Tech war: China pumps up state subsidies for chip industry to counter US sanctions

- Government subsidies granted to Huawei, SMIC, Naura Technology and other major chip players in China swelled in 2023, a Post analysis found

Government subsidies received by leading players in China’s semiconductor industry – including foundries, chip design and packaging firms – jumped significantly last year, as Beijing doubled down on efforts to boost technological self-sufficiency amid growing tensions with Washington.

Those subsidies made up only a portion of the total government support granted to the Chinese chip sector, which includes privately-held companies that do not disclose financial figures. Neither do they encompass other forms of state support, such as direct investments and low-interest loans.

Still, the numbers underscore the urgency of Beijing’s drive to boost the nation’s semiconductor industry, as the US tightened its export controls to restrict China’s access to advanced processors and chip-making technologies.

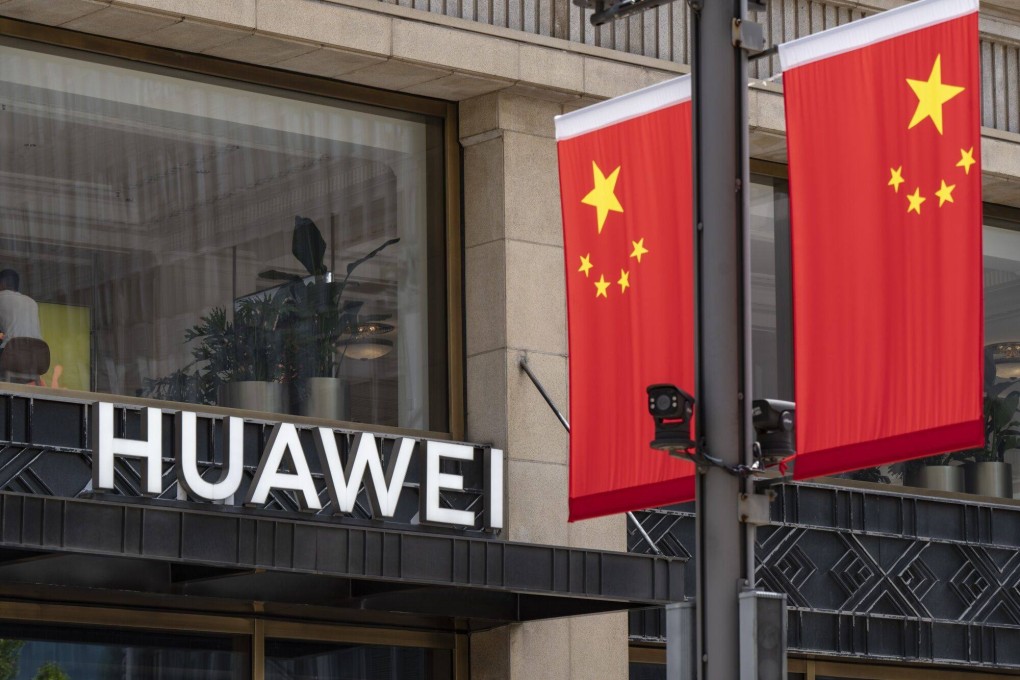

Among the 25 firms analysed by the Post, Huawei Technologies, which is privately held but voluntarily discloses key financial data, received the most government subsidies. The US-sanctioned company obtained 7.3 billion yuan in government subsidies in 2023, compared with 6.5 billion yuan in 2022 and 2.6 billion yuan in 2021.

In recent weeks, Huawei has been allowing potential clients to try out its Ascend 910C chips, successor to the 910B that is benchmarked against Nvidia’s H100, The Wall Street Journal reported on Tuesday, citing unnamed sources.