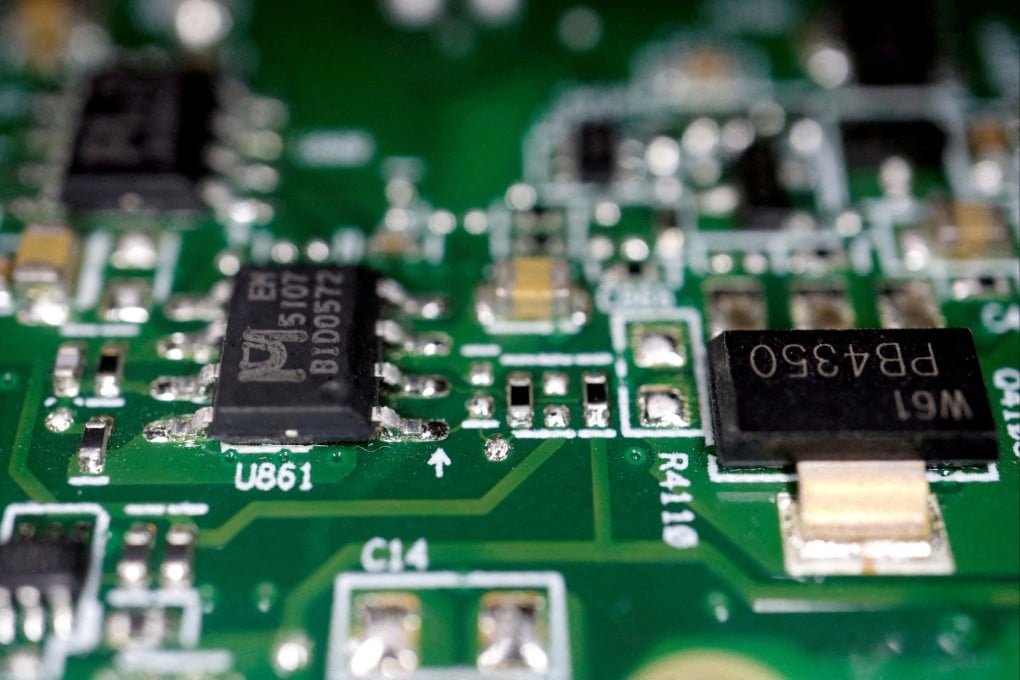

Semiconductor, AI firms dominate venture capital deals in China amid government push

- Ninety per cent of global venture capital investments in the chip sector last year came from China, according to Preqin research

China’s largest venture capital investments are increasingly coming from technology sectors that align with the government’s policy goals, such as artificial intelligence (AI) and semiconductors, even as overall funding continues to plunge, according to a new report.

The country contributed 90 per cent of global venture capital investments in the chip sector last year, totalling US$22.2 billion and more than doubling the US$9.5 billion invested in 2022, research firm Preqin said in a report released on Thursday.

Fundraising in China’s semiconductor sector appears to have slowed down since, with only US$1.6 billion invested across 128 deals in the first half of this year, Preqin data showed, although the country still accounted for four of the world’s 10 largest chip industry investments during that period.

State-backed investors are playing a growing role in private market funding in China, participating in about 60 of the 100 largest deals from 2021 to June this year, twice as many as from 2017 to 2020, the research company said.