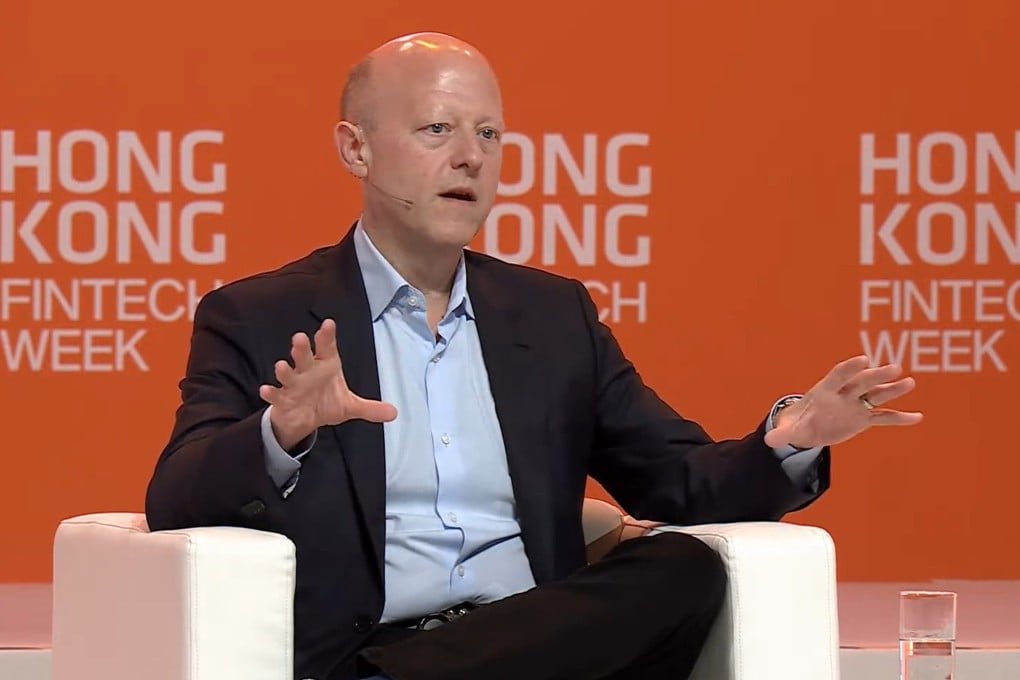

Circle CEO envisions stablecoins playing greater role in Hong Kong trade settlements

Jeremy Allaire envisions a ‘global network of stablecoins’ enabling ‘better, faster, cheaper’ transactions for emerging markets trading through Hong Kong

“In emerging and developing markets … there are importers who are importing out of Asia, and a lot of the trade flow is settled through Hong Kong,” Allaire said in an interview with the Post on the second day of Hong Kong FinTech Week 2024 on Tuesday. “We’re seeing this demand on both sides … The firms are like, ‘this is better, faster, cheaper.’”

The issuer of the world’s second-largest stablecoin, which is pegged to the US dollar, hosted its Circle Forum in Hong Kong for the first time at the Four Seasons Hotel on Tuesday. Coinciding with the event, the company announced two new partnerships: a memorandum of understanding with Hong Kong Telecom (HKT) to explore blockchain-based loyalty solutions and a collaboration with Thunes to help settle cross-border transactions in USDC.

“As I like to say, we’re kind of the global regulatory guinea pig for stablecoins in that we’re a regulated player, we always have been. We’re globally adopted,” Allaire said. “Our view is that this is going to become regulated financial infrastructure everywhere in the world.”

During a talk at FinTech Week on Monday, Allaire said Circle envisions a “global network of stablecoins that underpin the on-chain economy”. While some have seen potential for CBDCs to play an important role in a more streamlined cross-border settlement process, Allaire said stablecoins are on the path to fulfilling this role already. China has the largest CBDC project so far, but it remains nascent.