Advertisement

Advertisement

Karen Yeung

Specialist Reporter, Business

Karen Yeung joined the Post in 2017 after more than 15 years' experience on global newswires in Hong Kong and Shanghai. She spent eight years in Shanghai and has received awards for best feature, analysis and agenda-setting.

Debt issued by the Xinjiang Production and Construction Corps, a quasi-military entity in Washington’s cross hairs, has surged in recent years to fund social and security spending.

Australia, Singapore, Malaysia and South Africa will join forces to test the use of multiple central bank digital currencies (CBDCs) for cross border payments and settlements, according to the Bank for International Settlements.

Huaxia Bank confuses customers as it becomes latest Chinese lender to stop offering some foreign exchange services, while banking regulators keep pressure on to maintain financial stability.

China’s cross-border settlements in yuan accounted for a record 47.4 per cent of all of domestic and foreign currency transactions last year, while cross-border use of the yuan surged by 44.3 per cent year on year.

Advertisement

The government now officially allows couples to have three children, but for many families childcare is still a major concern.

Liberalising China’s markets could help generate greater returns for citizens via overseas investments, according to a former official in charge of international payments.

Six years ago, the People’s Bank of China devalued the yuan by nearly 3 per cent against the US dollar over two days, now it is laying out its policy plans to support the currency.

‘Psychological’ scarring from the pandemic continues to undermine consumer confidence in China, with lingering anxiety about financial security tarnishing economic recovery.

China is a net importer of goods from many Southeast Asian nations and a slowdown in demand would have knock-on effects for their currencies, analysts say.

Artificial intelligence (AI) could increase innovation in banking products and services, but Hong Kong Monetary Authority (HKMA) chief executive Eddie Yue Wai-man has expressed the need for proper governance.

Beijing still wants to double the nation’s GDP by 2035, but ‘policymakers feel they need to address social issues to ensure social fairness and justice’, while also protecting state enterprises and the environment.

PBOC says unfair competition will be a focus in the second half of the year.

The plan is being driven by the G20 and OECD and could make it harder for the likes of Apple, Google and Facebook to avoid paying tax in their home countries.

Steady economic recovery is not assured so long as segments of the world‘s population remain unvaccinated against the virus and its mutations, the International Monetary Fund says.

An index which measures the yuan’s value against a basket of foreign currencies climbed to a five-year high last week, with China’s currency set to remain strong.

Analysts caution that widespread adoption of China’s digital currency must be gradual, as embracing the e-yuan will be ‘an educational process and a cultural shift’.

A new proposal for a global minimum tax is being scrutinised by businesses in Hong Kong, where a range of concessions allow some companies to lower their effective rate below 15 per cent.

Moscow’s move reflects confidence in Chinese economic development, foreign ministry says.

There is a chance that China could become the leader in the global financial system, according to Charles Li, the former head of Hong Kong’s stock exchange operator.

While important details need to be hammered out, China appears to have put aside any major reservations to support a minimum global tax rate of at least 15 per cent.

China’s foreign exchange deposits hit US$1.01 trillion at end of May, up 35.7 per cent from a year earlier, having surpassed US$1 trillion for the first time in April.

Financial authorities are weighing threats to monetary sovereignty as the race to launch a central bank digital currency (CBDC) heats up.

