Advertisement

Advertisement

Andy Xie

Dr Andy Xie is a Shanghai-based independent economist specialising in China and Asia, and writes, speaks and consults on global economics and financial markets. He joined Morgan Stanley in 1997 and was managing director and head of the firm’s Asia-Pacific economics team until 2006. Prior to that he spent two years with Macquarie Bank in Singapore, where he was an associate director in corporate finance. He also spent five years as an economist with the World Bank. He was voted one of the 50 most influential persons in finance by Bloomberg magazine in 2013.

When future historians look back on China’s rise, Trump’s trade war might well be viewed as having helped to prevent a Chinese crisis.

Trump’s proposed tariffs on US imports would drive inflation and squeeze middle powers, but is that all part of the plan?

China’s declining demand for fossil fuels and increased clean-energy capacity could usher in a new shift in global wealth distribution.

The Fed has been running a bubble economy for a long time. A rate cut would help asset prices to stay high, which is key to the US model.

Advertisement

Stimulus right after a deflated bubble risks a debt mire. Better to invest in China’s green tech and harness global talent to ensure prosperity.

As the US steps up support for national industries and expands tariffs on China, its high-income allies could lose their pricing power.

China has a much better chance of nudging the European Union on free trade. Beijing should hit US cars with stiff tariffs to send a warning signal to Brussels.

Complaints of Chinese overcapacity and dumping may be useful in justifying US, EU subsidies and trade barriers but China’s success is really due to its innovation and scale.

Macroeconomic stimulus provides only a temporary boost. China is no longer a bubbly market full of speculators paying stupid money for overpriced products. Businesses must change to prosper.

The surge in Japan’s stock market looks out of place and unsustainable in an economy with a shrinking population and falling real wages. Chinese investors shifting money to Japan in the hope of catching the wave should be wary of being left behind when this bubble pops – possibly this year.

Next month’s NPC meeting is unlikely to produce any dramatic changes in China’s monetary and fiscal policy or a return of massive stimulus. Instead, policymakers are expected to continue focusing on technological development and attempts to make domestic firms the core of supply chains.

As its economy matures and becomes more competitive from battling the severe headwinds of recent times, China should have the confidence to let its currency reflect its true strength.

Beijing is right to hold back on coming to the rescue of the property sector, which would reinflate the real estate bubble. If it must use stimulus, it should spend a few percentages of GDP a year on a solar energy push, which could make the country energy and food independent.

Given the US bubble economy, a rising fiscal deficit and foolish behaviour of markets, the Federal Reserve faces a tough balancing act. It has already had to walk back some dovish statements, and further policy mistakes risk damage to the entire global economy.

China is using its downturn to deflate bubbles and raise productivity while the US is doing the opposite – feeding the Bernanke bubble and hoping for an AI cure for falling productivity

The effects of war and inflation could send US financial markets into a tailspin, forcing China to completely ‘unpeg’ from the dollar – which could then collapse.

Amid rising dollar risks, Brics states should integrate their currency and bond markets, and tax dollar transactions to promote local currency use.

In an era of deglobalisation, disinflation in China won’t help to moderate price rises in the rest of the world, as long as the drivers of inflation – including a massive monetary overhang – hold strong. More to the point, inflation will last for as long as confidence in the US dollar holds.

China’s current challenges are the result of misallocation of resources in its boom years; the troubles in the property sector are a symptom of this , not the cause. Competition and productivity are the main forces behind today’s deflationary pressure, and this is a positive development.

China is gently deflating its property bubble and absorbing overcapacities as it waits for demand to return. This could take a long time but China has the luxury to dither.

Hong Kong risks increasingly forced in step with US monetary policy, which could see property prices and the economy comes crashing down. Switching to the yuan would mean stability and a chance to ride the currency’s rise before it becomes fully convertible.

China has the supply chain, the better tech and the cheaper costs that keep on falling. Trade barriers would only force the world into two prices for one product – where the cheaper one is also likely to be better.

The economy stagnated as it was no longer as competitive, but misfiring central bank policies that propped up inefficient conglomerates made things worse. Unless Japan corrects its course soon, the future will be dire.

China’s pursuit of technological self-sufficiency risks leading to overcapacity and price wars, creating ripple effects across many industries. The current experience may motivate China to look into its other vulnerabilities and develop domestic substitutes, spreading overcapacity across many industries.

Expect more banking and bond fund blow-ups with the US reluctant to stop the endemic moral hazard in its financial system, preferring to lean on the dollar.

China’s coal revival has capped energy imports and prices as it works towards energy self-sufficiency. But for true energy security and a stable global energy market, China must boost its nuclear and solar power

The developing world needs China and its lower-cost goods, vast capacity and massive surplus capital. Robust trade with the Global South will support China’s growth and offers it another pathway to high-income status – even as its relationship with the West sours.

