Advertisement

Advertisement

Paul Podolsky

Paul Podolsky is an investor and the author of Raising a Thief. For 20-plus years, he worked on Wall Street, most of the time with Bridgewater Associates. https://www.paulpodolsky.com

With saving and investing, for most people, it’s best to stick to simple assets with easily understood characteristics. Bitcoin does not meet that test and there is also a regulatory risk.

When geopolitical tensions spill over into violence, productivity plummets and wealth is destroyed. Nationalism and negative views of China are rising worldwide, and any shift from the status quo could destroy productivity for decades to come.

Infrastructure spending can create jobs that will lift salaries and not require a college education, so the Biden administration should be pushing for much larger commitments than are on offer right now.

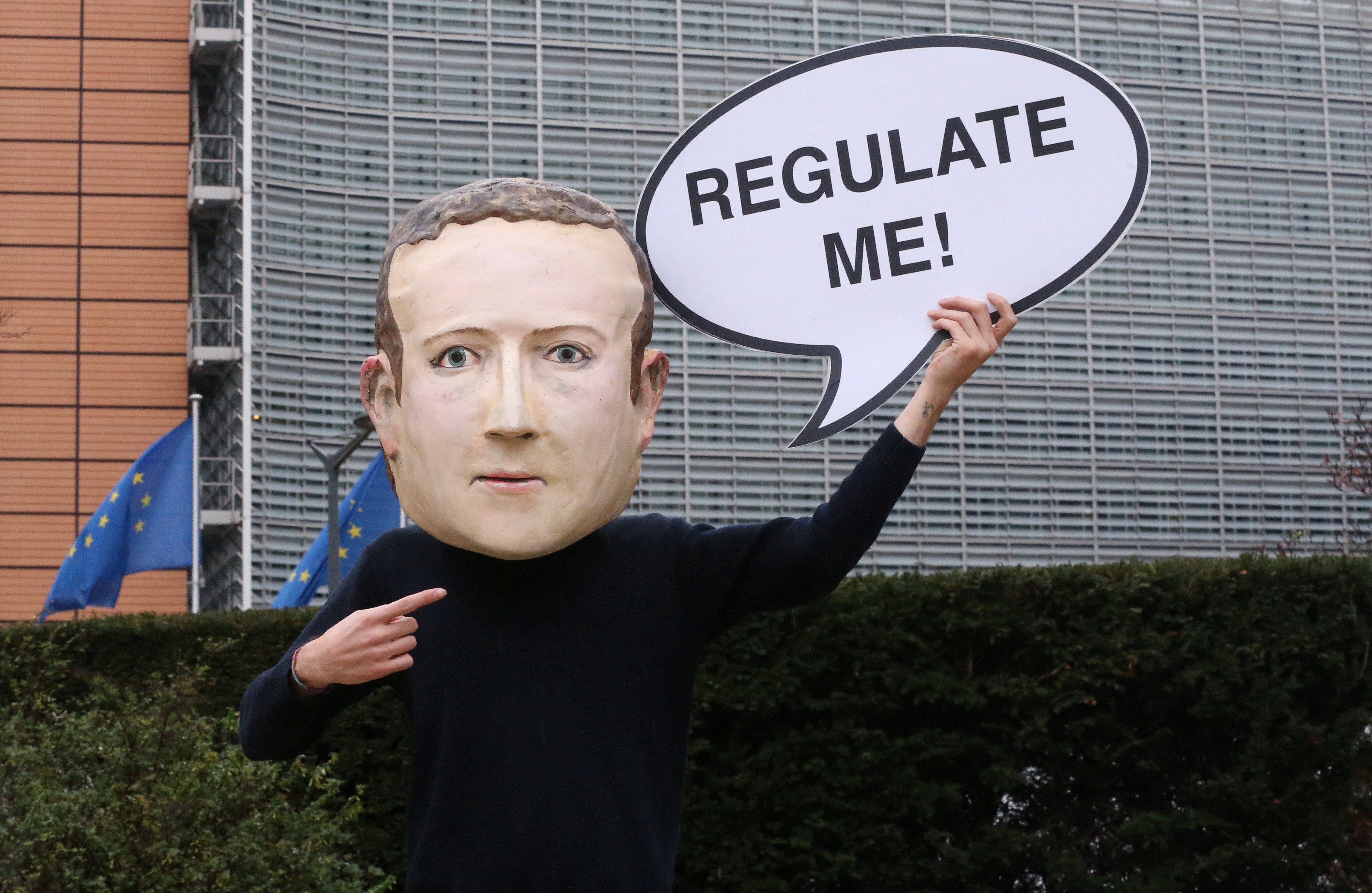

Policymakers need to bring the Balkanised information process to heel and quietly redistribute wealth. Telltale market signs include Facebook stock underperforming and the Fed buying long bonds.

Advertisement