Nvidia’s AI chip demand still booming but slowing sales growth worries investors

The company forecast revenue of US$37.5 billion, plus or minus 2 per cent for the fourth quarter

Nvidia forecast its slowest revenue growth in seven quarters on Wednesday, failing to meet lofty expectations of some investors who have made it the world’s most valuable firm.

Shares of the Santa Clara, California-based company fell 5 per cent after it posted results but quickly pared losses to trade down 1.5 per cent after hours. During the regular session they closed 0.8 per cent lower.

Expectations ran high ahead of the results, with Nvidia shares up more than 20 per cent over the last two months and hitting an intraday record high on Monday. The stock has nearly quadrupled so far this year and is up more than ninefold over the last two years. Nvidia is in the middle of launching its powerful Blackwell family of artificial-intelligence chips, which will weigh on the company’s gross margins initially but improve over time.

The new line of processors has been embraced by Nvidia’s customers and the company will exceed its initial projections of several billion dollars in sales of the processors in the fourth quarter, finance chief Colette Kress told analysts on a conference call on Wednesday.

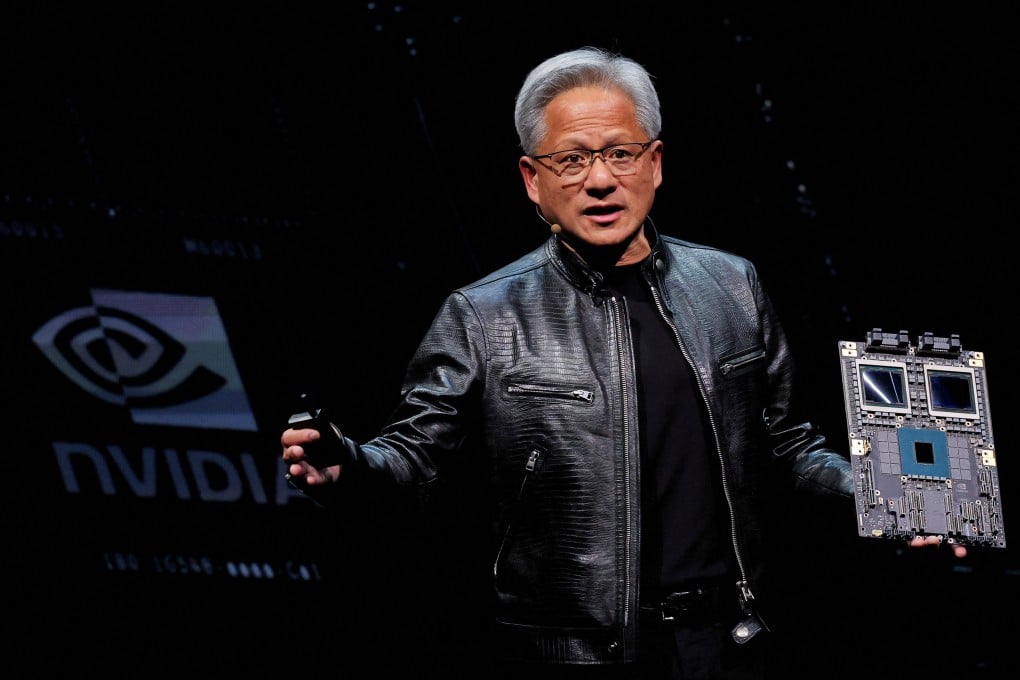

Asked about media reports that a flagship liquid-cooled server containing 72 of the new chips was experiencing overheating issues during initial testing, Chief Executive Jensen Huang said there are no issues and that customers such as Microsoft, Oracle and CoreWeave are implementing the systems.