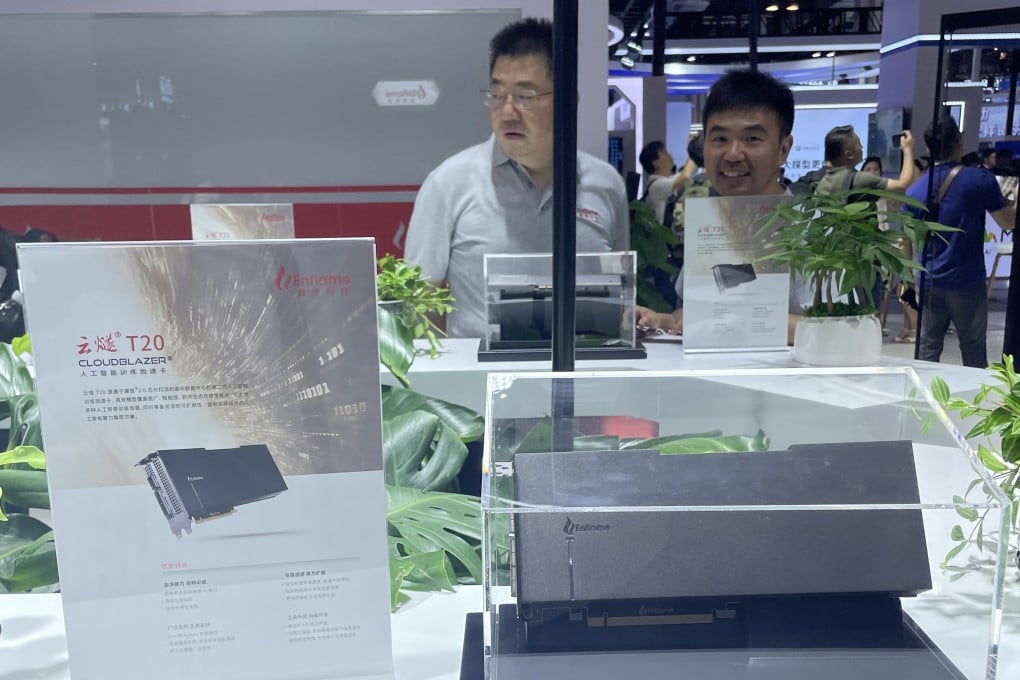

China’s Nvidia wannabe, Tencent-backed AI chip start-up EnFlame, flags IPO intention

The Shanghai-based unicorn has begun the so-called tutoring process, compulsory for IPO applicants in China

Tencent Holdings-backed Chinese artificial intelligence chip start-up Enflame has kicked off the “tutoring” process with an investment bank ahead of a planned initial public offering (IPO).

The Shanghai-based unicorn – which was valued at US$1.65 billion last September, according to venture deal tracker Pitchbook – has hired China International Capital Corporation, one of the country’s biggest investment banks, to coach company executives on IPO-related issues, the China Securities Regulatory Commission (CSRC) announced in a statement on Monday.

All IPO applicants in China are required to go through tutoring before filing a listing plan to regulators, a process that takes between three to 12 months. Enflame did not disclose where it plans to go public or how much it aims to raise.

A darling of China’s state-backed chip investment fund as well as Big Tech companies, Enflame had taken in more than US$742 million from eight fundraising rounds as of last September, Pitchbook data showed.