Even before the pandemic, China faced a turning point in its growth model as investment returns began to shrink. As long as policymakers prolong the needed transition to a consumption-based economy, growth will remain low for years to come.

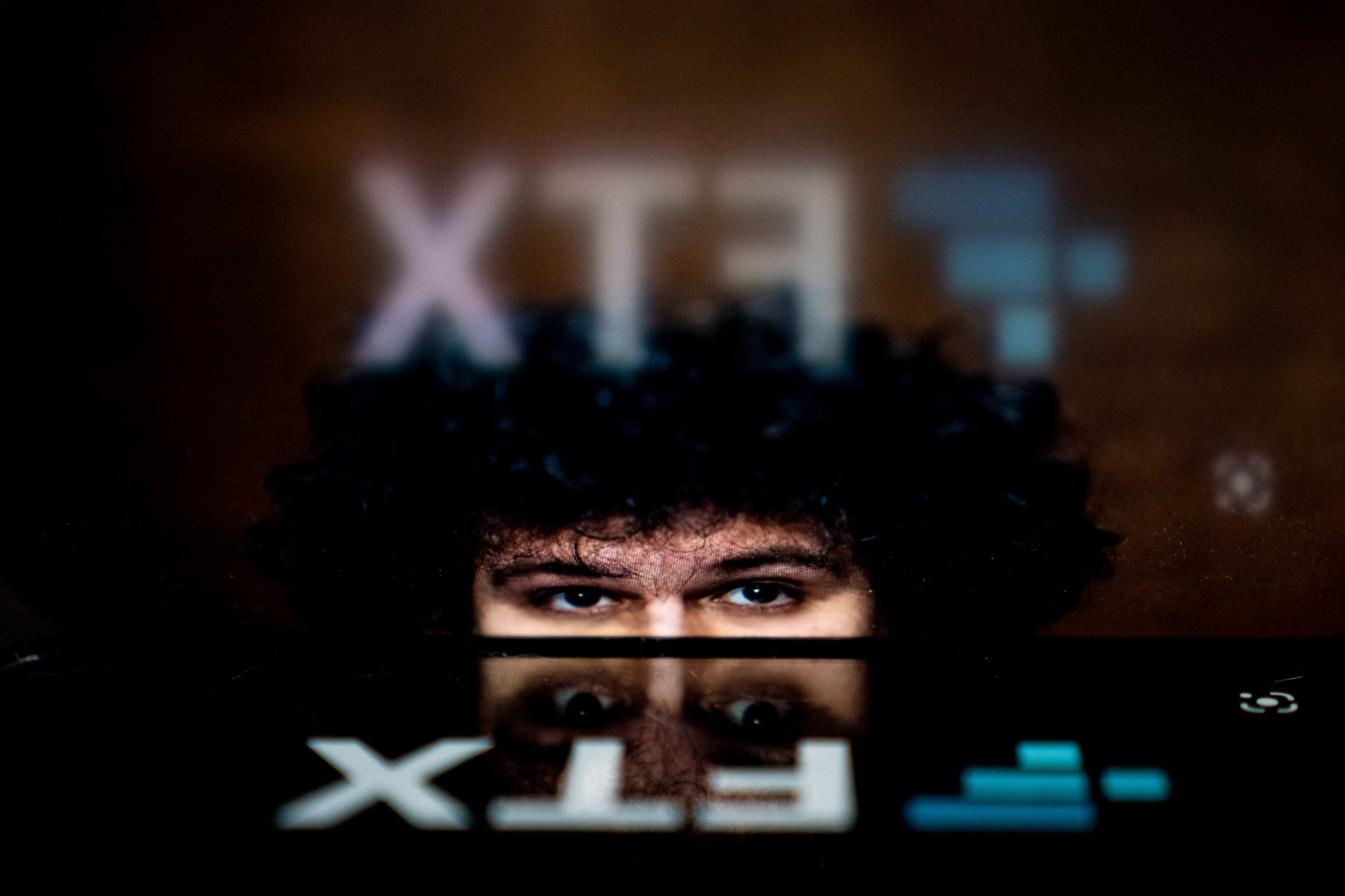

As the Fed boosted liquidity, the odds of cooking up a successful scam improved greatly – and more people did. Now that the Fed is winding down its bloated balance sheet, hot-air assets like cryptocurrencies are losing their life line.

Facing financial catastrophe in 2008, instead of fixing the imbalances of the global economy the Fed flooded the system with liquidity and kept interest rates low, sparking a speculative frenzy that has lasted to this day.