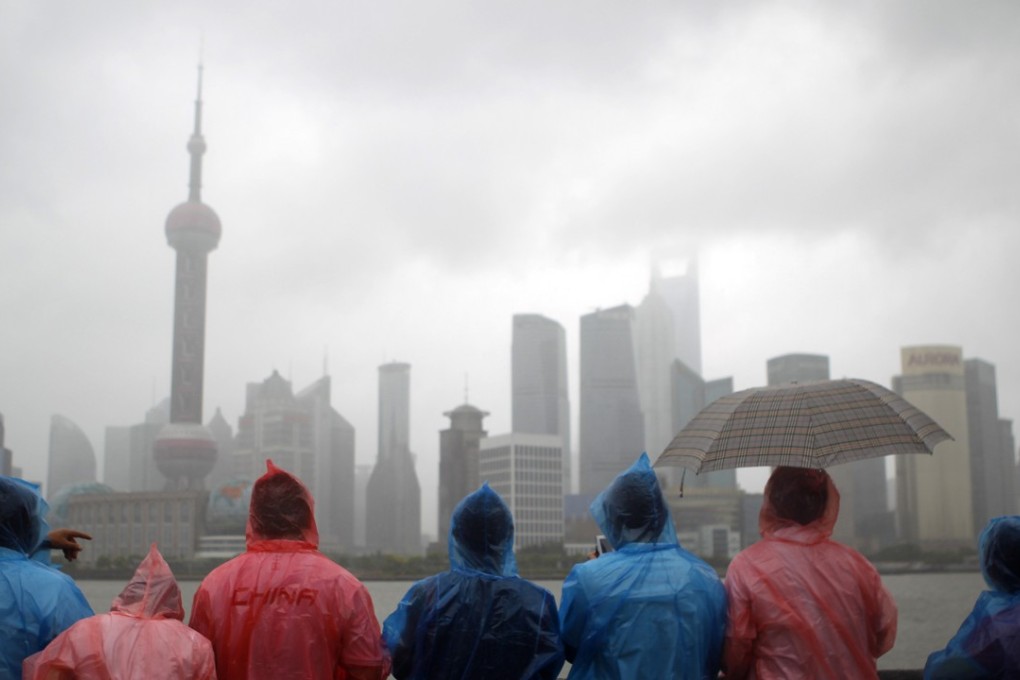

America first and China vs Japan: Is Asia ready for next financial crisis?

Trump’s appointments throw into question whether the region can rely on the IMF. Perhaps China and Japan should take note ... and put their wrangling over a regional financial firewall behind them

Ten years since the Great Recession and 20 since the Asian Contagion, now is an appropriate time to reflect on past financial crises – and ask whether East Asia is ready to deal with the next one.

The election of a US president critical of the International Monetary Fund (IMF) has thrown up at least one reason to doubt it is.

After all, the IMF’s response to the crisis of 2007-08 – not least the US$700 billion in financing it committed to member countries – played no small part in steadying the global economy. Any suggestion it could be blocked from playing a similar role in a more localised Asian crisis should be cause for alarm.

Hong Kong’s plan to attract tech firms is a great leap backward

“My big concern at the moment is: what would happen if there were a currency crisis in East Asia that required IMF involvement,” said Professor William Grimes of Boston University, an expert in regional finance.

In particular, Grimes noted Trump’s team at the Treasury for International Affairs was led by David Malpass and Nicholas Lerrick, both of whom are sceptical of IMF bailouts.

“Together with the very narrow Trumpian vision of ‘America First’, I can easily imagine a sensible IMF-led plan being vetoed by the US,” Grimes said.