Tech war: China’s AI hopes face fresh setbacks as US set to restrict advanced memory chip exports

South Korea’s SK Hynix and Samsung dominate the supply of HBMs, each controlling about 48 per cent of the global market share in 2023

China’s efforts to develop home-grown artificial intelligence (AI) semiconductors are facing fresh setbacks as the US prepares to implement new rules restricting South Korean exports of advanced memory chips to Chinese companies.

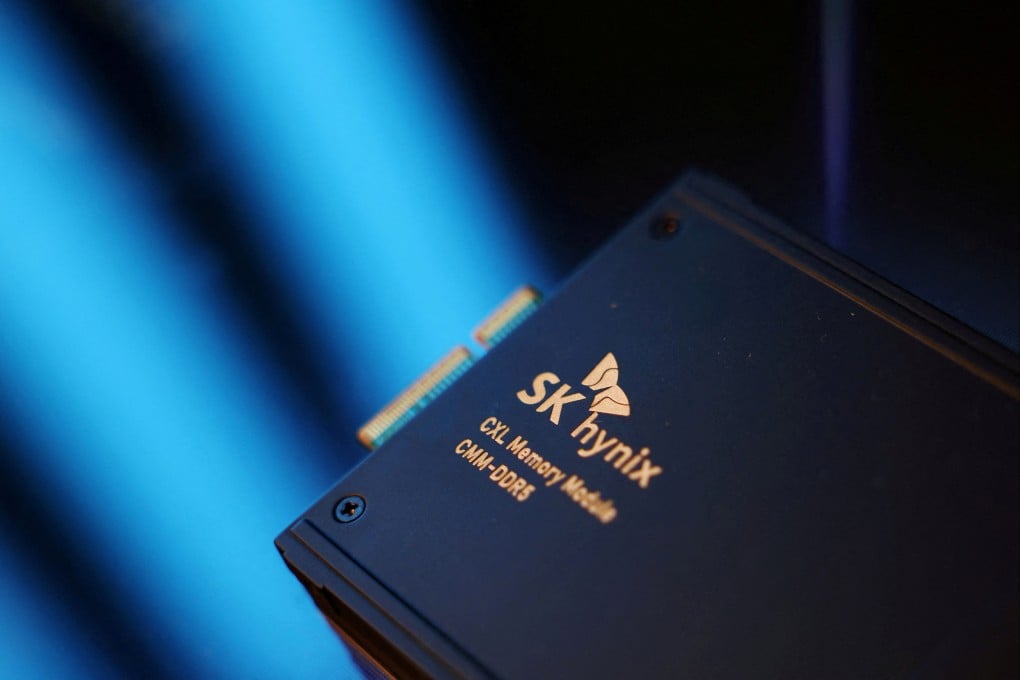

The mainland would find itself in a difficult position if the supply of high-bandwidth memory (HBM) chips from South Korea is cut off by new US restrictions because of the lack of domestic alternatives, according to industry insiders. HBM chips, dynamic random-access memories (DRAMs) that are vertically connected using advanced packaging technologies, are vital components for graphic processing units (GPUs) and other AI accelerators.

“If China can’t import HBM, it will be hurt in the short to mid-term,” said Jeongdong Choe, a senior analyst at Canadian research firm TechInsights. “HBM chips used in China are mainly from Samsung and SK Hynix, especially HBM2 and HBM2E.”

CXMT is working to develop its first domestically-made HBM in partnership with a domestic chip packaging and testing company, according to a note issued Monday by US investment bank Morgan Stanley by analysts Shawn Kim, Duan Liu and Michelle Kim.