Singapore’s worrying trend of homeowners defaulting on mortgages

- Even as new home launches are seeing brisk demand, the number of homeowners in the Lion City defaulting on their mortgages is on the rise

- Amid a rise in mortgagee sales and a slowing economy, private homes continue to be built, prompting analysts to warn of an oversupply

The couple, both 36, whose monthly household income totals S$17,000, are what is known in Singapore as “HDB [Housing & Development Board] upgraders”. They are selling their public housing flat to move into a two-bedroom apartment in a private condominium.

They were among the thousands of people who had flocked to showrooms in the city state recently to view and buy new flats. Just last month, 276 of the 300 released units at the centrally located Avenue South Residence were bought on the opening day of sales. Prices ranged from S$982,000 for a 527 sq ft one-bedroom apartment to S$2.63 million for a 1,496 sq ft four-bedder.

Yet, not all is rosy in the housing market. The number of homeowners in the Lion City defaulting on their mortgages is on the rise.

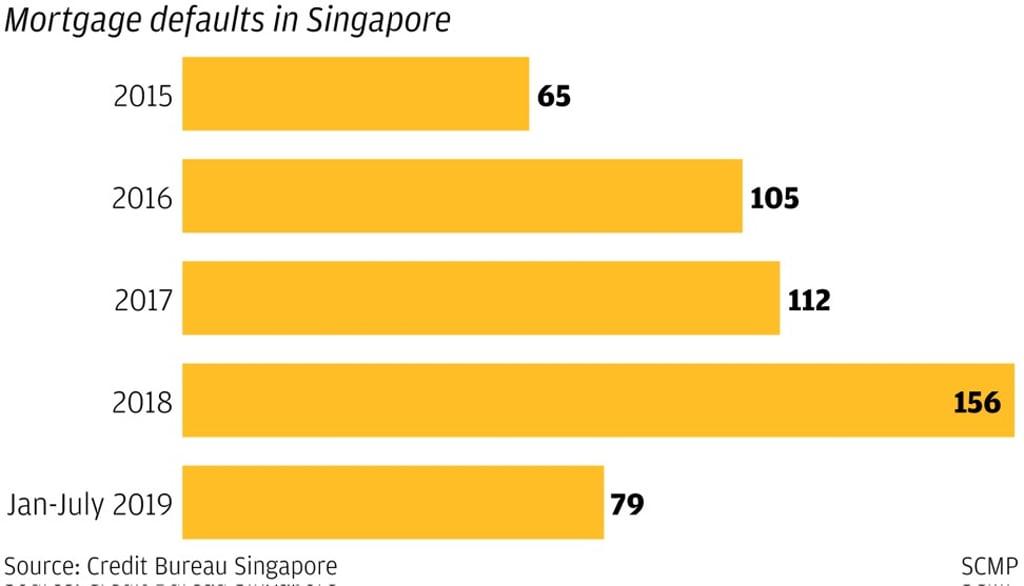

Data from the Credit Bureau Singapore – which gets information from banks on real-estate loan defaults by individuals – shows 79 such cases this year as of July. Last year, there were 156 mortgage defaults in total, compared with 112 in 2017 – more than double the 65 cases seen in 2015.