectors plagued with overcapacity problems, credit rating agency Standard & Poor's said.

Credit rating agency Fitch Ratings has placed Oversea-Chinese Banking Corp, Southeast Asia's second-largest lender, on negative watch, citing higher potential exposure to China, after the bank announced a HK$38.4 billion takeover of Hong Kong's Wing Hang Bank.

Oversea-Chinese Banking Corp, Southeast Asia's second-largest lender, has offered HK$38.4 billion to fully acquire Wing Hang Bank, the eighth-largest lender in Hong Kong, to tap into increasing money flows between Southeast Asia and China.

The Australia and New Zealand Banking Group (ANZ) is looking to buy assets with strong ties to Asia to expand its business on the continent and become a super-regional bank, but its chief executive says the lender will be cautious about acquisitions going forward.

Agricultural Bank of China, the mainland's third-largest lender in terms of market capitalisation, saw the slowest profit growth since its 2010 listing but last year's results were in line with market expectations, with slightly improved credit quality and a more or less stable lending margin.

Asia’s financial system will be bigger than the US and Europe combined by 2030 amid continuing economic reform, in which China will account for half of the financial assets, ANZ said on Monday.

The mainland's four biggest banks are expected to report the slowest profit growth for last year since the global financial crisis in 2008 amid shrinking margins and surging bad-loan write-offs.

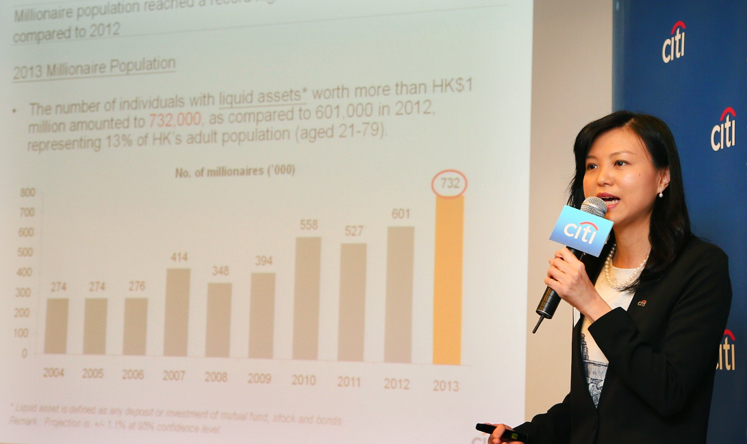

The number of millionaires in Hong Kong shot up by more than 20 per cent last year, but nearly one in 10 in the city are considering moving away, according to a survey by Citibank.

Hong Kong banks' mainland exposure has been a strong growth driver for income but has also been a drag on their valuation, say some experts.

Hong Kong's first home-grown peer-to-peer (P2P) online lending platform is set to expand outside the city in six months and double its headcount after being in operation for just seven months.

Six traders at Swiss lender UBS attempted to manipulate Hong Kong interbank offered rates following the rigging of similar London interbank rates, the Hong Kong Monetary Authority found after an investigation lasting more than a year.

Bank of East Asia appears to have emerged as the winner in the latest round of results announcements among leading listed banks in Hong Kong, as a clean balance sheet and sound growth momentum impressed investors more than international peers HSBC and Standard Chartered.

Standard Chartered, the British bank which is heavily exposed in emerging markets, posted its first decline in earnings in a decade due to volatile financial markets and tough conditions in South Korea, with analysts warning the bank still faces challenges in 2014.

Standard Chartered's decade of rising earnings is expected to come to an end when the emerging-markets-focused British bank delivers its results for last year on Wednesday.

Growing demand for the yuan in trading among local companies and in global trade is expected to continue despite increased volatility in the mainland currency, spurring the need for yuan hedging services to help offset potential losses caused by short-term currency fluctuations.