Singapore’s US$288 billion Temasek stays bullish on China – targets US, India for growth

- The city state’s sovereign wealth fund says its main priority is building a ‘resilient portfolio’ that can withstand market ‘dislocations’

In its annual review this week, the fund announced its net portfolio had increased by S$7 billion (US$5.18 billion), cementing its status as the world’s 11th largest sovereign wealth fund, according to Global SWF, a platform that tracks such funds.

For the full year to March this year, Temasek weathered volatility to post a 1.6 per cent total shareholder return, rebounding from the previous year’s negative return of 5.07 per cent.

The fund’s longer term total shareholder returns held steady at 6 per cent over 10 years and 7 per cent over 20 years, as it maintained a focus on long-term returns with a mix of financial, transport, telecoms, real estate and agriculture investments.

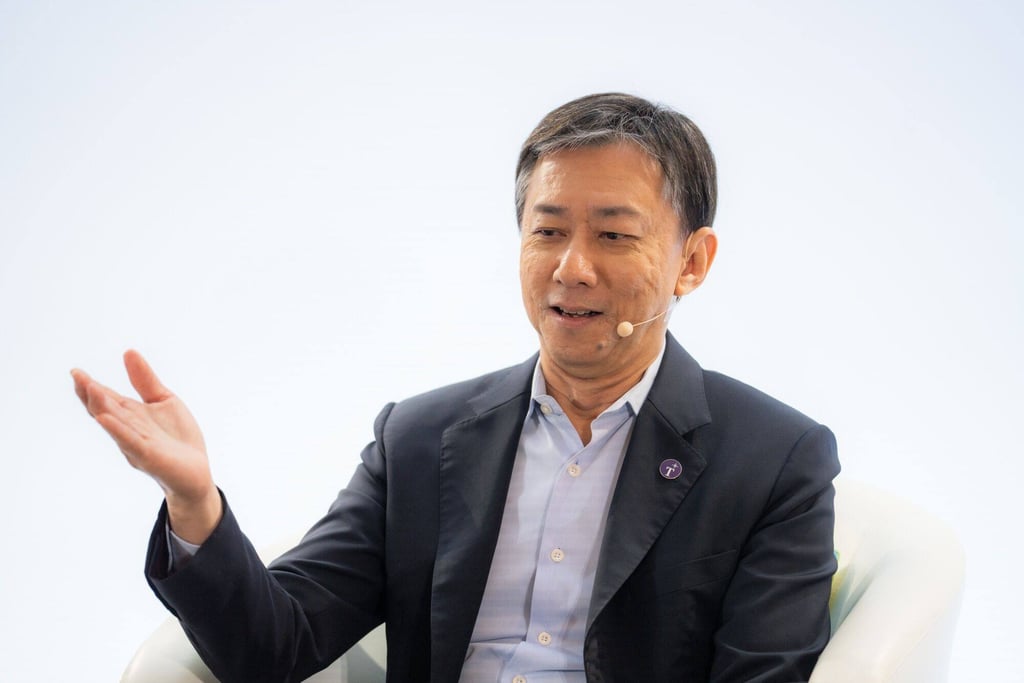

Temasek’s “main focus” was 10- and 20-year returns, said Chia Song Hwee, the fund’s deputy chief executive officer, at the results announcement on Tuesday. “We take a long-term view and invest with that in mind. We’re not a kind of a day trader investor.”

Another key priority for Temasek was to build a “resilient portfolio that could withstand market dislocations”, Chia said.