Forget the US$23 billion question. China-Malaysia ties are strong

Malaysian businessmen say the shelving of joint projects by the administration of Mahathir Mohamad should be welcomed as the move could provide more transparency – and ultimately, more support for Belt and Road projects

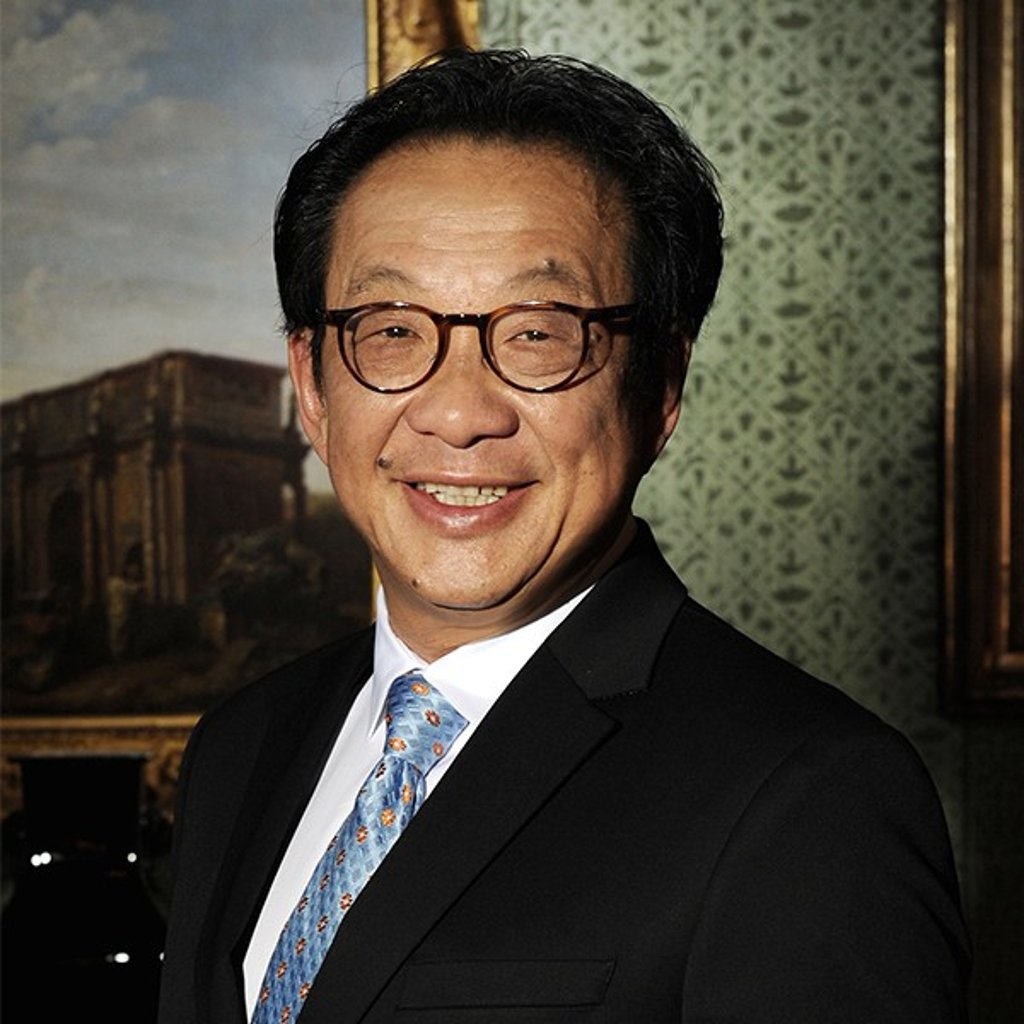

Francis Yeoh, the executive chairman of the YTL Group, used the example of the East Coast Rail Link, a US$13 billion railway project which had been put on ice by Malaysia’s new Pakatan Harapan-led government pending a feasibility study. The administration cited concerns over its cost and what it fears will be low demand for the service.

Yeoh said such scrutiny was to be welcomed, as transparency would boost public support.

Infrastructure projects created jobs, he said, but transparent and coherent frameworks were still needed as “billions and trillions” of dollars went into such projects.

Yeoh suggested that infrastructure projects should be undertaken through domestic financing and using the nation’s currency, to avoid volatility. He suggested bonds of up to 50 years for infrastructure projects to raise capital locally.