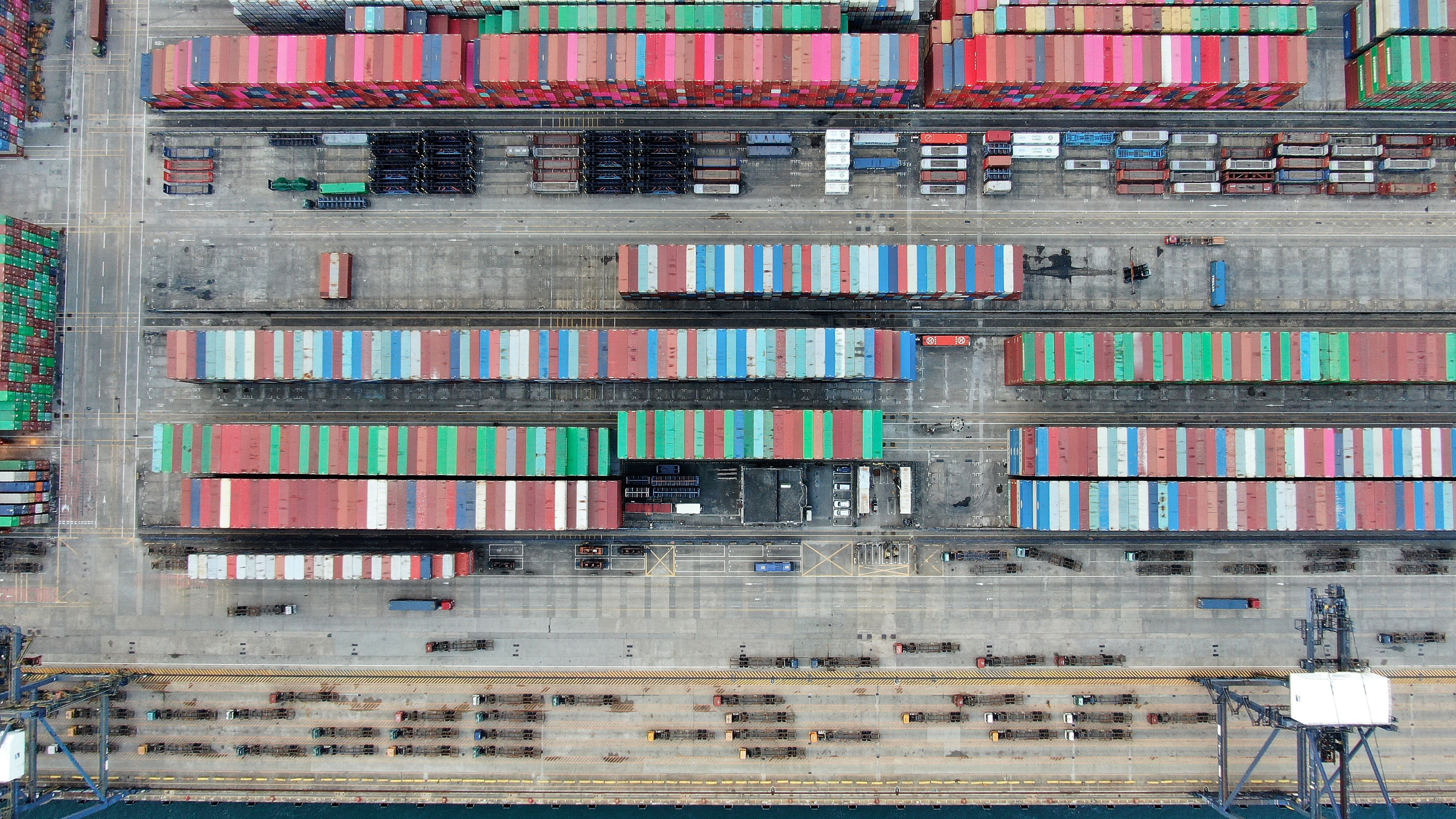

Weeks of coronavirus-containment efforts following outbreaks among dockworkers in China’s Pearl River Delta have caused global backlogs and inventory shortages, bringing some major ports in South China to a standstill.

Hong Kong’s de facto central bank has set up a working group to study ‘legal and regulatory issues’ related to an e-Hong Kong dollar.

Market entities will use the yuan for cross-border purposes as China’s economy integrates with the rest of the world, according to former deputy central bank governor Hu Xiaolian.

Analysts are looking into whether the Australian dollar has started to weaken recently because of ongoing tensions with China.

China began exploring the concept of a sovereign digital currency in 2014, and has already distributed some 200 million yuan (US$30.7 million) as part of pilot projects across the country.

China has an established digital payment system dominated by Alipay and WeChat Pay, potentially slowing the adoption of the nation’s new sovereign digital currency.

Hong Kong manufacturers in mainland China have been beset by sky-high raw material prices, electricity cuts and hiring difficulties in recent weeks.

The strength of the yuan is likely to renew attention on how China manages its exchange rate amid negotiations with the United States, analysts say.